Trending News

17 October, 2024

11.11°C New York

One of the biggest questions looming over the drone space is how to best use the tech. Inspection has become a key driver, as the autonomous copters are deployed to dangerous or remote spaces like power plants and oil rigs. Inventory drones are a promising subset of the category that has emerged in recent years.

Ingka Group, which owns and operates hundreds of Ikea locations comprising around 90% of its retail sales, is perhaps the most prominent name embracing the emerging space. It makes sense: The Swedish furniture giant and meatball vendor runs massive warehouses stocked with large items. It’s a lot of ground for humans to cover and too much vertical space for most robots.

That’s the primary advantage to systems like the 100 drones Ikea currently commands across Europe. The little scanning drones can provide around-the-clock updates to inventory and reach heights humans and most robots can’t.

The drones, which have been branded with the blue and yellow color scheme, an Ikea logo and the familiar “Hej!” tagline, are produced by Verity. The firm has been popular with investors, thanks in large part to its Ikea partnership. The startup raised $32 million last March and another $11 million four months later.

“We are always curious of learning from others, and this project is a great example of how we have collaborated across Ikea and together with an external partner come up with a solution that we all benefit from,” Ikea logistics head Peter Ac noted in a statement.

The Ikea initiative kicked off in 2021 in Verity’s native Switzerland. The drone company provided a bespoke solution for the furniture giant’s needs. It now covers 16 locations, with stores in Belgium, Croatia, Slovenia, Germany, Italy and the Netherlands.

Verity might have the highest profile partnership at the moment, but it’s far from alone in the inventory drone category. Competitors include Corvus Robotics, Gather AI and Indoor Robotics. There’s also Dexory, which reaches the high shelves with a massive telescoping autonomous mobile robot.

Google is hosting a version of its Cloud Next conference in Tokyo this week, and it’s putting the focus squarely on tweaking its databases for AI workloads (because at this point in 2024, AI is the only thing these major tech companies want to talk about). These include updates to its Spanner SQL database, which now features graph and vector search support, as well as extended full-text search capabilities.

This wouldn’t be a Google announcement without some Gemini-powered features. These include Gemini in BigQuery and Looker to help users with data engineering and analysis, as well as governance and security tasks.

Google argues that while the vast majority of enterprises think that generative AI will be critical to the success of their business, they also know that much of their data remains unmanaged, leaving it outside of the scope of their analytics and AI initiatives.

“They have to really get out of all of their existing data silos and data islands, and get to a consolidated multimodal data platform, spanning structured and unstructured data — [because] GenAI is terrific at analyzing unstructured data — and combining data at rest with their data movement, so real-time data and data at rest processing,” explained Gerrit Kazmeier, Google’s VP and GM for database, Data Analytics and Looker. Activating this enterprise data flow, he argued, is what a lot of these new features are all about.

Spanner powers most of Google’s own products like Search, Gmail and YouTube and its customer list includes the likes of Home Depot, Uber, Walmart and others. And while Spanner can handle a massive volume of data, vector and graph databases are a necessity to bring enterprise data into GenAI applications and enrich existing foundation models.

“What we’re thinking about is what would it really take for us to take Spanner’s availability, scale, relational model, and really expand that to be the best data platform for operational GenAI apps,” said Andi Gutmans, Google’s VP and GM for databases. Like so many database vendors, the first step here for Google is adding graph capabilities to Spanner, using the emerging GraphQL standard. Enterprises can then use this graph to augment their GenAI applications — and the foundation models that power them — using Retrieval Augmented Generation (RAG), which is currently the de facto standard for this use case.

Also new in Spanner are full-text search and vector search, with the vector search capabilities backed by Google’s ScaNN algorithm. “With Spanner Graph, full-text search and vector search, we have evolved Spanner from not only being the most available, globally consistent and scalable database, to a multi-model database with intelligent capabilities that seamlessly interoperate to enable you to deliver a new class of AI-enabled applications,” Google says.

In addition to these AI-centric updates, Spanner is getting a new, optional pricing structure. Dubbed “Spanner editions,” the idea here is to offer a tier-based pricing model that offers them more flexibility. Currently, Google Cloud customers had to choose between a single-region offering and a multi-region version, which also offered a bundle of additional features like replication.

Google also on Thursday announced a major update to Bigtable, Google’s NoSQL database for unstructured data and latency-sensitive workloads. Bigtable now features SQL support (or more precisely, support for GoogleSQL, the company’s own SQL dialect), making it significantly easier for virtually any developer to use the service.

