Trending News

18 October, 2024

12.78°C New York

Sanjay Agrawal and Shashank Gupta, who helped co-found the business intelligence company ThoughtSpot, say that several years ago, they observed that organizations were struggling to deal with the increasing amount of data under their purview.

Even enterprises with robust data analytics and orchestration tools seemed to be having a rough go of it, Agrawal and Gupta say. Maybe so. According to a Deloitte study, 67% of managers aren’t comfortable accessing insights from data analytics platforms, partly due to tech-related challenges.

“Everyone wants to be strategic, but current approaches keep companies trapped in firefighting mode, grappling with routine, preventable operational and tactical tasks,” Agrawal told TechCrunch. “Companies need a modern approach to address their expanding roles and drive business success.”

And, wouldn’t you know, Agrawal and Gupta say they’ve developed exactly this “modern approach” and built it into Revefi, a software-as-a-service platform (and startup of the same name) they co-launched in 2021.

Revefi connects to a company’s data stores and databases (e.g. Snowflake, Databricks and so on) and attempts to automatically detect and troubleshoot data-related issues, as well as makes suggestions as to how these various resources might be optimized.

“Revefi enables data teams to be more strategic,” Agrawal said, “and deliver the right data at the right time at the right cost to businesses.”

Agrawal and Gupta assert that Revefi can help accomplish things like delivering a unified view of a company’s data operations and decreasing storage bills by performing an analysis of cost and quality across different providers. One customer was able to reduce their cloud data platform costs by 30% using Revefi, Agrawal claims.

“We have replaced and won against Monte Carlo, Acceldata, Anomalo, Informatica and other data observability and data quality products,” Agrawal said. Bold claims!

Asked how just many clients Revefi has at present, Agrawal declined to say. But he did reveal that several “large enterprises” are paying for Revefi’s services, including a “$5 billion public security company” and “$10 billion public data company.” (Perhaps revealingly, Revefi lists ThoughtSpot in the case studies section of its website.)

Seattle-based Revefi, which this week closed a $20 million Series A funding round led by Icon Ventures with participation from Mayfield, GTM Capital and StepStone Group, plans to greatly expand its product and 30-person team in the coming year. To date, the startup has raised $29 million.

“Enterprises are struggling with the explosive growth in and variety of data, the proliferation of data tools and complexity and out-of-control data spending,” Agrawal said. “We’re benefitting from this; we are in a high-growth phase and are hiring AI, engineering, sales and marketing talent. We are agile, manage our costs efficiently and have a pragmatic approach to growth.”

TestParty, a software compliance company powered by AI, announced a $4 million seed round today co-led by Harlem Capital and the Urban Innovation Fund.

Michael Bervell and Jason Tan, the company’s CEO and CTO, respectively, co-founded TestParty in March 2023 to automatically rewrite source code to help businesses avoid violating global digital accessibility regulations like the European Accessibility Act or the Americans with Disabilities Act.

As of today, nearly all of the world’s most popular website homepages are not compliant with the Web Content Accessibility Guidelines. This means people who are blind or who need other assistive devices to help them scan the web are unable to fully engage with most of the world’s websites. TestParty seeks to fix this by automating testing, remediation, training, and code monitoring to bring websites into compliance with accessibility standards.

Tan first came across this idea after working at Twitch, which was sued in 2021 for its lack of digital accessibility. Looking more into the issue, Tan realized that disability suits like this were common and that the rapid expansion of the internet has caused many to overlook guardrails that would make their technology more inclusive. He teamed up with Bervell with the belief that engineers can be trained with AI to simply write more accessible website coding.

Inclusive technology like this is exactly what advocates talk about when they say they would like to see more innovation with overlooked communities taken into account. The market for Compliance management software tops well over $30 billion, and finding a way to automate tedious coding tasks is sure to help make creating accessibility easier for companies.

