Trending News

17 October, 2024

8.4°C New York

This is not a drill! Today marks the final day to secure your early-bird tickets for TechCrunch Disrupt 2024 at a significantly reduced rate. At midnight tonight, May 31, ticket prices will increase, so act now to save up to $800 on admission to one of the most anticipated technology conferences of the year.

Disrupt is where you’ll find innovation for every stage of your startup journey. Whether you’re a budding founder with a revolutionary idea, a seasoned startup looking to scale, or an investor seeking the next big thing, Disrupt offers unparalleled resources, connections, and expert insights to propel your venture forward. In addition to amazing networking opportunities, you’ll get to hear from today’s top tech leaders in startup-packed sessions across three days.

How the Chainsmokers Bring Value Beyond Their Celebrity Status

While a lot of celebrities invest in startups, the Chainsmokers are different. Instead of angel investing, Drew Taggart and Alex Pall launched a formal fund, Mantis Venture Capital; invest out of a formal closed-end fund; and back companies in industries their celebrity prowess can’t always help in, like security startups and analytics platforms. In this session, Taggart and Pall will be joined by Dan Lorenc, the founder of Chainguard, to talk about how they are an asset to their B2B startups.

Can Startups Reignite American Manufacturing?

Not every startup is building mere software. A great number today are also building hardware, raising the question of where their gear will get designed and built. Some are choosing to invest in domestic manufacturing, often under the rubric of “American dynamism.” This panel will dig into how far — and how fast — the reindustrialization of the United States may occur, and how we’ll pull it off.

Want to see more sessions coming to Disrupt? Check out the agenda page. Make sure you register for your early-bird ticket today so you can attend these sessions, and more, at a great price.

What does it take to raise your first round of funding? That’s just one of the many topics that will be featured at TechCrunch Early Stage 2024 on April 25 in Boston.

At this daylong event, experienced founders, VCs and startup experts will lead sessions focused on the building blocks that new and prospective founders need to know. It’s where to go to get help, not hype.

Buy your ticket before our launch price ends January 26, and you’ll save $300* off a Founder or Investor pass.

Raising your first round requires artful finesse, because the last thing you want to do, years from now, is look back and regret the terms, conditions or side letters.

It’s a serious subject, and it’s why we’re excited to announce that Tom Blomfield, a group partner at Y Combinator, will join us at TC Early Stage for a session called “How to raise money and come out alive.”

That might sound a bit dramatic, but there may be days when it feels like fundraising might age you — so arm yourself with solid, up-to-date information. During this session, Blomfield will talk about the way investors think, the common gotchas that might come back to haunt you, and how to put your company in the strongest possible position to raise.

Prior to joining Y Combinator, Tom Blomfield, a British entrepreneur, founded two companies valued at more than $1 billion. He co-founded Monzo, one of the first app-based challenger banks in the U.K., which raised more than £500 million and counts 10% of the U.K. population as its customers.

He also previously founded GoCardless, an online payments processor for the Direct Debit system.

TechCrunch Early Stage 2024 takes place on April 25, 2024, in Boston. Prices go up January 26! Buy a TC Early Stage pass now, save up to $300 — and join us in Boston!

*Launch-price savings reduce the full, onsite price of Founder and Investor passes. The launch-price period ends January 26 at 11:59 p.m. PT.

Is your company interested in sponsoring or exhibiting at TC Early Stage 2024? Contact our sponsorship sales team by filling out this form.

It’s not every day that a new VC firm comes out of stealth. This time, Varsity is announcing its first fund. Founded by a former Société Générale executive and two VC investors who worked at Serena Capital, Varsity has already raised €70 million ($75 million at today’s exchange rate) to back early-stage startups across several verticals.

This is just a first close, as Varsity hopes it’ll be able to raise as much as €150 million ($161 million) for Varsity I. Overall, the firm plans to invest in roughly 30 startups in Europe. Some of Varsity’s limited partners include French public bank Bpifrance, MACSF, Sogecap and Elevation Capital Partners (with the creation of a feeder fund).