Previously, developers had to use the Bigtable API to query their databases. Currently, Bigtable supports roughly 100 SQL functions.

For the Oracle database fans out there, Google will now allow them to host their Oracle Exadata and Autonomous database services right in the Google Cloud data centers — and they can link their applications between Google Cloud and the Oracle Cloud. For Google, that means more workloads in its cloud and for Oracle, at least, it means these users are still paying their licensing fees, even if they aren’t using the Oracle cloud.

Also new in Google Cloud is support for open-source Apache Spark and Kafka for data streaming and processing, as well as real-time streaming from Analytics Hub (Google’s service for securely sharing data between organizations).

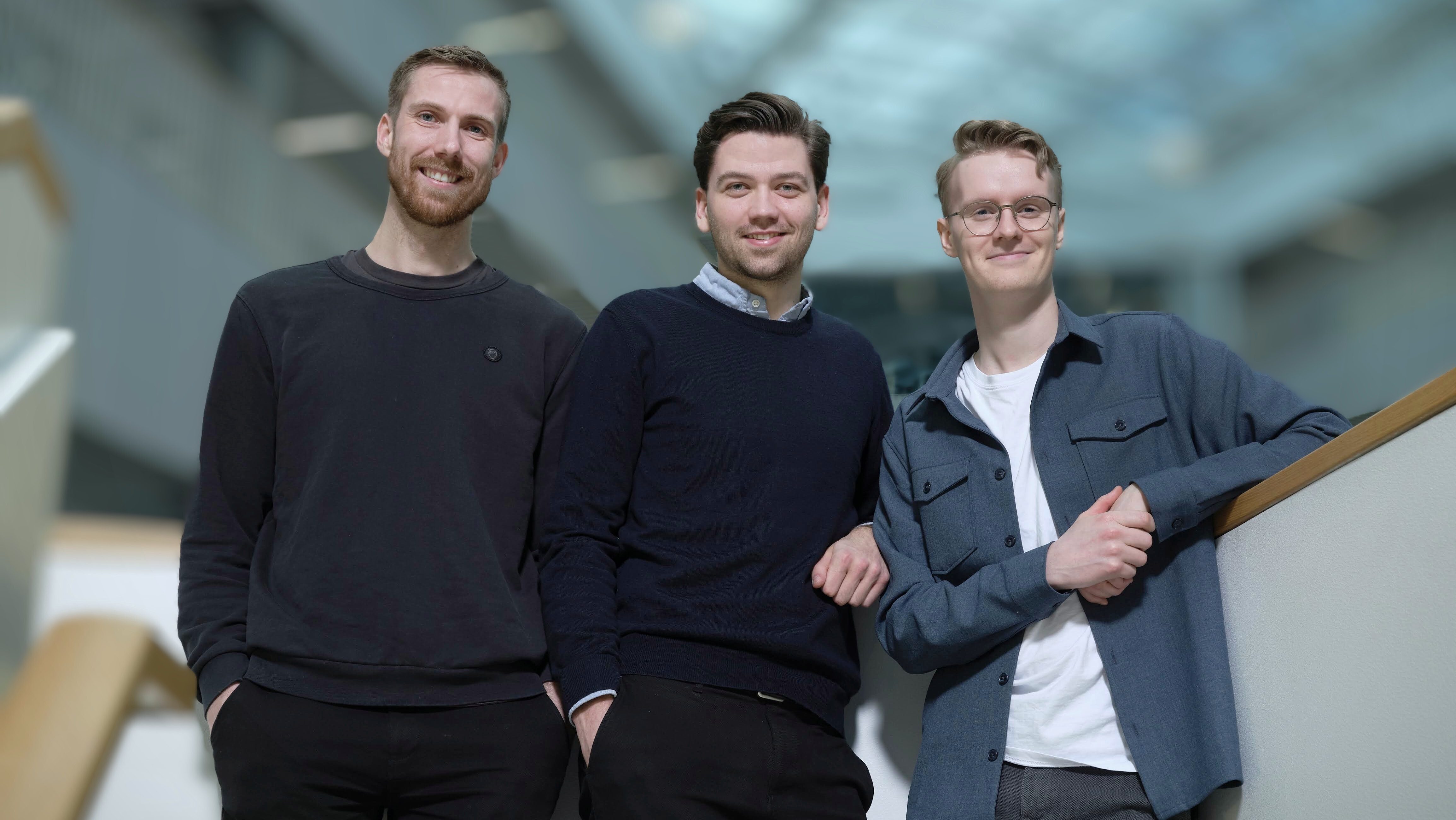

Danish startup Whistleblower Software is rebranding as Formalize as it expands into the broader compliance software sphere — and it has raised a fresh €15 million ($16 million) to fund the expansion.