Traditionally, companies hired consultants to manually audit and fix a code base. But Bervell and Tan predict that the method will no longer work as more digital products enter the market. There is also more regulatory pressure on this topic, such as the EU managing digital accessibility complaints starting in 2025 and the U.S. mandating compliance for its local, state, and federal institutions. They believed consultants soon will not be able to keep up with increased demand, which is where TestParty and automation will come into play.

“We give existing engineers the skills that they need to write ADA-compliant code, instead of hiring an accessibility specialist for hundreds of dollars per hour,” Bervell said. “It makes accessibility a human right, more affordable, in turn leading to the creation of a more accessible internet.”

He said their fundraising journey was all about persistence although it took them just 71 days to close the round. The team was introduced to their lead investor Harlem Capital, because Bervell used to intern at Harlem Capital. He stayed in contact with the team and participated in alumni events. The firm said this is the first time it has invested in a company founded by someone who used to work for them.

“We believe TestParty will become the ultimate solution to ensure every website is accessible to all, leaving an indelible mark on society,” Henri Pierre-Jacques, managing partner at Harlem Capital, told TechCrunch.

K Ventures and Soma Capital also participated in the round.

Tan met Bervell around 2021 while taking a gap year in the Smoky Mountains. At the time, he was attending Princeton, then went on to work at Twitch and also helped run TigerLaunch, one of the world’s largest student-run startup competitions. Bervell, meanwhile, used to work as a portfolio development manager at Microsoft’s Venture Fund and as a software engineer at X.

“I realized I could make a bigger impact as a founder if I was able to find a business I cared about that had both social impact and business mission,” Bervell said about his decision to become a founder. Tan, meanwhile, always wanted to become one. They are hoping together, they can make a difference. “TestParty is a business with such a meaningful social impact and deeply caring community that it felt like a once-in-a-lifetime experience to work.”

Stephanie Song, formerly on the corporate development and ventures team at Coinbase, was often frustrated by the volume of due diligence tasks she and her team had to complete on a daily basis.

“Analysts burn the midnight oil working hundreds of hours doing the work that nobody wants to do,” Song told TechCrunch in an email interview. “At the same time, funds are deploying less capital and looking for ways to make their teams more efficient while reducing operating costs.”

Inspired to find a better way, Song teamed up with Brian Fernandez and Anand Chaturvedi, two ex-Coinbase colleagues, to launch Dili (not to be confused by the capital of East Timor), a platform that attempts to automate key investment due diligence and portfolio management steps for private equity and VC firms using AI.

Dili, a Y Combinator graduate, has raised $3.6 million in venture funding to date from backers, including Allianz Strategic Investments, Rebel Fund, Singularity Capital, CoreNest, Decacorn, Pioneer Fund, NVO Capital, Amino Capital, Rocketship VC, Hi2 Ventures, Gaingels and Hyper Ventures.

“[AI] affects all parts of an investment fund, from analysts to partners and back-office functions,” Song said. “Investment professionals at funds are looking for a differentiated edge on decision-making, and can now use their wealth of data to combine their understanding of the deal with how it fits into the funds . . . Dili has a unique opportunity to emerge as a solution for funds in a harsh macro environment.”

Song’s not wrong about funds looking for an edge — or any new promising ways to mitigate investing risk, for that matter. VCs reportedly have $311 billion in unspent cash, and last year raised the lowest total — $67 billion — in seven years as they grew increasingly cautious about early-stage ventures.

Dili isn’t the first to apply AI to the due diligence process. Gartner predicts that by 2025, more than 75% of VC and early-stage investor executive reviews will be informed using AI and data analytics.

Several startups and incumbents are already tapping AI to pour through financial documents and copious amounts of data to craft market comparisons and reports — including Wokelo (whose customers are private equity and VC funds, like Dili’s), Ansarada, AlphaSense and Thomson Reuters (through its Clear Adverse Media unit).

But Song insists that Dili uses “first-of-its-kind” technology.

“[We can] deliver very high accuracy on specific tasks like pulling financial metrics from large unstructured documents,” she added. “We’ve built custom indexing and retrieval pipelines tuned for specific documents to provide [our AI] models with high quality context.”