It means that Varsity plans to invest anything between €1 million and €5 million, depending on the investment opportunity with the option to invest in follow-on investments — Varsity has already invested €15 million in five companies. While the team doesn’t have a specific vertical in mind, it says that it plans to invest in finance, health, enterprise software and climate startups.

The three founding members are Didier Valet, the former deputy CEO at Société Générale, as well as Kamel Zeroual and Florent Thomas, who spent some time working for Serena Capital.

Florent Thomas (pictured right) also created TalentLetter back in 2018. It’s an email newsletter for tech startups looking for potential hires. Every week, TalentLetter sends two profiles that have been selected because they can have a high impact at a fast-growing startup. Along with Marie Brayer, they also created Karma Driven, an invite-only job board.

As for Kamel Zeroual (pictured left), he created the Startup Mafia podcast, interviewing several executives working for a handful of successful tech startups. During the first season, he interviewed Swile executives. He shifted his focus to Alan and Checkout.com for seasons two and three.

Both already know quite a few people in the startup ecosystem. So it’s going to be interesting to see how the Varsity team plans to leverage these platforms to identify interesting investment opportunities and make sure they perform well at later stages.

Get ready for an exciting lineup at TechCrunch Early Stage — happening on April 25 in the lively city of Boston, Massachusetts. We’ve gone through a bunch of applications from experienced founders and experts in the startup world, all hoping to shine in our Audience Choice segment.

Don’t miss out: Grab your tickets at a discounted early-bird rate before they’re all gone!

Audience Choice voting ends in just a couple of days on February 15. This week is your last chance to have a say and help decide who makes it to the event.

We’ve chosen six awesome contenders, each ready to lead an interesting roundtable discussion. Check out their summaries, cast your votes, and help us pick who gets to present live at TC Early Stage.

But what exactly are these roundtables, you ask? Let us explain.

Roundtable sessions: Picture a 30-minute chat led by one person, chatting with up to 40 founders. These sessions will happen twice during the event, so there’s plenty of chances to join in and learn.

Remember, Audience Choice voting stays open until February 15. Make your picks, grab your pass for TC Early Stage, and mark your calendar for April 25 to dive into a day of learning, skill-building, and turning startup dreams into reality.

Is your company interested in sponsoring or exhibiting at TC Early Stage 2024? Contact our sponsorship sales team by filling out this form.

You voted and the results are finally in! We’re excited to announce that you chose Dana Louie, HubSpot’s Senior Manager of Corporate Development, as this year’s Audience Choice roundtable winner at TechCrunch Early Stage 2024.

Dana’s roundtable “Exiting via M&A: What Acquirers Are Looking for and How You Can Prepare for a Successful Acquisition” will cover factors companies’ consider when evaluating M&A opportunities, real-world perspectives and strategies that drive acquisitions, and it will provide practical insights to maximize a successful acquisition.

Grab your pass today, and hear from Dana and other leaders at TechCrunch’s annual founder summit on April 25 in Boston.

Dana leads strategic prioritization and execution for acquisitions and corporate venture capital investments. In her role, Dana works closely with executive leadership to build business cases, execute deals, and analyze opportunities throughout the acquisition process. She works closely with a number of startups in the HubSpot Ventures portfolio and most recently closed HubSpot’s largest deal, a $150 million acquisition of Clearbit.

Prior to HubSpot, Dana spent time at a venture-backed startup and in consulting before receiving her MBA from Harvard Business School in Boston, Massachusetts, where she and her husband still reside.

During this one-day startup conference, you’ll learn about legal issues, fundraising, marketing, growth, product-market fit, pitching, recruiting and more. We’re talking dozens of highly engaging presentations, sessions and roundtables with interactive Q&As and plenty of time for networking. At TechCrunch Early Stage you’ll walk away with a deeper working understanding of topics and skills that are essential to startup success.

Stability AI has announced Stable Diffusion 3, the latest and most powerful version of the company’s image-generating AI model. While details are scant, it’s clearly an attempt to fend off the hype around recently announced competitors from OpenAI and Google.

We’ll have a more technical breakdown of all this soon, but for now you should know that Stable Diffusion 3 (SD3) is based on a new architecture and will work on a variety of hardware (though you’ll still need something beefy). It’s not out yet, but you can sign up for the waitlist here.