The announcement comes as the compliance software market has exploded, due in large part to growing regulatory pressure — and investors have taken note. Private equity giant Thoma Bravo took German compliance and investor relations software company EQS Group private in a $435 million deal last month, while startups Cypago, Hyperproof, Certa, and Anecdotes have all raised sizable venture rounds for various flavors of compliance software these past few months.

And now Formalize wants a larger piece of the $54 billion GRC (governance, risk, and compliance) pie too.

“The compliance software market is booming, driven by the EU’s robust regulatory agenda,” Formalize co-founder and CEO Jakob Lilholm told TechCrunch over email. “While compliance is beneficial for society, it can burden companies without efficient management tools.”

From the Facebook and Cambridge Analytica data harvesting scandal through Tesla’s accident report revelations last year, whistleblowing has played a major contributing part to some of the biggest news stories in recent times — but conscientious workers are often deterred from reporting internal misdeeds due to fears of retaliation.

Formalize emerged in 2021 after Europe’s new whistleblowing directive came into force, requiring most larger companies to introduce internal reporting systems for whistleblowers to safely report corporate wrongdoings in confidence. Businesses with more than 250 employees had to implement their systems by the end of 2021, and those with between 50 and 249 employees were given until December 2023 — two months ago.

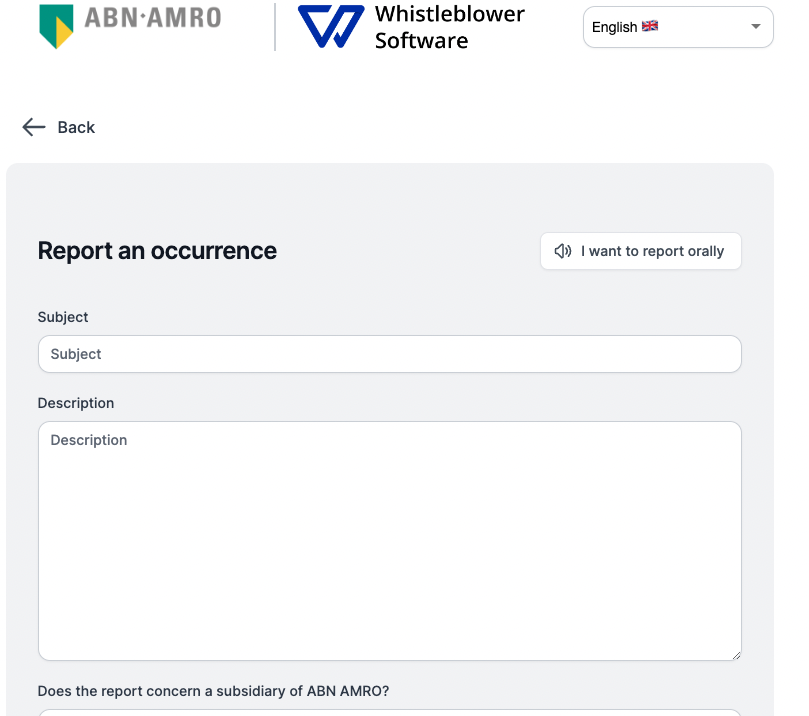

And this, essentially, is what Formalize helps companies achieve. Its customers integrate the whistleblowing software to offer employees a way to file a report anonymously in writing, while those who want to report orally can do so safe in the knowledge that the software distorts the caller’s voice.

Formalize claims a slew of big-name customers already, including McDonald’s, Gap, and Dutch banking giant ABN AMRO.