Dili leverages generative AI, specifically large language models along the lines of OpenAI’s ChatGPT, to streamline investor workflows.

The platform first catalogs a fund’s historical financial data and investment decisions in a knowledge base and then applies the aforementioned models to automate tasks such as parsing databases of private company data, handling due diligence request lists and digging for little-known figures across the web.

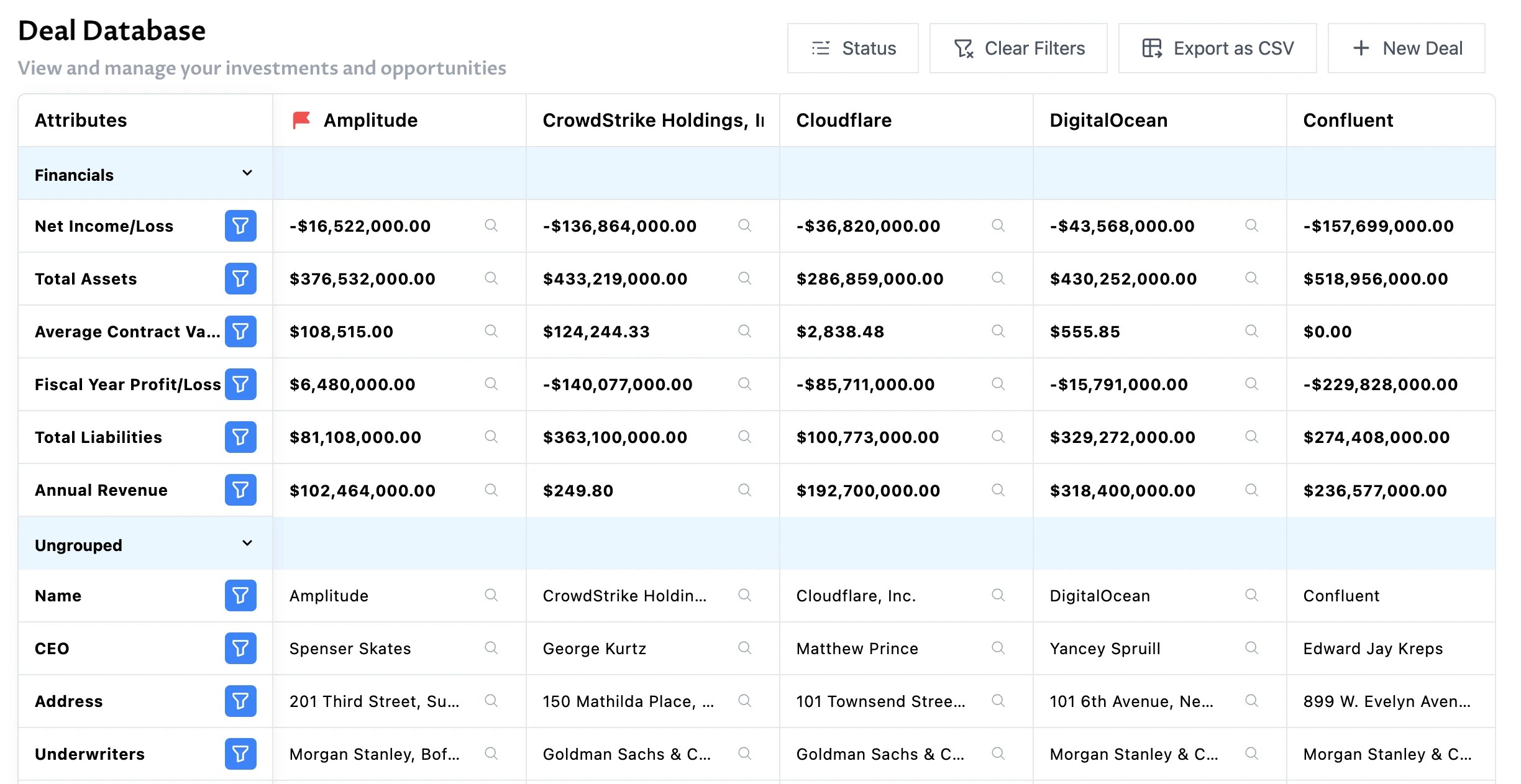

Dili recently added support for automated comparable analysis and industry benchmarking on a firm’s backlog of deals. Once funds upload their deal data, they can compare historical and current investment opportunities in one place.

