A startup called Diem wants to tackle the problem of “search engine gender bias,” where results can produce default male information, making many women feel unsatisfied by the answers they receive to taboo or personal questions online. The company’s social search engine aims to provide a space for women and nonbinary individuals to share personal stories and ask questions about various topics, including sexual health, relationship problems, mental health, body positivity and more.

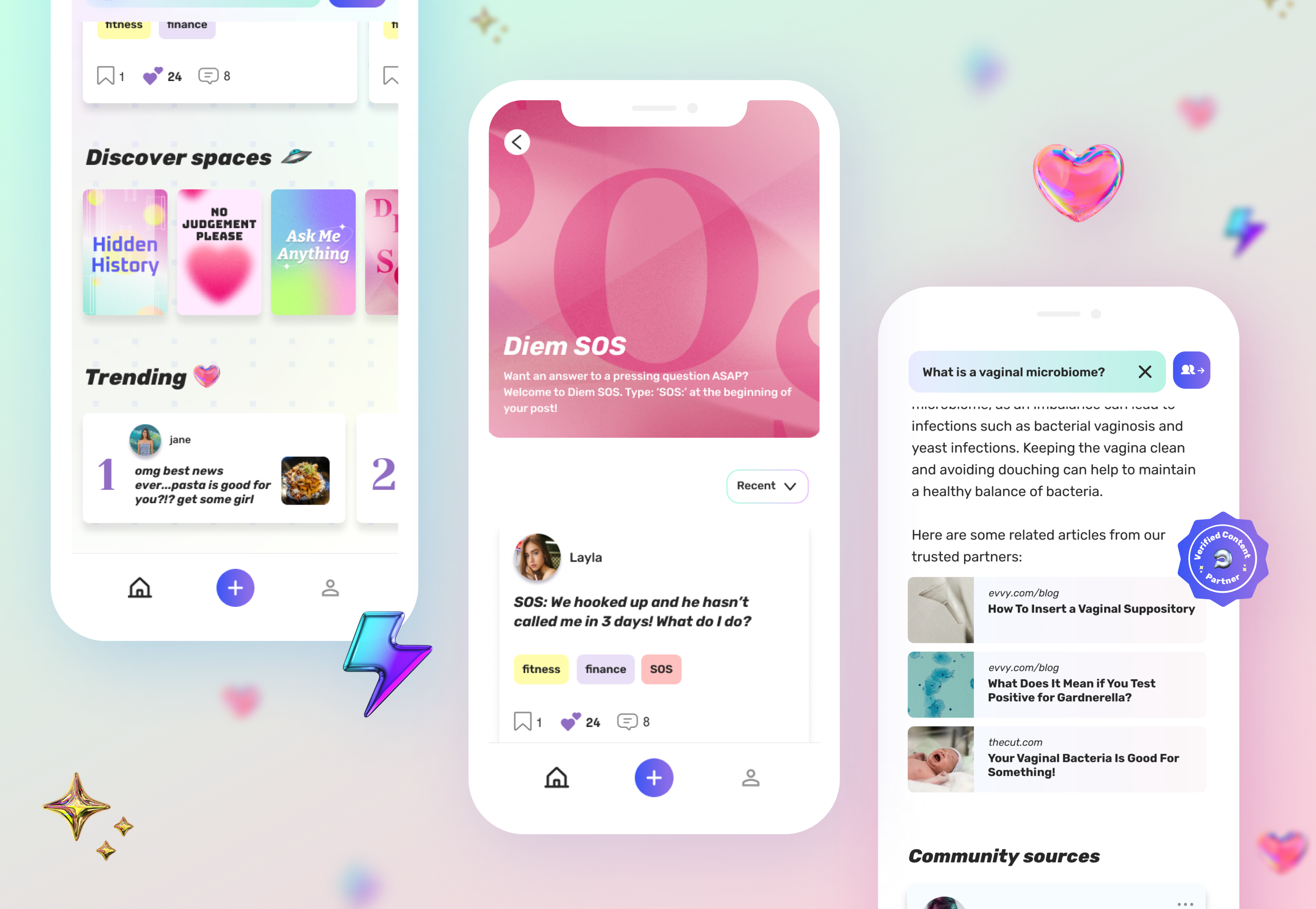

Available as a web app and on iOS and Android devices, Diem is designed to feel like a giant group chat with people around the world, where users can speak about things that they would normally tell their closest friends, like getting out of a toxic relationship, managing period symptoms or dealing with unhealthy body image. There’s even an option to ask questions anonymously.

The app also has an AI component where answers are pulled from reputable sources on the internet and, with the use of ChatGPT and Diem user-contributed content, summarized through “a feminine lens,” the startup claims.

The company recently launched a slew of features, including a referral tool called “Nominate Your Friends,” where users invite friends to participate in questions; “Spaces,” or micro-communities centered around interests (similar to subreddits); and “Daily Briefing,” a personalized selection of 10 daily posts.

Diem also recently partnered with verified content providers so users can get information from trusted sources. The first four companies are experts in the reproductive health space, including hormone health startup Aavia, sexual telehealth clinic Hey Jane, vaginal health startup Evvy and female health brand Stix. Diem’s AI can now pull up related articles directly from websites to answer a question. Diem will partner with more content providers in the coming months, including companies specializing in finance and relationships.

With the new nomination tool, users can directly share a question with a friend to weigh in on the conversation. In the future, users will be able to nominate community members who already have a Diem account. The “Nominate Your Friends” feature is also a way for Diem to grow its user base since users send their friends a link to the question, requiring them to sign up to the platform before answering. Diem currently has more than 40,000 users, we’re told.

Spaces is a new beta feature designed to help members feel comfortable sharing important topics and common interests with others while overall getting closer to people in the Diem community. Six spaces are available, run by community members and inspired by popular posts on the platform. For instance, “Is This Normal,” “No Judgment Pls,” “SOS,” “Hidden History,” “Big Sis Advice” and “Ask Me Anything.” The feature is set to officially launch in a few weeks, and Diem will roll out a new space each month. The platform also plans to allow influencers to run some of the spaces as well.

Additionally, Diem plans to introduce two more features this month, such as “Recommended Reading,” an AI-powered recommendation feature for users to discover and discuss trending news articles, and an event feature for users to host in-person events with other members of the community. The event feature is an expansion of its insider program called the Diem Society, an exclusive community of users who engage in monthly chats to foster a deeper experience within the platform.

While the company declined to share specific details, it’s planning a monetization feature to pay users for their content contributions.

Diem was founded by Emma Bates (CEO) and Divia Singh (COO) after Bates had to take the morning-after pill.

“I ended up in this classic internet doom spiral, trying to query others’ experiences and find their stories,” Bates said in a TechCrunch interview. “My search experience felt in direct contrast to the real-world information sharing that exists over dinner tables, in private group chats, in the bathroom at a nightclub… I think that there are so many moments in which we lean on each other to decipher the world around us or the experiences we may be having. And there’s no real place that captures all that information and makes it a resource for everyone.”

Bates and Singh previously worked at DTC travel brand Away.

The company has raised $3.7 million in total, with Stellation Capital leading its most recent seed round. Other investors include Acrew Capital, Flybridge, Techstars and XFactor Ventures, along with angels Lindsay Kaplan, co-founder of Chief; Steph Korey, co-founder of Away; Jaclyn Johnson, founder of Create & Cultivate; Amber Atherton, an early-stage investor; and Abadesi Osunsade, founder of Hustle Crew.