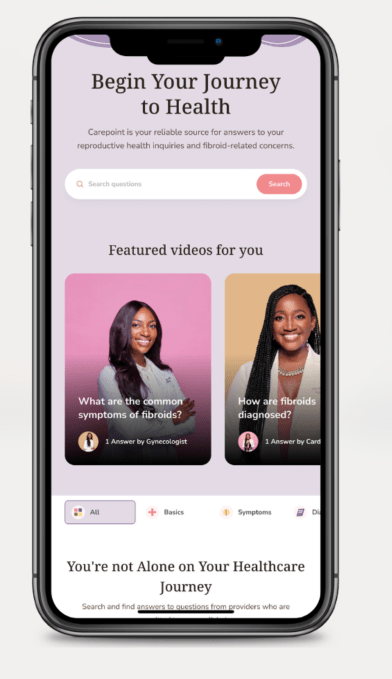

Image Credits: Flo Health (opens in a new window)

Image Credits: Flo Health (opens in a new window)

Women’s health tech, which leverages innovations in AI, smartphones and connected wearables to give women more insights into reproductive and menstrual health, continues to gain momentum with users, and investors are following.

London-based Flo Health, a fertility-focused period-tracking app, on Tuesday said it has raised a $200 million Series C from General Atlantic. The funding values the startup at more than $1 billion post-money, which, per the company, makes it the first “purely digital” women’s health app to become a unicorn. That distinction is challenging to qualify, since it seems that there are no clear “purely digital” unicorns in the women’s health category for comparison. (Maven, which describes itself as a health clinic and benefits platform, was last valued at $1.33 billion in 2022.)

The fundraise comes after an impressive run of growth, which is notable considering the bumps Flo has faced, including one around a now-settled, privacy-related regulatory investigation from the Federal Trade Commission, and the generally bearish state of the technology market. The company says it has served some 380 million users globally so far, and it currently has 70 million monthly active users of its free product, and another 5 million who are paying for the premium version.

The funding will be used both to attract more users, as well as to appeal to older users with a focus on menopause and perimenopause. The startup may also look to make acquisitions to grow inorganically, potentially with more support from General Atlantic.

“We are excited about their big vision and the innovation ahead for the broader women’s health and wellness ecosystem,” said Jessie Cai, principal at General Atlantic, in a statement. “We believe Flo is a category leader and look forward to leveraging our deep expertise across disruptive consumer technology and subscription platforms to support the company’s continued growth.” Cai and Tanzeen Syed, MD, and head of consumer internet and technology at General Atlantic, are both joining Flo’s board.

Investors have poured nearly $5 billion into women’s health startups over the last three years, which represents a jump of around 60% on the three years prior to that, per PitchBook data cited by the Financial Times. Part of that increase has been due to a rapid acceleration of technology, including the use of AI, to provide more insights to users, and part is likely a sign of the times, since digital health is often part and parcel of healthcare.

Flo’s last round, a Series B of $50 million in 2021, was part of that investment swing. This latest $200 million — raised after “significant inbound interest,” the CEO told me — points to more acceleration for the biggest players.

Flo’s origins are quite interesting: CEO Dmitry Gurski co-founded the company with his twin brother after accumulating years of experience building other fitness and health apps. The pair are part of the massive trove of tech talent that has left Belarus for other countries in the wake of geopolitical turmoil.

The following is an interview with Gurski about the funding, Flo, and things in between, edited for clarity and length. It was conducted over email.

Many [women’s health] startups like Elvie also build hardware as part of their product. Do you have any plans in that area? If not, what’s on the horizon for Flo?

We don’t have any plans to build hardware into our product. Our priority is to continue integrations with devices like Apple Watch and deliver a personalized experience for users across ages and demographics, and personal health goals. This includes providing accurate cycle and symptom predictions, improving personalized health insights, and strengthening our localization in international regions.

You started Flo in 2015 having never built any healthcare apps previously. What got you interested in this area?

My brother and I had a background in building health and fitness apps prior to Flo, including apps for fitness, yoga and running. I also have a degree in pharmaceutics and drug design.

However, I saw the challenges women face in healthcare, and realized there was a critically underserved gap in the women’s health market. At the time we founded Flo, the market was full of simple apps offering surface-level information and tools, but there was a lack of innovation focused on education and personalized insights. So, we set out to create Flo. We envisioned a platform that would empower women with accurate, personalized insights throughout their reproductive journey.

We listened to countless women worldwide, gathering insights on their expectations. We brought in Dr. Anna Klepchukova as our chief medical officer, who established the Flo Medical and Scientific Advisory Board, which now includes over 120+ leading experts in female health.