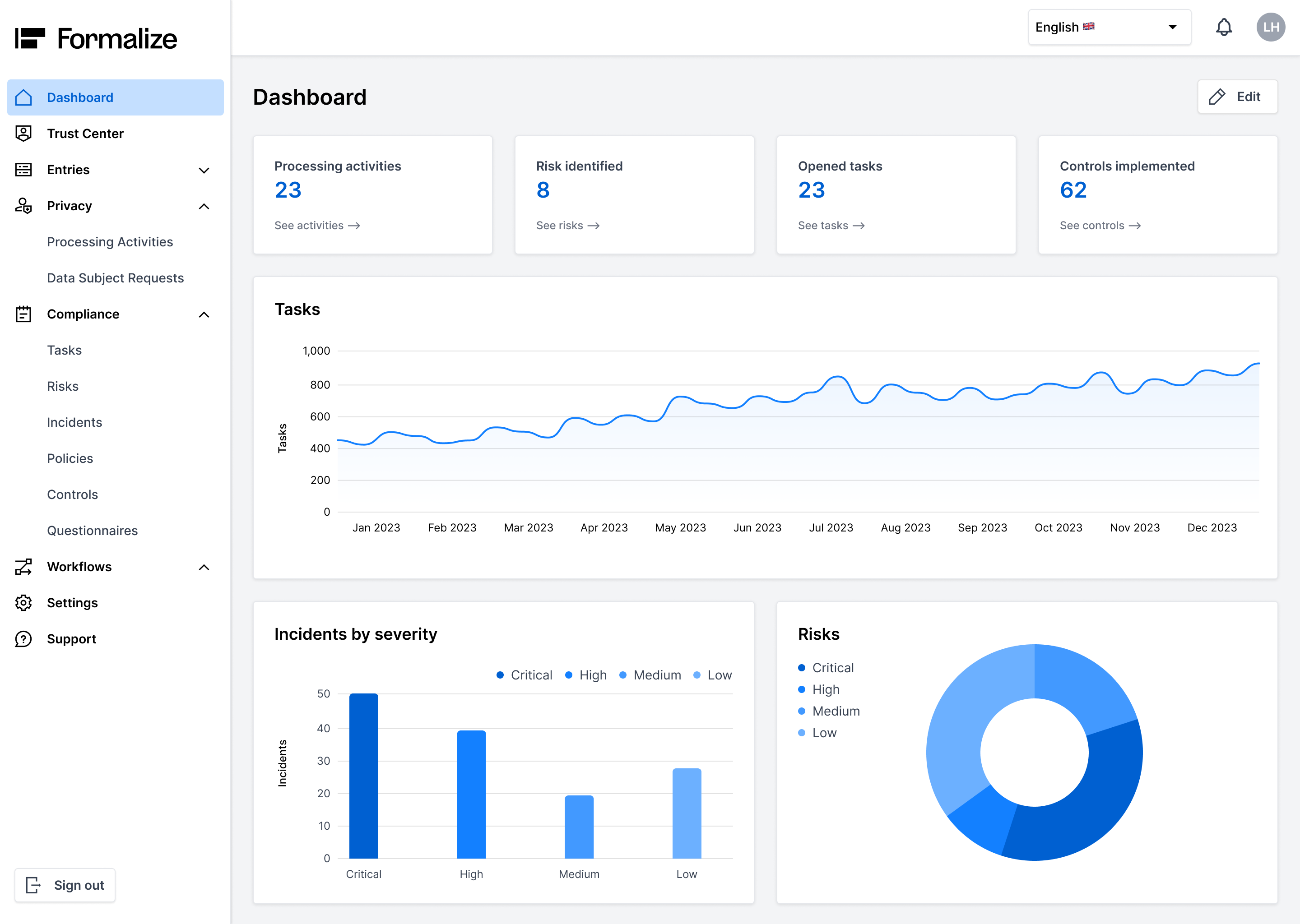

Formalize raised a $3 million seed round of funding 16 months ago. And with another €15 million in the bank, the company is now gearing up to expand beyond whistleblowing software with the launch of a new compliance platform designed to “gather, structure, and automate” all the compliance work that companies are increasingly expected to engage in as part of GDPR data protection laws in Europe. It’s also worth noting the NIS2 cybersecurity regulations, which have provisions for data security, entering into force last January with European member states given until October this year to transpose it into national law.

“Each new law, like GDPR or the upcoming NIS2, requires time to implement and operate — effectively managing regulations is a business advantage in an evolving landscape of new legislation,” Lilholm said.

The new compliance system can be integrated with other systems such as CRMs or supplier databases — this enables companies to conduct all their risk assessments and incident reports from a single interface, as well as map data processing activities, policies, and tangential GDPR procedures.

This is also why the company is changing its overarching company name from Whistleblower Software, as it diverges from its initial focus into a far more extensive (and lucrative) market.

“[Data compliance and whistleblowing] are primarily connected by the intention of the [GDPR] regulation,” Formalize co-founder and CTO Kristoffer Abell told TechCrunch. “Where whistleblowing is enforced to help companies detect noncompliance across a wide range of areas of ethics and compliance, most other compliance areas are there to define a new standard for organizational responsibility that aligns better with the public interests.”