“Imagine being able to get an email with a new investment opportunity or portfolio company update and instantly having a platform produce AI-generated deal red flags, competitive analysis, industry benchmarking and a preliminary summary or memo leveraging your fund’s historical investing patterns,” Song said.

The question is, can Dili’s AI — or any AI really — be trusted when it comes to managing a portfolio?

AI isn’t necessarily known for sticking to facts, after all. Fast Company tested ChatGPT’s ability to sum up articles and found that the model had a tendency to get stuff wrong, leave pieces out and outright invent details not mentioned in the articles it summarized. It’s not tough to imagine how this might become a real problem in due diligence work, where accuracy is paramount.

AI can also bring prejudices into the decisioning process. In an experiment conducted by Harvard Business Review several years ago, an algorithm trained to make startup investment recommendations was found to pick white entrepreneurs rather than entrepreneurs of color and preferred investing in startups with male founders. That’s because the public data the algorithm was trained on reflected the fact that fewer women and founders from underrepresented groups tend to be disadvantaged in the funding process — and ultimately raise less venture capital.

Then there’s the fact that some firms might not be comfortable running their private, sensitive data through a third-party model.

In a survey from Bloomberg Law, 30% of deal lawyers said they wouldn’t consider using AI as it exists today at any stage of the due diligence process, citing concerns such as violating confidentiality agreements associated with deals by entering third-party info into AI software.

To attempt to allay all those fears, Song said that Dili is continuing to fine-tune its models — many of which are open source — to reduce instances of hallucination and improve overall accuracy. She also stressed that private customer data isn’t used to train Dili’s models and that Dili plans to offer a way for funds to create their own models trained on proprietary, offline fund data.

“While hedge funds and public markets have invested heavily in tech, private market data has a lot of untapped potential that Dili could unlock for firms,” Song said.

Dili ran an initial pilot last year with 400 analysts and users across different types of funds and banks. But as the startup expands its team and adds new capabilities, it’s angling to expand into new applications — ultimately toward becoming an “end-to-end” solution for investor due diligence and portfolio management, Song says.

“Eventually we believe this core technology we’re building can be applied to all parts of the asset allocation process,” she added.

