Image Credits: Bryce Durbin/TechCrunch

Image Credits: Bryce Durbin/TechCrunch

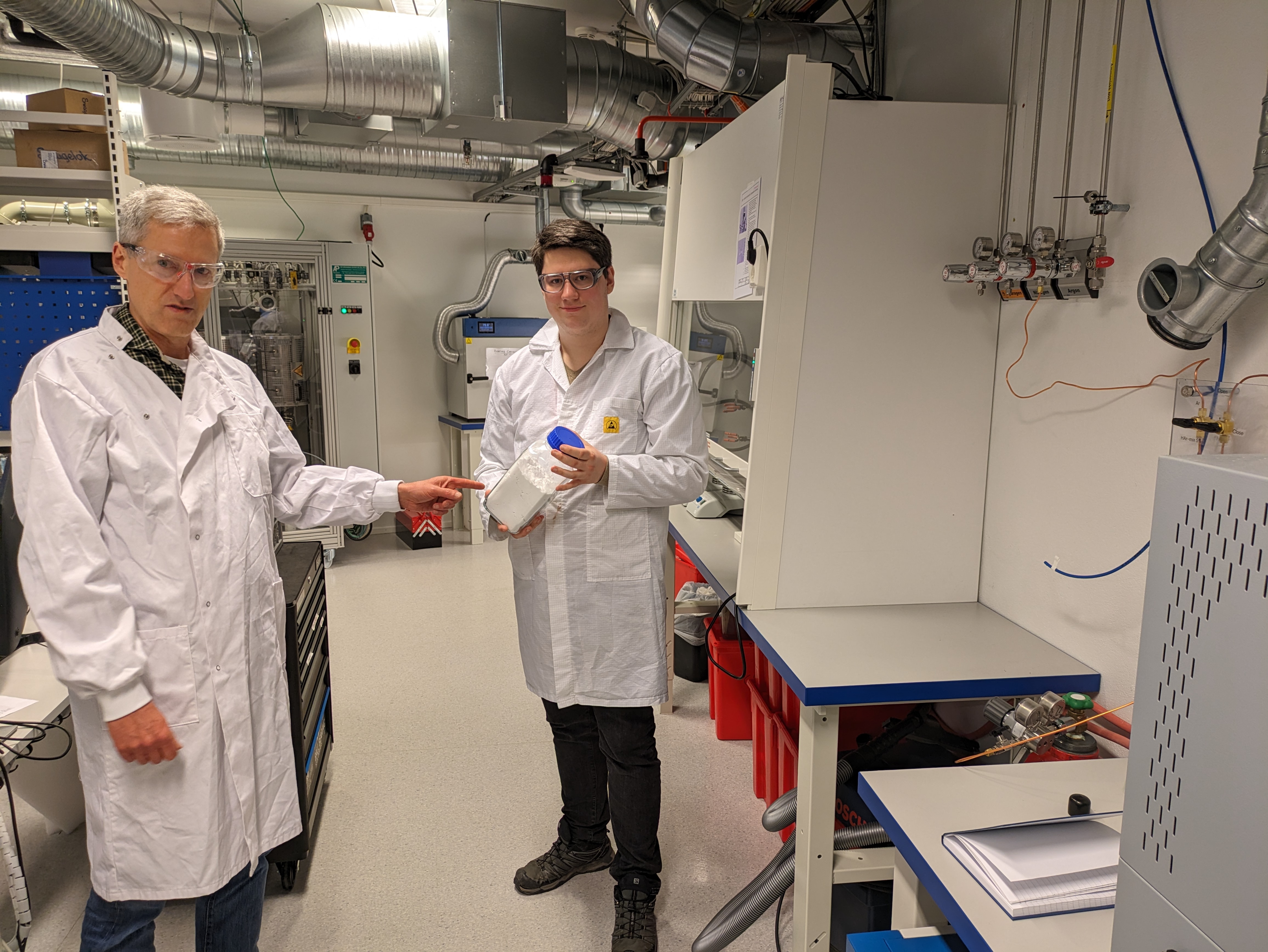

The humble garage is so steeped in Silicon Valley lore it’s almost cliché. Yet that’s exactly how Caleb Boyd and Kevin Bush started Molten Industries: in the garage of the Stanford professor’s on-campus home, where Kevin rented an apartment.

It had everything they needed: space and, most importantly, power. The two wanted to break methane’s back, so to speak, stripping hydrogen from carbon in a way that didn’t emit atmosphere-warming carbon dioxide.

“We call it a garage, but it was really just a carport. We plugged into his EV charger, heated up a methane pyrolysis reactor to around 1,000 Celsius and started cracking methane,” Boyd told TechCrunch.

The professor who lived there “was super helpful,” Boyd said. “He would just come by, help us tinker with things and give us advice.”

While the garage can still be a great place to do basic research, it’s the next step that poses a problem. Climate tech companies often face a “valley of death” between lab experiment and investable company.

Founders have typically had to solve that problem themselves. But increasingly, investors are intervening early.