SD3 uses an updated “diffusion transformer,” a technique pioneered in 2022 but revised in 2023 and reaching scalability now. Sora, OpenAI’s impressive video generator, apparently works on similar principles (Will Peebles, co-author of the paper, went on to co-lead the Sora project). It also employs “flow matching,” another new technique that similarly improves quality without adding too much overhead.

The model suite ranges from 800 million parameters (less than the commonly used SD 1.5) to 8 billion parameters (more than SD XL), with the intent of running on a variety of hardware. You’ll probably still want a serious GPU and a setup intended for machine learning work, but you aren’t limited to an API like you generally are with OpenAI and Google models. (Anthropic, for its part, has not focused on image or video generation publicly, so it isn’t really part of this conversation.)

On X, formerly Twitter, Stable Diffusion boss Emad Mostaque notes that the new model is capable of multimodal understanding, as well as video input and generation, all things that his rivals have emphasized in their API-driven competitors. Those capabilities are still theoretical, but it sounds like there is no technical barrier to them being included in future releases.

It’s impossible to compare these models, of course, since none are really released and all we have to go on are competing claims and cherry-picked examples. But Stable Diffusion has one definite advantage: its presence in the zeitgeist as the go-to model for doing any kind of image generation anywhere, with few intrinsic limitations in method or content. (Indeed, SD3 will almost surely usher in a new era of AI-generated porn, once they get past the safety mechanisms.)

Meet Unstable Diffusion, the group trying to monetize AI porn generators

Stable Diffusion seems to want to be the white label generative AI that you can’t do without, rather than the boutique generative AI you aren’t sure you need. To that end, the company is upgrading its tooling as well, to lower the bar for use, though as with the rest of the announcement, these improvements are left to the imagination.

Interestingly, the company has put safety front and center in its announcement, stating:

We have taken and continue to take reasonable steps to prevent the misuse of Stable Diffusion 3 by bad actors. Safety starts when we begin training our model and continues throughout the testing, evaluation, and deployment. In preparation for this early preview, we’ve introduced numerous safeguards. By continually collaborating with researchers, experts, and our community, we expect to innovate further with integrity as we approach the model’s public release.

What exactly are these safeguards? No doubt the preview will delineate them somewhat, and then the public release will be further refined, or censored depending on your perspective on these things. We’ll know more soon, and in the meantime will be diving into the technical side of things to better understand the theory and methods behind this new generation of models.

Age of AI: Everything you need to know about artificial intelligence

Intuitive Machines’ first moon mission will come to a premature end due to the spacecraft landing on its side, which altered how the solar panels are positioned in relation to the sun, the company said in an update Tuesday morning.

Flight controllers were still working to determine the battery’s remaining life, which could be between 10-20 hours. The spacecraft, which landed on the moon five days ago, was expected to operate for 7-10 days.

Intuitive Machines made history when it landed its spacecraft, called Odysseus, near the lunar south pole last week. The lander is the first American hardware to touch the lunar surface since NASA’s final crewed Apollo mission in 1972. It’s also the first privately built and operated spacecraft to land on the moon — ever – and the closest a lander has ever come to the lunar south pole.

But the momentous success was somewhat dashed when company officials revealed in a televised press briefing the following day that the spacecraft had actually tipped over at some point during landing. Intuitive Machines CEO Steve Altemus suggested that Odysseus did not descend straight down, but at a lateral angle. It also came down a little too quickly, which could’ve caused one of the feet to catch on a rock or crevice and causing the tip, he speculated.

The spacecraft likely came to a rest slightly elevated on a rock, based on the amount of power that was being generated by the solar arrays, he added. Images captured by NASA’s Lunar Reconnaissance Orbiter, a satellite that’s been orbiting the moon and collecting data on its surface for over a decade, located Odysseus on the surface and confirmed it landed within just 1.5 kilometers of its intended site near the lunar south pole.

Odysseus is continuing to send science data and imagery related to the onboard payloads, but the company did not specify whether the data rates have been limited due to the lander’s position. While none of the science payloads are located on the panel facing the moon’s surface, two of the spacecraft’s antennae are now pointing at the ground.