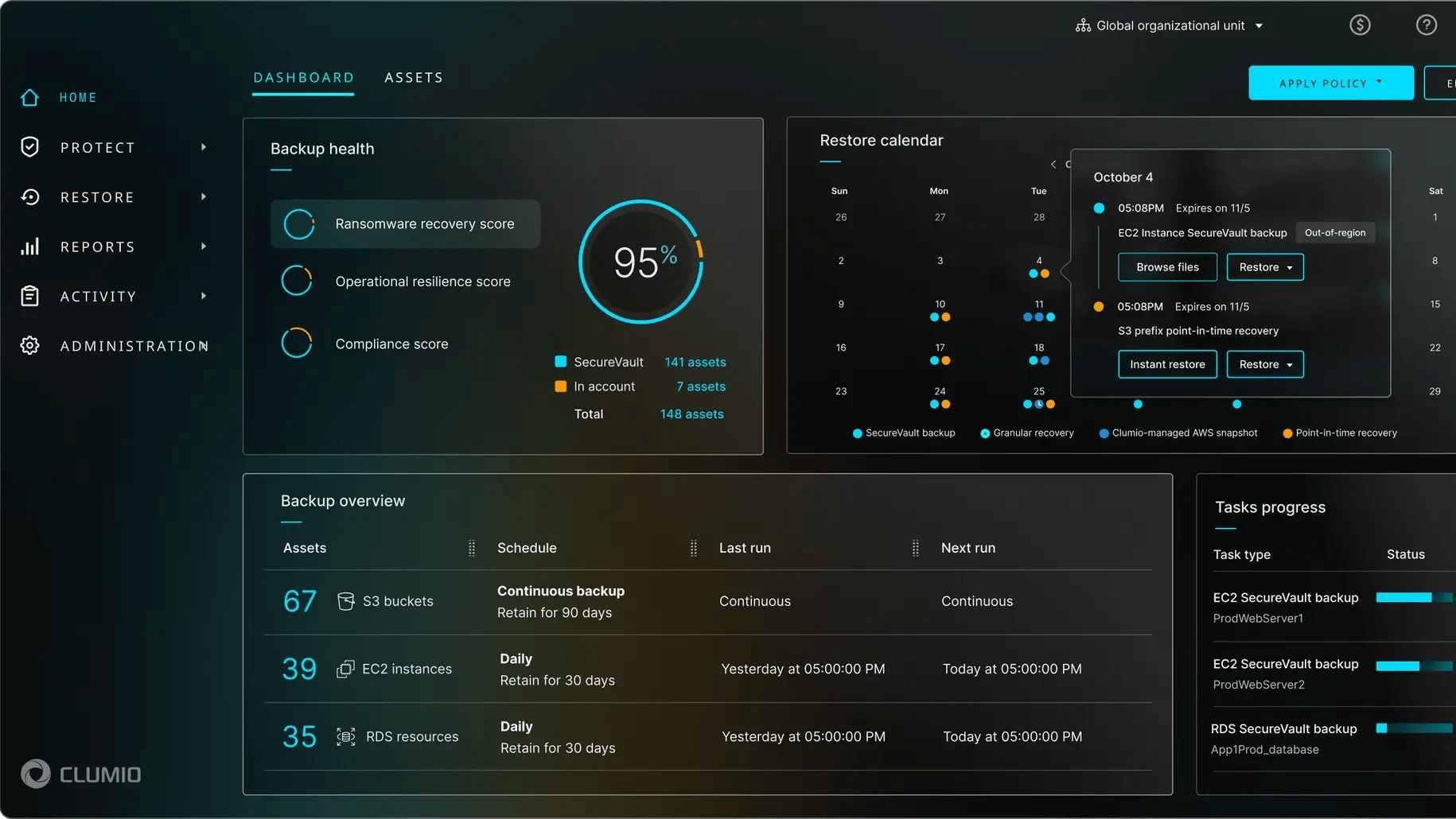

Clumio, a data backup and recovery provider for companies using the public cloud, has raised $75 million in a Series D round of funding.

The raise comes as the Santa Clara, California-based company claimed a four-fold increase in annual recurring revenue (ARR) last year, driven by new customers such as Atlassian, which is now using Clumio for the cloud-based incarnation of its Jira project management software.

The problems that Clumio and others like it, such as Veeam and Rubrik, are trying to solve are manifold. While public cloud spending is showing little sign of weaning, businesses also face growing threats related to ransomware, with extortion gangs enjoying a bumper 2023 by most estimations. And then there is the issue of data center disasters like the fire that hit France’s OVH in 2021, leading to millions of websites going offline and significant data loss.

Throw into the mix a growing array of regulations with strict data retention stipulations, and the need for greater transparency in the snowballing generative AI movement, and this all amounts to a fertile landscape for companies like Clumio to flourish, by helping companies to automate their data backup and recovery workflows.

Founded in 2017, Clumio largely serves to protect workloads on Amazon’s cloud infrastructure, though it introduced support for Microsoft 365 back in 2020 too. While it’s true that AWS and its ilk offer native data backups spanning areas including replication (where objects are copied across buckets), versioning (where multiple versions of an object are kept in the same bucket) and object locking (storing objects as “write-once-read-many“) this is typically to solve accidental data deletion and over-writes — it typically reverts to the previous version, and restricts how companies can restore objects or an entire bucket (a data storage repository) to a chosen point in time.

Moreover, it’s important to keep production (i.e. “live”) data and backup data in separate secure domains, something that many backup solutions (including first-party from the cloud providers themselves) don’t do. So if there is a breach, and security credentials were to be compromised across an entire organization, this would effectively jeopardize the backups as well as the production data.