When Boyd and Bush were still in the garage, they received a visit from Ashley Grosh, vice president at Breakthrough Energy, the climate tech organization founded by Bill Gates that includes a for-profit venture capital arm and various nonprofit programs. Grosh was representing one such program called Breakthrough Energy Discovery, a new division devoted to early-stage companies, the company told TechCrunch.

Discovery is an evolution of Breakthrough’s Fellows program, which has been operating since 2021. Discovery identifies promising first-time founders, who are often fresh out of grad school or a postdoc and provides them with grants of up to $500,000, Grosh said. The organization has also created digital resources for common problems and pays for fellows to attend various conferences and meetings.

To date, the Breakthrough Energy Fellows program has supported 42 companies spanning the gamut of climate tech, from cement and hydrogen to agriculture and fusion power. Altogether, the startups have raised a cumulative $250 million.

Grosh has been overseeing the program since 2020. “The way we have built a thesis around this is there’s government funding, there are programs like ARPA-E, but they’re not really positioned to pick winners. They can do the science, but they’re not really going to go out and pick winners and double down on a company,” Grosh told TechCrunch.

Venture capital has historically been hesitant to commit to companies that it considers too early. “We saw what happened in cleantech 1.0,” she said, referring to the first wave of climate-related investments that peaked about 15 years ago. “People came in a little too early. Now they’ve moved back and figured out where the strike zone is for venture. But I think what we’re seeing is that there’s still a lot of scientific discovery that needs to be done.”

For investors who can stomach earlier stages, the advantage is clear: an early window into the founders of tomorrow. These bets tend to be riskier and because the valuations are lower and the checks are modest, the potential returns can be significant.

“The term we use internally on this topic is proto-companies,” Johanna Wolfson, co-founder and general partner at Azolla Ventures, told TechCrunch. “It’s not a company yet, but if you squint, you can see how it could become a company.”

Plus, in climate tech, moving earlier in the pipeline is about more than just returns. At Azolla Ventures, in particular, finding companies and opportunities that have been overlooked is part of the organization’s mandate.

“As time passes, and as we keep missing our emissions targets, the crisis deepens,” Wolfson said. “And so it heightens the stakes to be able to make sure we’re not leaving anything on the table.”

Funding basic research: Earlier than early

For Breakthrough Energy, the application process alone has helped it identify some promising areas where basic research still needs to be funded.

“We started seeing some ideas that were further upstream. We’d say, ‘Oh, this is interesting. It’s not quite ready to be a fellow, but this research would be really helpful,” Grosh said. “We started to amass a list of those applications, and we then started funding a few as research grants.”

Soon, Grosh and her team realized they’d need to be more systematic about it. Rather than put out the usual request for proposals, Breakthrough Energy Discovery started convening workshops for researchers spanning the spectrum of experience, from grad students to Nobel Prize winners. At a workshop, they would identify the most promising and impactful opportunities.

“Out of that is where we will start to seed a couple of research projects,” Grosh said.

Azolla Ventures is taking a slightly different tack, bringing on what they call a tech scout fellow.

“We fund a graduate student to look around for interesting projects and tell us what they’re excited about,” Wolfson said, “because graduate students are going to be the ones who are the most plugged in.”

The program is still young. So far, Azolla is working with grad students at Georgia Tech, a research powerhouse that the firm felt was being overlooked by venture capital.

“If you had to guess how active the venture community is there, you’d probably guess less than MIT, Harvard, Stanford, or Berkeley just based on geography, unfortunately. Georgia Tech is an example of a place where we’re experimenting, we’re saying there’s probably some undervalued opportunities.”

Even among the usual academic suspects, promising research can fall through the cracks and opportunities can be overlooked. It’s why Collaborative Fund gave Harvard University’s Wyss Institute $15 million to start a lab to research sustainable materials. The goal is to identify promising projects and scientists and sharpen them to the point where they’re ready to raise funds, according to partner Sophie Bakalar.

From lab to real business: How founders benefit

Collaborative gets first dibs on the projects, which have ranged from PFAS detection to addressing air-quality issues, and Bakalar is now also a visiting scholar at the Wyss Institute, maintaining a front row seat at the institute. Along the way, Bakalar and Collaborative offer support to help founders bridge the valley of death between lab project and investable startup. Bakalar said she expects the first project to emerge from the lab in the next couple months.

Those sorts of resources can be helpful for the sort of founders that climate tech investors need. Many of them have spent years head down in the lab. Even if they had exposure to the business side through coursework, it’s an entirely different experience from running a startup.

“We’re still based at a university,” said Mattia Saccoccio, co-founder and CTO of NitroVolt, which makes sustainable ammonia for fertilizer. “We sometimes miss the exchanges with other companies or companies that like us are working on climate solutions or on deep tech.”

To counter that isolation, Breakthrough Energy groups its fellows into cohorts and encourages them to stay in touch during their tenure and after, including with the growing alumni network. “We meet regularly with other founders,” Saccoccio said. “I found that one of the most precious parts of the program.”

Founders also said that access to Breakthrough Energy’s business fellows was particularly helpful. The business fellows are a mix of what VCs might consider advisers or operating partners.