It is still unclear if this is affecting any data-gathering, but Altemus said the loss of the antennae was a “limiter.”

“Those antennas are unusable for transmission back to Earth,” he said last Friday. “So that really is a limiter. Our ability to communicate and get the right data down so that we get everything we need for the mission I think is the most compromised from [it] being on its side.”

Intuitive Machines’ historic landing is due in no small part to extremely quick thinking on the part of flight controllers, who had to improvise a navigation solution after they learned the spacecraft’s onboard laser range finders — which collect essential landing data, like altitude and horizontal velocity — were not working. Remarkably, they turned instead to one of the payloads on the lander, a doppler lidar technology demonstrator from NASA, to help land the vehicle on the surface.

Company officials later revealed that the laser range finders stopped working due to human error and trade-offs made to save time and money, rather than any technical issues. Engineers chose not to test fire the laser system on the ground due to cost and scheduling, Intuitive Machines’ head of navigation systems, Mike Hansen, told Reuters yesterday. Engineers also failed to toggle a physical safety switch on the system prior to launch.

Intuitive Machines and NASA leadership will host a second televised news conference tomorrow to discuss updates to the mission.

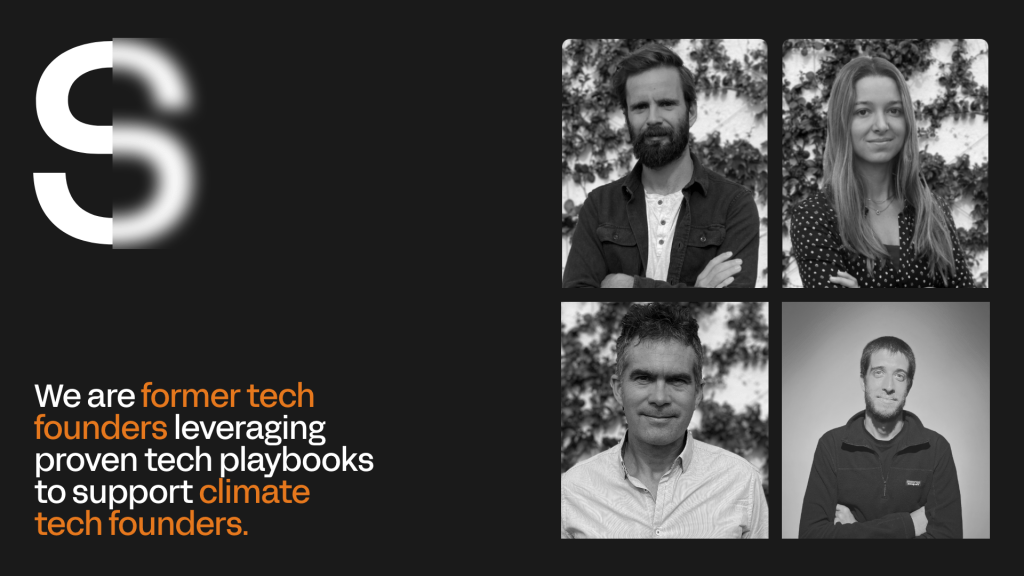

Silence wants to shake things up when it comes to climate tech investment. This new angel-style VC firm has already raised $35 million and plans to make dozens of small investments in climate startups to help them apply the tech startup playbook.

The Silence team is led by Borja Moreno de los Rios, who acts as a solo general partner for Silence’s original fund. Before starting Silence, he was a venture partner at FJ Labs. He also founded Merlin, an hourly jobs marketplace in the U.S.

With Silence, Borja wants to apply his experience to climate investment. He has surrounded himself with a team of tech experts who have all done the work to become climate experts as well.

“I have been very connected to nature and the environment ever since I was a child. I grew up water-skiing competitively from a very young age. Since I was five or six years old, I spent every weekend and all my vacations by lakes and in the countryside,” Borja told me.

“But as I was growing through my tech career, I always had an eye on trying to learn as much as possible so I could really have an impact at the climate tech level. So after my last company got acquired, I knew that I wanted to do something in climate,” he added later in the conversation.

Since the first close of the fund in June 2022, Silence has already invested in 22 different companies. They apply the same investment strategy (with a few exceptions). Silence doesn’t lead rounds and doesn’t take board seats.