What would you say has been Flo’s breakthrough or unique selling point?

We’re proud that Flo serves one in four U.S. women today. Flo offers the broadest set of features compared to other period tracking apps across several modes (tracking, trying to conceive, pregnancy, etc.).

Flo sets itself apart with features like “Anonymous Mode” for enhanced privacy, and Symptom Checker for personalized health insights. Specifically, our platform offers curated cycle and ovulation tracking, and users can monitor over 70 symptoms and access various features to enhance their understanding and management of their health. In 2023, Flo launched “Flo for Partners,” which lets users educate and empower their partners with scientific insights into their menstrual and reproductive health.

You were the subject of an FTC investigation several years ago, which has now been settled. How did that impact business? What did you do to change your practices at Flo?

We did indeed reach a settlement with the FTC in 2021. It is important to note that agreement was in no way an admission of wrongdoing, but — as a growing company — a decision to avoid the time and expense of litigation and to put the matter behind us decisively. Flo did not at any time sell data.

We have a comprehensive privacy and security framework with a robust set of policies and procedures to safeguard our users’ data, and these are regularly reviewed both internally and using independent auditors.

We are proud to be the only dual-certified female health app to hold both the ISO 27001 Security and ISO 27701 Privacy certifications.

What have you taken away from that FTC experience?

Our priority is, and always has been, to protect our users’ data. We understand that our users place trust in our technology to keep their sensitive information private, and the responsibility we have to provide a safe platform for them to use. That’s why we implement measures designed to protect individual user data and privacy rights. We are transparent about our data practices and adhere strictly to applicable regulations.

You currently have both free and premium product offerings. How do you plan to develop that in the longer term? How do you get people to move from free to paid?

Our subscription offering will remain our core business model, and there are no plans to change that.

As part of our next growth phase, we will focus on expanding our user base. We will extend our reach to untapped user segments by developing features for women experiencing perimenopause and menopause, and partners of our existing users through our “Flo for Partners” feature.

Do you monetize the paid tier of users in any way? If so, how? Do you plan to?

Our monetization strategy is through our premium subscriptions, which provide additional features and insights to users. We continuously innovate to enhance the value of our premium offerings without compromising the core functionality of our free version.

Will you continue to keep the free tier indefinitely?

We don’t have any plans to change our business model, as it has proven to be very successful.

Can you talk a little about where your users are located currently and their average age? (I’m guessing the U.S. is your biggest market but would love to know the actual proportion.)

Flo maintains a strong and growing presence in North America and Western Europe. Our average user age is 18-35, but it’s important for us to cater to users at all stages of their reproductive lives. That is why one of our key focuses, as part of this next phase of growth, is extending our reach to untapped user segments.

What are the primary differences between business in the U.S. versus Europe or other parts of the world? Does a particular market’s healthcare system play a role (for example, in the UK we have the NHS)?

The main difference is mostly the propensity for people to pay for a premium subscription. We see different conversion [rates] to premium in different countries.

We’re also aware that in some regions, there is a huge gap in women’s health services, and women might be less able to pay for a premium subscription, which was important for us to address. Our global pro-social program provides free access to Flo Premium across 66 countries, including India, Indonesia and Nigeria, with nearly 16 million women already benefiting.

You are originally from Belarus. How has the situation in that part of the world impacted your trajectory as an investor and entrepreneur?

I have been living and working in London, from our HQ, for a while now. Regarding the recent events, I’m fortunate that our business hasn’t been directly impacted. We’ve always maintained a global outlook, and Russia has never been a significant part of our market.

It looks also like a big part of your team is in Lithuania. Do you plan to continue doing the majority of development there (assuming these are R&D workers)?

Flo Health is headquartered in London, but we do have a major hub in Vilnius, Lithuania. We plan to invest in top-tier talent, with an emphasis on engineering, in both regions.

Through your investment firm, Palta, you’ve been at the table for a number of acquisitions of portfolio companies, including MSQRD, which Facebook acquired. What has that taught you about building Flo?

The most important thing I’ve learned is the importance of creating the best possible product for a large market at the right time. This insight has been fundamental to our success and growth. My experience with other companies has provided me with valuable insights on how to grow a business effectively. From the beginning, we understood the significance of timing and the need to address a substantial market with a high-quality product.

For clarity, I have not been part of or involved in Palta since 2018, when Flo reached major growth. In fact, the Palta investment company was created after the inception of Flo Health. I do participate in board meetings and sometimes advise, but otherwise my focus is 100% dedicated to Flo.