Intuit is winding down budgeting app Mint this week, and that’s become good news for competitor Copilot. Mint’s demise represents both the end of an era and proof that consumers want more from their finance app, founder Andrés Ugarte told TechCrunch.

The New York-based CEO started the subscription-based personal finance tracker in January 2020 to offer an alternative to Mint. Today, Copilot has more than 100,000 subscribers with a majority of them coming into the app at least once a day. Others enter the app multiple times a week, with 20% of users being what Ugarte considers “heavy users,” using Copilot between five and 10 times a day.

“That’s good for an app that is not a social network,” Ugarte said.

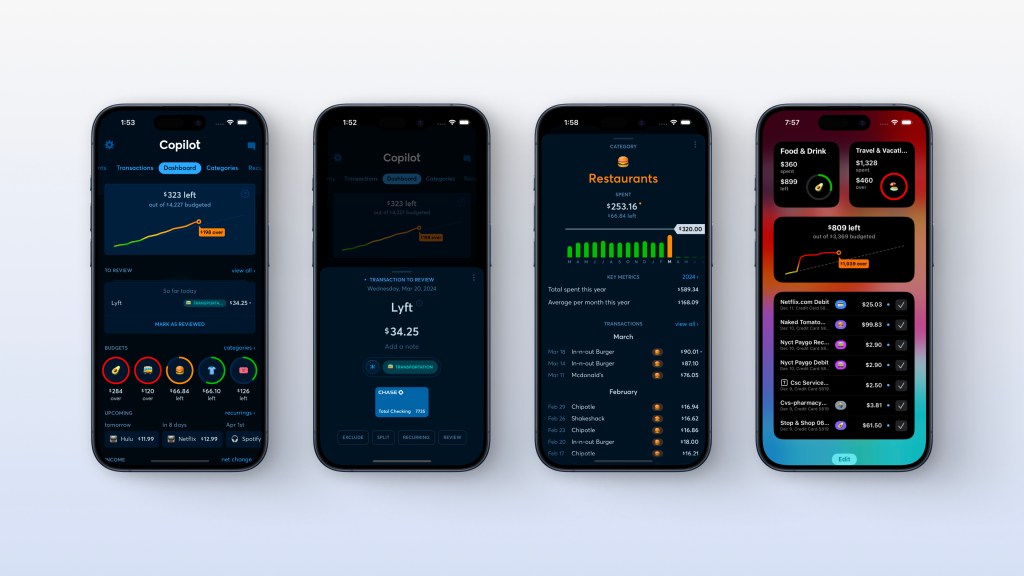

Other personal finance apps show where you are spending, even in categories that might not be relevant, he said. Copilot analyzes activity, including recurring payments, and displays the five to 10 budget score categories that the user wants so they can see where they are at in terms of spending and saving.

Users also save an average of 5% after starting with the app, Copilot calculates. While that might not seem like a lot, Ugarte notes that for someone making $100,000, for example, that is $5,000 a year. Multiplied by 100,000 users, and the app is putting half a billion back into consumers’ wallets, he said.

Beyond Mint

Like millions of others, Ugarte tried some personal finance apps, including Mint, yet found them to be lacking. For example, Ugarte made a rental payment each month, and Mint would flag it and alert him every month that a big purchase was made. Only it didn’t actually tell him what the purchase was, just gave a notification to log in and find out what was going on.

“When it launched, Mint was groundbreaking, but the app ended up being asleep at the wheel,” Ugarte said. “Other startups offered alternatives, however, when they would launch, they seemed like Mint, but with a fresh coat of paint.”

Copilot is a subscription personal finance tracker aiming to kill Mint

Trying those apps also gave Ugarte perspective on how cumbersome it was to connect accounts — Copilot users connect an average of 10 individual accounts. Therefore, he wanted to create an app that would reward users by taking in all that data and making sense of it for them.

Capturing Mint users

Following Intuit’s announcement on November 2 that Mint would shut down on March 23, Ugarte was among a number of finance app founders, including Monarch Money co-founder Ozzie Osman, who told me Mint’s loss was their gain. In Copilot’s case, that November announcement day turned out to be its “biggest day ever,” Ugarte said.

That growth has not stopped, he says. The company grew more in the last four months than in the previous four years. Copilot was able to parlay that growth into a $6 million Series A round of funding led by Nico Wittenborn’s Adjacent. Wittenborn previously invested in companies including Revolut, Calm, Niantic, PhotoRoom and BeReal.

TechCrunch reported on Copilot when it first launched with $250,000 in angel funding and then again when it added support for Apple Card. The new investment gives Copilot $10.5 million in total venture-backed capital.

Personal finance app Monarch sees bump in users following Intuit’s news it is closing Mint

The company reached profitability in 2023, however, more customers were asking for an Android app so they could share it with family and friends. Copilot has been an iOS app since its launch. Ugarte decided to go after new capital so it could take that opportunity.

In addition to doing some hiring to build Android and web capabilities, Copilot will accelerate AI and product development efforts.

“We’ve been doing a lot of machine learning over the years, however, we now have users saying they export their data from Copilot into ChatGPT and having conversations about their finances,” Ugarte said. “It makes sense for us to provide that experience so that they have accurate information.”

Ugarte didn’t give an exact date on when the new capabilities would launch, however, the goal is by the end of the year.

Why last week felt like 2021 in fintech