This way, they believe they can remain neutral and unbiased over the long run — just like an angel investor, but with a larger ticket size. “The average ticket size is around $300,000. We invest from pre-seed to Series A and we invest anything from $100,000 up to $700,000,” Borja said. There will be some follow-on investments for the most promising investments.

They also don’t compete with top-tier VC funds, meaning they can get invited to participate in very competitive deals. “We wanted to find a way so that we were not competing with the current VCs,” Borja said. For instance, Silence already participated in several rounds with well-known VC firms, such as Point Nine, FJ Labs, FifthWall, FirstMark Capital and Lowercarbon Capital.

I’m not going to list all portfolio companies (check the portfolio page), but Silence’s portfolio companies are building virtual power plants, energy management systems, home energy management systems, financing platforms for solar equipment and circularity-focused marketplaces.

“There’s one that just grew really fast. And we’re very proud because we invested in pre-seed and we never lead deals. But in this case, the company was struggling to close a round because everyone was saying, ‘We’ll put money only if you find a lead.’ And no one wanted to be the lead. So we told them, ‘We’ll be your lead,’” Borja said.

“This is a company called Cardino, which is a used EV marketplace. So we invested with just the deck, and they’re doing like €72 million in GMV in nine months. And now they raised a seed round with Point Nine leading the seed. So obviously, it’s super early, but so far so good.”

In addition to Borja, Sara Ramos Colmenarejo left the Hummingbird team to join Silence. Guilherme Penna, who previously worked at Global Founders Capital, is also an investor at Silence. Finally, Brendan Hayes acts as the CFO and COO for the fund.

Silence’s limited partners include general partners at other VC firms, such as FirstMark Capital, DST Global, FJ Labs, Point Nine and Hummingbird, as well as family offices, successful founders, etc. Overall, Borja seemed like an enthusiastic investor. Even though Silence wants to remain a small, angel-style investor, he couldn’t stop listing some of his portfolio companies.

“There’s a company called Electryone that’s really early that’s building a virtual power plant software that we’ve invested in and we really like,” he said. “We also invested in a company called Runwise in the U.S., which basically has built a technology that integrates with the heating system in a building and then has sensors around the building and is constantly optimizing the temperature.”

Interestingly, unlike many climate funds, Silence doesn’t want to participate in deep tech investments with a very long-term timeframe. Borja believes Silence’s expertise is in SaaS and marketplaces.

“In the end — I know this is kind of controversial — but, in the end, I think we are going to be creating more value towards climate through these safer investments than if we invest in ten moonshots and all of them fail,” he said.

TechCrunch Disrupt takes place on October 28–30 in San Francisco. While the event is a few months away, the deadline to secure your early-bird tickets and save up to $800 is fast approaching. You have until May 31 at 11:59 p.m. PT to take advantage of this great deal!

The countdown is on. With only a few days left at this price point, make sure to grab your TC Disrupt pass now and enjoy significant savings.

TechCrunch Disrupt is more than just a tech conference; it’s an immersive event that drives innovation and growth. Attend three tech-packed days and dive into masterclasses that cover everything from building and funding to launching and scaling your startup. Join a vibrant community of 10,000 passionate founders, investors, and entrepreneurs. With six stages of programming, numerous breakout sessions, and roundtables, the opportunities for learning, networking, and inspiration are limitless.

We just released our first round of speakers! You’ll hear from leaders like:

Alex Wang, Founder and CEO at Scale AI.Dayna Grayson, Co-Founder and Managing Partner at Construct Capital.Denise Dresser, CEO at Slack.Matt Rogers, CEO and Co-Founder at Mill.Navin Chaddha, Managing Partner at Mayfield Fund.Peter Beck, Founder and CEO at Rocket Lab.Sangeen Zeb, General Partner at Google Ventures.Spenser Skates, CEO and Co-Founder at Amplitude.Vinod Khosla, Founder and Partner at Khosla Ventures.

TechCrunch Disrupt is set to ignite San Francisco from October 28–30, but to save up to $800, you must act quickly. The deadline for early-bird pricing is May 31 at 11:59 p.m. PT! Buy now.