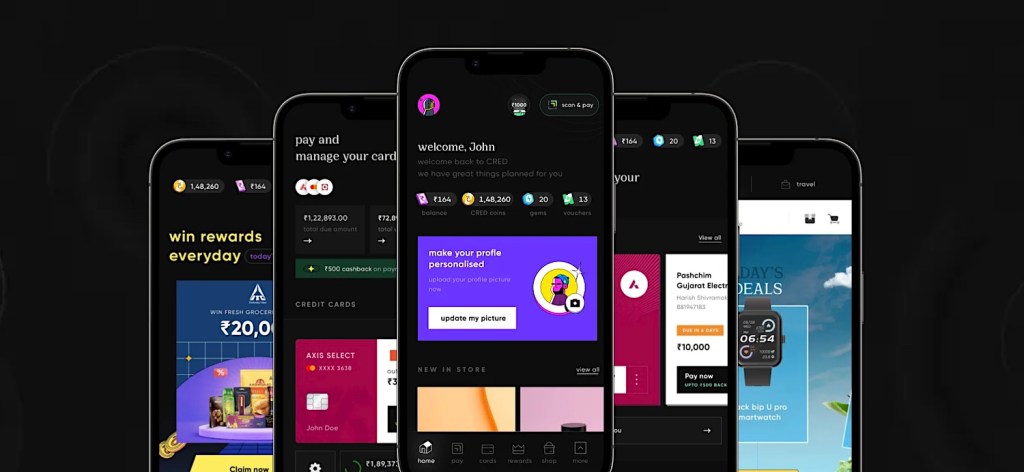

Image Credits: CRED

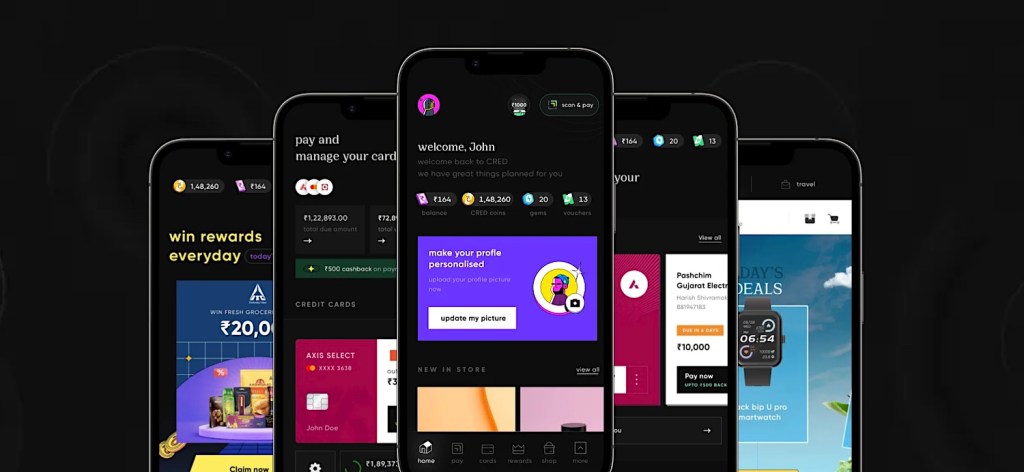

Image Credits: CRED

Indian fintech startup CRED has reached an agreement to buy mutual fund and stock investment platform Kuvera as part of an expansion into wealth management.

The $6.4 billion Bengaluru-headquartered startup said it was attracted by Kuvera’s experienced team and expertise in enabling customers to invest directly in mutual funds and stocks with advisory and tracking tools.

Kuvera, which manages assets of over $1.4 billion for its 300,000 strong user base, has emerged as a platform of choice for many of India’s affluent investors. The average monthly SIP contribution on the platform stands at 5,000 Indian rupees ($60), more than twice the industry average, while total mutual investment amounts over $14,450 are over 5x higher than the norm.

Kuvera will continue to operate as a stand-alone app following the acquisition, CRED said, adding that it will explore integrations in the future. Kuvera’s 50-person team will join CRED as part of the acquisition.

“Through our engagement with CRED we realized that our core values of transparency, user value and simplicity align beautifully with each other,” said Kuvera co-founder Gaurav Rastogi in a statement. “Together with CRED we see an exciting opportunity to fast-track building new products and features for our community while also bringing a trusted wealth management solution to millions more.”

TechCrunch reported last year that CRED was in talks to acquire Kuvera. The deal involves both cash and stock, the firms said. They declined to share the precise value of the deal. Kuvera had raised about $10 million in private rounds prior to the acquisition. The U.S. asset manager giant Fidelity will become a shareholder of CRED following the acquisition.

“Excited to welcome Kuvera and their team into the high-trust CRED ecosystem,” CRED founder Kunal Shah said in a statement.

“Kuvera is extremely popular among financially savvy Indians; their products and vision are aligned with CRED’s principle of investing for long-term value creation rather than short-term entertainment. Look forward to working and sharing learnings with the Kuvera team in our mutual intent to enable financial progress.”

CRED’s interest in Kuvera comes at a time when the Indian fintech giant, which serves some of the country’s most affluent customers, is expanding its offerings. The eponymous app originally launched six years ago with the feature to help members pay their credit card bills on time. It has since added scores of features that incentivize good financial behavior and expanded to e-commerce and lending.

The startup has been eyeing broadening its wealth management offerings for some time. It held talks with Bengaluru-headquartered Smallcase in 2022, but the talks didn’t materialize into a deal. (CRED has made a series of investments in the past three years, acquiring stakes in LiquiLoans and CredAvenue, and buying Happay.)

Mutual funds can be a lucrative category for CRED, which processes a third of all credit card payments in India by volume.

The Indian mutual fund market is one of the largest and fastest growing in the world. According to the Association of Mutual Funds in India (AMFI), the assets under management (AUM) of the Indian mutual fund industry stand at more than $575 billion, up over 20% from a year ago. But the majority of people — about 90% of the population — still don’t invest in mutual funds and stocks.

Indian fintech CRED’s earnings surge 3.5x to $168M