“Clumio overcomes this challenge by delivering a default air-gapped, ‘immutable’ platform that keeps enterprises’ data secure from such adversarial incidents,” Clumio CEO Poojan Kumar told TechCrunch by email.

Indeed, Clumio stores its backup data in what Kumar calls a “hyper-optimized data plane” on AWS. “Unlike other vendors, we don’t deploy any heavy file systems or compute in the customer’s account to optimize storage,” he said. “We leverage our serverless data processing engine in AWS to perform all core backup operations. Having said that, we do plan to expand our data plane to other clouds this year.”

On that note, many enterprises actually build applications upon infrastructure spanning cloud providers — for instance, deploying a Microsoft SQL server database on an Amazon EC2 compute instance. This can create a “blank space” in backup coverage, where neither cloud provider is backing up the full stack. This is something that Clumio is increasingly supporting as it expands its coverage across the cloud infrastructure and application landscape.

While Clumio has been substantively AWS-focused thus far, which is perhaps understandable for a startup looking to target the biggest piece of the cloud computing pie from the get-go, Kumar says the platform has been architected in a way that makes it easy to port to any cloud.

“Our mission is to be THE backup solution for any cloud, any workload,” he said. “And this year, we will make progress on that mission. We have started in AWS, but will soon expand to the other key cloud providers as customer demand on those clouds increase.”

2023 was a hotbed of ransomware activity, with prolific gangs such as Russia-linked Clop exploiting software vulnerabilities to target hundreds of organizations, from hospitals to banks, universities and airlines. But holding data to ransom is just one immediate risk of not having sufficient backup and recovery systems in place, with various rules and standards such as SOC2 and ISO27001 requiring enterprises to store and maintain data for a set period of time for auditing purposes.

And the OVH fire three years ago also demonstrated the importance of a robust data backup regimen, when the French cloud provider was successfully sued by customers who had paid for backups but lost their data because OVH had kept the backups on the same servers as the “live” production data.

On top of that, the fast-moving AI revolution is leading to new regulations such as the EU AI Act, which has strict provisions for traceability so that it’s possible to document the origins of data used to develop a given model — this is important for averting the much-maligned “black box” problem and help make AI more trustworthy. And this could prove to be a boon for Clumio and its ilk, as businesses look to identify, classify and backup datasets preemptively even before regulations have gained much of a foothold.

“With the unstoppable force of generative AI and the immovable focus on privacy, there is enormous flux in the regulatory environment,” Kumar said. “We have some famous genomics customers that are using AI for drug discovery, and they want to do it responsibly because new regulations will require backward traceability for years, perhaps decades.”

Clumio says that it is now “well into” double-digit millions of dollars for ARR, a 400% increase from 2022 to 2023, though it stopped short of giving specific numbers. Prior to now, the company had raised around $186 million, the lion’s share arriving via a $135 million Series C round more than four years ago. While startups’ funding typically increases as they move through their rounds, Clumio’s latest cash injection sits at almost half its 2019 raise — a clear reflection of how the world’s economic landscape has shifted in the intervening years.

“The macro environment is quite challenging — capital is more expensive, and the mantra of ‘grow-at-all-costs’ has developed into responsible growth,” Kumar said. “So, even though we quadrupled ARR and secured net new investors in our cap table, we decided to raise our Series D appropriately.”

Still, $75 million is nothing to be sniffed at, and the capital will be necessary as Clumio seeks to bolster its market reach both in terms of industry coverage as well as its cloud support.

Clumio’s Series D round was led by Sutter Hill Ventures, with participation from Index Ventures, Altimeter Capital and NewView Capital.

Thomas Li was working at Point72, the hedge fund founded by notorious investor Steve Cohen, when he realized that the financial industry relies heavily on manual data entry processes that could be prone to errors.

“As a buy-side analyst, I felt the pain of manually sourcing and entering data to build and update financial models,” Li told TechCrunch. “It took time away from the more important work of analyzing and making investments.”

