Uber has quietly been testing a flexible pricing service in more than a dozen cities in India, a move that could help it expand its consumer base in the South Asian nation and put pressure on rival ride-hailing platforms, including Ola and inDrive.

The flexible pricing service, called Uber Flex, was started in India in October last year and has since expanded to more than 12 cities, including Aurangabad, Ajmer, Bareilly, Chandigarh, Coimbatore, Dehradun, Gwalior, Indore, Jodhpur and Surat, among others, TechCrunch has exclusively learned. Uber confirmed that the flexible pricing service has expanded.

“We are piloting this feature in some of the Tier 2 and 3 markets in India currently,” an Uber spokesperson said in an emailed response to TechCrunch.

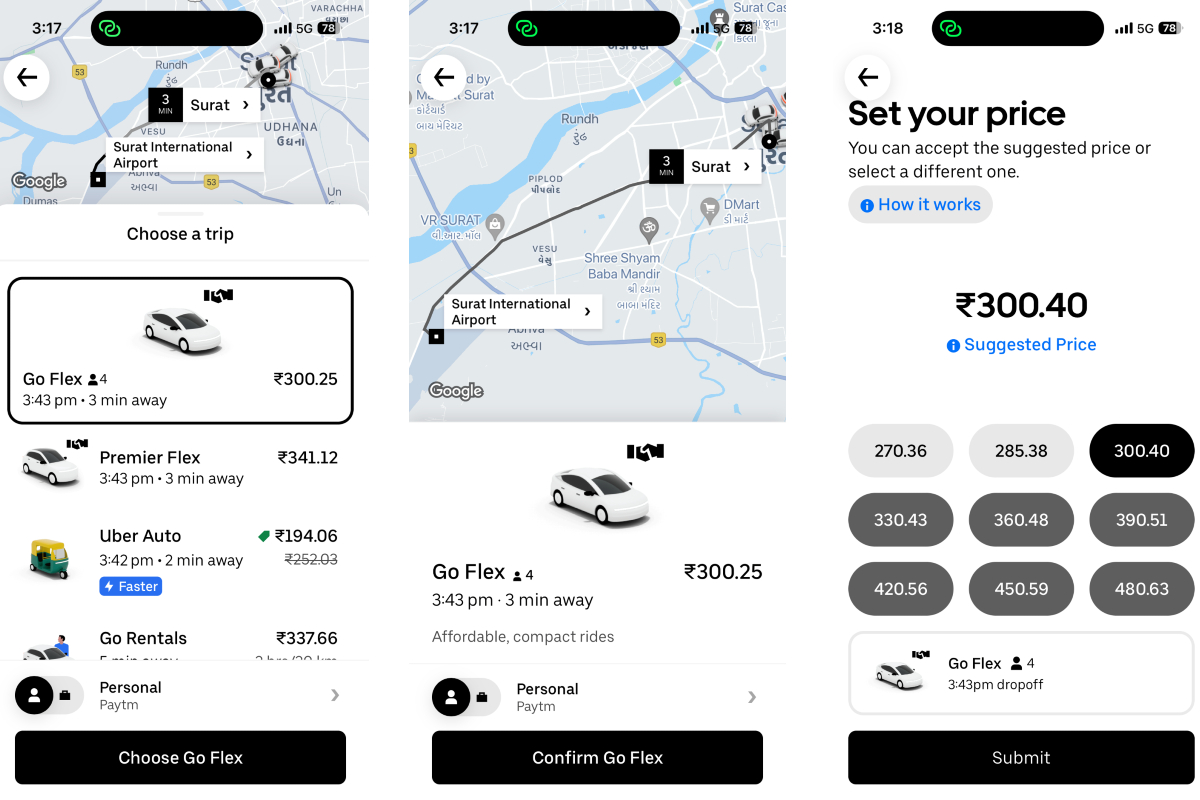

The service, which was initially rolled out for cabs and later expanded to auto-rickshaw rides, lets commuters bid a particular fare for their ride. That’s different from Uber’s standard dynamic pricing model, which moves up and down depending on supply and demand and traffic in a particular region.

Uber Flex offers nine pricing points — with a default price selected — to let riders pick a fare of their choice that will be shared with nearby drivers. Based on that fare, the drivers can accept or reject the ride.

Uber’s competitor inDrive, which operates in a number of Indian cities, allows riders to haggle the fare by manually putting in a particular price for their ride. However, many inDrive drivers in the country have complained about passengers offering them too low prices for their rides. inDrive has not yet addressed the driver concern over riders fiercely bargaining their fare and has instead touted that its “unique approach ensures that drivers are fairly compensated while passengers enjoy an affordable yet high-quality ride-hailing experience.”

“By offering drivers the option to make counterbids to passengers’ prices, inDrive fosters an option for the driver to increase the price if he feels to do so,” inDrive APAC director Roman Ermoshin told TechCrunch while answering how inDrive is addressing driver concerns of not being moderately compensated.

“Drivers are often dissatisfied with the pricing in the ride-hailing platforms, as they yearn for fair compensation for their services. With a focus on fairness and transparency, inDrive showcases a recommended price in the app, which is usually slightly lower than in the other apps, and this is made possible by inDrive’s significantly lower fees for drivers (roughly twice as low as the competition, so the driver earns the same or more as with the higher prices in the other apps).”

Uber is trying to solve the too-low fare problem faced by some inDrive drivers by not allowing passengers to set a specific fare manually in the flex-pricing mode. It also places a cap on the lowest fare.

The service is available for affordable Uber Go rides and Intercity cabs in some cities, while in some, it is even offered for Premier cabs and auto-rickshaw rides. Commuters can pay their fare in cash or via digital payment. Moreover, while Uber’s flex pricing model is available for various modes, the raid-hailing giant is not applying it to all modes in one city.

Uber is testing Flex in other markets including Lebanon, Kenya and Latin America. TechCrunch learned that the company was also looking to test the new service model soon in metro cities in India, including Delhi and Mumbai.

In addition to Uber Flex, the San Francisco-headquartered company is testing different services in India to cater to the local demand. These include Uber Taxis in Mumbai, which offers traditional taxi drivers as an option in the city, and a Wait & Save model in cities including Mumbai, Guwahati and Chandigarh to let riders overcome surge pricing and pre-book a taxi when available at a cheaper fare.

India’s app-based cab market has expanded recently, with new players entering its urban transportation space in the last few months. Companies including BluSmart and Evera offer electric taxis, while Ola, Uber and inDrive have onboarded a large number of gasoline cabs. Last year, bike taxi startup Rapido also started offering its cab service in the country to expand its revenues and reach new customers.

Nonetheless, Indian cab drivers — irrespective of the platform they work on — struggle due to relatively low compensation and lack of safety. There is no clarity for many on whether they will remain in the business once their present vehicles become obsolete.

India’s gig economy drivers face bust in the country’s digital boom