“If we need help with IP, we can get help there. If we want to get into the ammonia industry, there’s a fellow who has worked with industry and can help us open doors,” said Suzanne Zamany Andersen, co-founder and CEO of NitroVolt.

For Boyd, the Molten Industries co-founder, the business fellows have been indispensable as his company has evolved. In addition to hydrogen, the company’s process also produces carbon. Initially, “we were like, we’re just going to bury it or put it in concrete or something,” he said. But as the startup went out to fundraise for a Series A, it started considering alternative uses, eventually settling on making graphite for lithium-ion batteries.

“The whole Breakthrough Fellows team was super supportive during that, helping us not only think through that and what the implications would be, the pros, the cons, but then also just taking it in stride,” Boyd said. “As a founder, you want your investors to be partners alongside you and not freak out or be controlling. That’s something the Breakthrough Energy Fellows team does really well.”

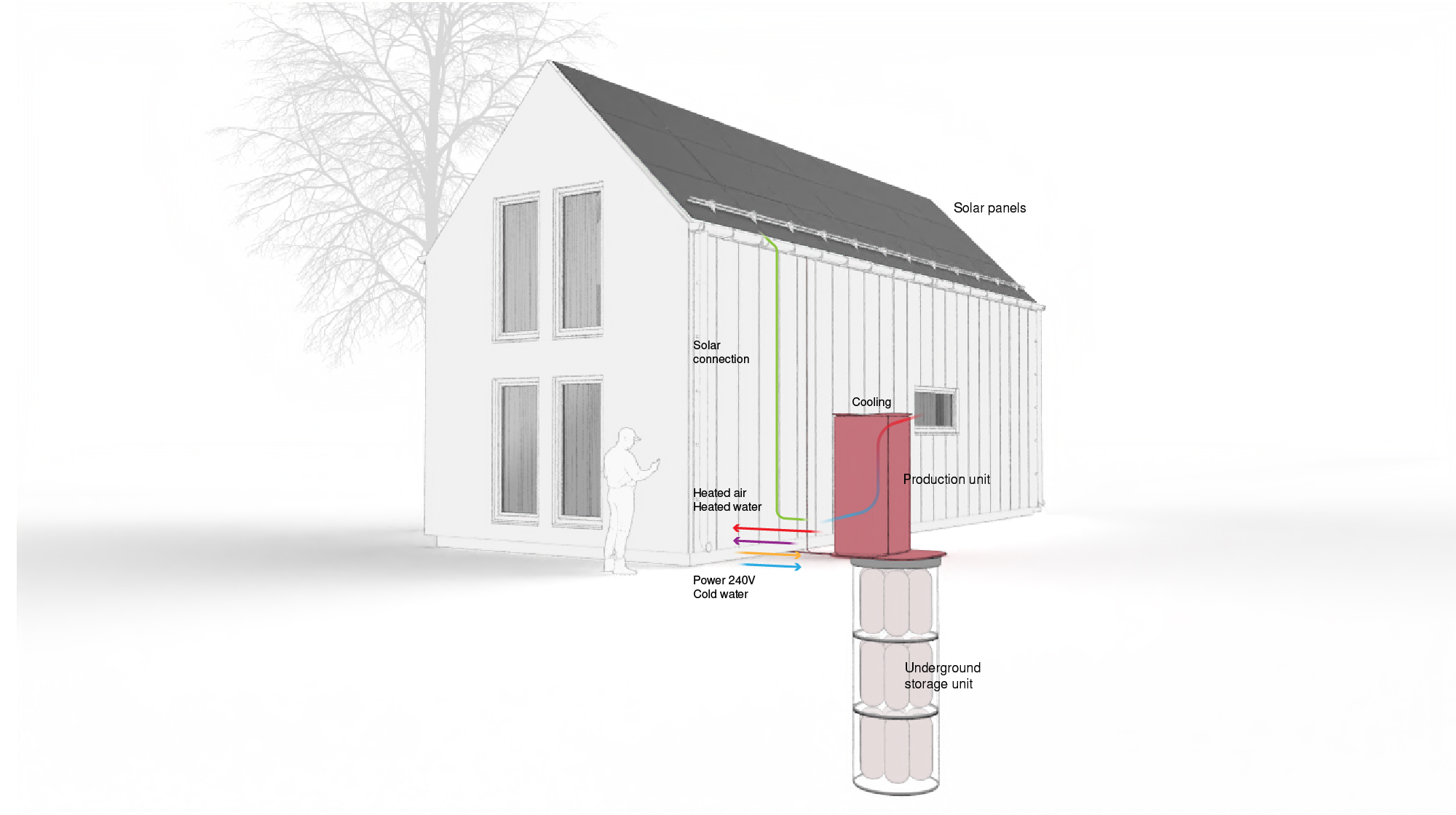

Ted McKlveen, co-founder and CEO of Verne, which is developing a new way to store hydrogen, agreed. “It does help get you from zero to one, from nothing to something that you can take to investors and say, ‘Okay, well, we got it, we’re real.’”

Crossing the chasm from idea to reality is just the first of many that climate tech startups have to traverse. Not all will make it, but as investors and their affiliates step in to fill the gap, their odds are certainly improving.