After meeting Jeremy Huang, a former software engineer at Airbnb and Meta, and Daniel Chen, an ex-Microsoft engineer, through New York University connections (all three are all alums), Li decided to try his hand at an automated solution to the data entry challenges.

The three partners launched Daloopa, which uses AI to extract and organize data from financial reports and investor presentations for analysts. Daloopa on Tuesday announced that it raised $18 million in a Series B funding round led by Touring Capital, with participation from Morgan Stanley and Nexus Venture Partners.

“Daloopa is an AI-powered historical data infrastructure for analysts,” Li said. “This way of approaching the data discovery process keeps highly competitive firms and teams ahead of the curve.”

Daloopa’s customers are primarily hedge funds, private equity firms, mutual funds and corporate and investment banks, Li says. They use the startup’s tools to build workflows for investment and due diligence research. The workflows, powered by AI algorithms, discover and deliver data to analysts’ financial models, reducing the need to copy data manually.

“Daloopa provides a new way to get mission-critical data to both the buy side and sell side,” Li said. “The time savings is reinvested into research and analysis, or client-facing time — helping our customers gain an edge in their research process.”

Now, I’m a little skeptical that Daloopa’s AI doesn’t make mistakes: No AI system’s perfect, after all. Thanks to the phenomenon known as hallucination, it’s not uncommon for AI models to make up facts and figures when summarizing documents and files.

Li didn’t suggest that Daloopa is foolproof. But he did claim that the platform’s algorithms “only continue to improve over time” as they’re trained on growing sets of financial documents. Mum’s the word on where the data’s sourced from, exactly; Li says only that it’s from “public sources such as SEC filings and investor presentations.”

“Daloopa has been an AI company since birth five years ago, before all the AI hype,” Li said. “We’ve spent those years training our algorithms and developing AI for financial institutions.”

With the new funding, which brings NYC-based Daloopa’s total raised to $40 million, the company plans to grow its team of ~300 employees, bolster product R&D and expand its customer acquisition efforts.

“Daloopa is an AI-powered solution that started ahead of the curve and has seen year-over-year growth acceleration over the past two years,” he said. “As financial institutions increase their adoption of AI tools, we’re very well positioned to be a leader in the AI-driven fundamental data space.”

Microsoft wants to put its Copilot everywhere. It’s only a matter of time before Microsoft renames its annual Build developer conference to Microsoft Copilot. Hopefully, some of those upcoming events will be a bit less lackluster than this year’s edition, which lacks any real standout announcements after Microsoft already announced its new Arm-based laptops and AI features in Windows 11 at a separate event the day before Build.

One of the more interesting announcements at Build, however, is about how the company is bringing generative AI to Power Automate, its process and workflow automation platform. And while process automation may not exactly be a topic that sets your world on fire, this may be one of the areas where generative AI can create real value.

Starting soon, for example, you will be able to take any repetitive desktop workflow and not just record it with Power Automate Desktop but also narrate what you are doing to Power Automate’s AI Recorder. Through this, the service can then combine voice and a screen capture to create more resilient workflow automation. One nifty aspect of this is that those automations are less likely to break when there are small changes to the user interface, too.

In a demo ahead of today’s announcement, Sangya Singh, Microsoft’s VP of Power Platform, described Recorder as a way to “disrupt how [Robotic Process Automation] is done.”

As of now, even these desktop flows will be created in the cloud. Singh noted that the team is looking into using smaller models to maybe run some of this on the desktop. She also stressed that even today, Recorder uses multiple foundational models to do its job.

Power Automate is also getting a new feature called AI flows, which are now available as part of an early access program. With AI flows, users describe the kind of workflow they want to create in natural language — augmented with additional parameters and source documents — and the generative AI system then creates the actual Power Automate flow.

An events company could use this to triage booking cancellations based on their terms of service, for example, or allow a company to see if an employee’s business travel booking request conforms to their guidelines.

We’re launching an AI newsletter! Sign up here to start receiving it in your inboxes on June 5.