For its €15 million Series A round, Formalize has ushered in France’s BlackFin Capital Partners as lead investor, with participation from the startup’s seed round lead investor, London-based West Hill Capital.

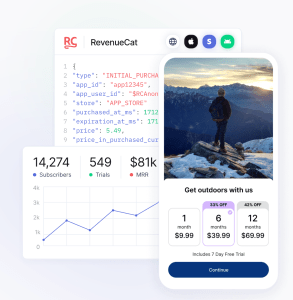

RevenueCat, a top subscription management platform for apps that monetize via in-app purchases, is now flush with new capital as it expands to the web. The company has closed on a $12 million Series C led by Adjacent, following the launch of a new product, RevenueCat Billing, that allows web app developers to integrate subscription purchases into any website. Later, it will also support Roku.

The timing of the product’s launch is notable, as it arrives amid the implementation of the EU’s Digital Markets Act (DMA) regulation, which is forcing Apple to open the iPhone and the App Store to new competition. As a result, Apple initially blocked iPhone web apps (Progressive Web Apps, or PWAs) in the EU, likely fearing developers would abandon its App Store, before reversing that decision under regulatory pressure.

For RevenueCat, however, the changes ahead for iOS — not to mention Apple’s refusal to cut its default 15%-30% commission rate — mean there are now more developers looking to the web to monetize their apps.

“It could be for progressive web apps or any kind of customer that wants to take payments outside of the App Store,” said RevenueCat CEO Jacob Eiting of the new web billing product. “It’s going to play within all the new [DMA] rules … it’s going to be a pretty significant product expansion for us.”

The company says it moved in this direction because of the inbound interest from developers. Even if they didn’t have a web app, many developers wanted to shift their customers to the web to pay.

Apple reverses decision about blocking web apps on iPhones in the EU

Though Stripe already enables this functionality, what developers were lacking was a system that’s specifically designed for consumer subscription apps. Now, even if developers are processing payments through Stripe or others, they’re getting their data and insights in the same format and within the same dashboard where they already manage their in-app purchase data. This makes it easier for them to focus on how their subscription apps are monetizing overall, regardless of where the payment comes from, web or mobile.

Though Apple has historically not allowed app developers to steer customers to the web from inside their iOS apps, it has permitted steering from other channels, like the developer’s website or emails to customers. The EU’s DMA rules should also permit developers to steer customers to the web from inside their mobile apps, too.

With RevenueCat Billing, essentially a web SDK, developers can accept subscription payments from any website. It joins other recent product releases like Paywall, Targeting and Experiments, which are all designed to help developers grow their revenue. RevenueCat powers subscriptions in over 30,000 apps and handles over $2 billion in subscriptions annually, it says.

The new Series C from Adjacent (led by Nico Wittenborn, a Series A investor, now board member) totals $12 million. Other investors include Y Combinator, Index Ventures, Volo Ventures and SaaStr Fund. Ahead of this round, RevenueCat had raised $56 million, bringing its total raise to more than $68 million.

In addition to fueling its new products, the fundraise will help RevenueCat expand to new markets, including Japan and South Korea.

“Our main competitor is ‘cobbling together monetization technology yourself’,” said RevenueCat CTO and co-founder Miguel Carranza in a statement about the fundraise and expansions. “In the U.S., we’ve done a good job at educating developers, product people, marketers, and CEOs on the challenges of building in-house. In many other regions, it’s unfortunately still the default for businesses to sink valuable resources into something that provides zero differentiation or value for that business’s end users. We’re investing in those regions by expanding our support for languages and local currencies later this year, deepening our relationships with local technology partners and agencies, as well as hiring in-market where possible.”

RevenueCat is not yet a profitable company, but Eiting says that profitability is always on the horizon. The company still has the money it raised in 2021 and now has over $40 million in the bank in addition to around $20 million in ARR. It has also halved its burn rate since last summer.

“There’s so much stuff we can build by deploying capital and doing it on a profitable basis would just slow us down right now. So while there’s access to capital, which isn’t always the case … the best thing for our customers and investors is to take more capital and deploy it faster,” Eiting told TechCrunch.

“RevenueCat is too important to too many apps to risk the company driving towards a financial cliff. This may be counter to the prevailing narrative of how venture-backed companies should be built, but our investors are aligned with us and know that Miguel and I are leading the company to maximize the value for developers. Investors make more money when developers make more money,” the CEO said in a blog post. “To that end, we’re still aiming to take the company public in this decade.”