Richard Hong found that while expanding his e-commerce brand of men’s personal care brands, gaining international customers was easy to do. The challenges came when trying to get the merchandise to them.

“We found that logistics pack compliance, product compliance and marketing had no localization technology,” Hong told TechCrunch. “We had to build a lot of those capabilities in-house to be able to scale.”

Hong, working through his e-commerce company Pangaea Holdings, was able to scale to the point where a majority of revenue — well into nine figures — was coming from outside of the United States.

Hong and his Pangaea co-founder Darwish Gani started thinking about how they could help other e-commerce businesses expand internationally. Only not have to conquer the same obstacles.

Pangaea Holdings, developing men’s personal care brands, raises $68M, including minority stake from Eurazeo

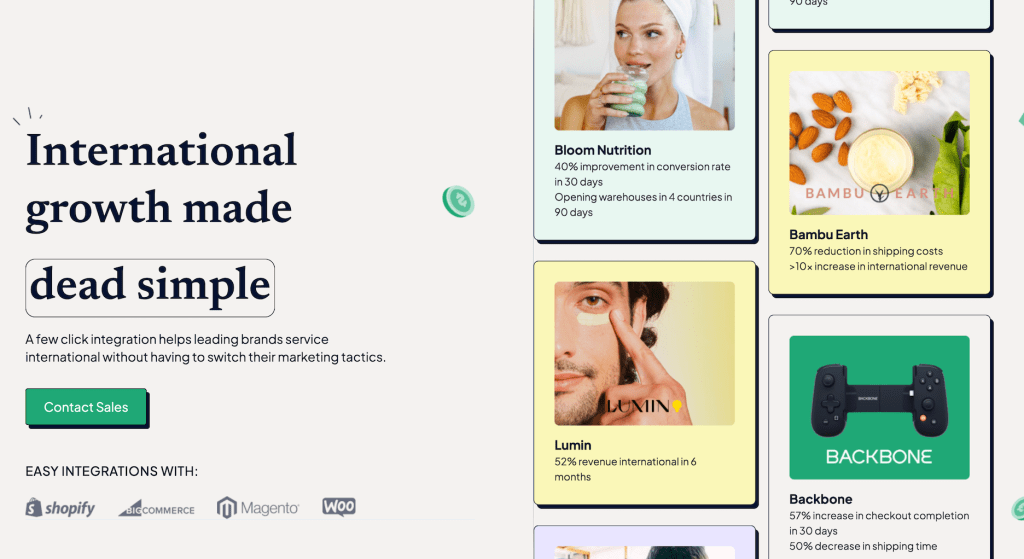

In March 2023, Hong and Gani spun off the technology business into OpenBorder, which raised $10 million in seed funding. At the time, the company had five merchants, and that has grown to nearly 70 merchants in a year’s time. It has also increased processing volume 10 times.

OpenBorder’s cross-border trade concept is simple: Provide e-commerce merchants instant access to international customers through automation of certain logistical needs.

Those include shipping, trade, tax and duty compliance, product localization and international marketplace listings — all from one software platform. Merchants can also sell on Amazon and regional marketplaces with a two-day, Prime-like experience, Hong said.

With the cross-border market being a $2 trillion opportunity, OpenBorder is not alone in working to address this need. For example, Nocnoc is doing something similar for merchants in Latin America, while Keeta is providing a way for easier cross-border payments.

Meanwhile, Peak XV Partners (formerly Sequoia Capital Southeast Asia) led the investment and was joined by Capital 49 and Harlem Capital. OpenBorder is using the capital on software development, including partnerships and artificial intelligence to find areas of cost reduction to improve performance. The board also added Pangaea investor Eurazeo, which has vast experience in the consumer merchant segment.

Many OpenBorder merchants start at 4% of revenue coming from international, but grow to 15% or even 20%. Pangaea was able to reach over 50% of its revenue coming from non-U.S. customers, and OpenBorder wants to help other merchants get there in just a few years, Hong said.

“With us doing it, that tells us there is truly a potential for other merchants to get there, but the question is, “What does it take to get there?” Hong said. “We have the obvious answer to that question and want to help every merchant access every consumer around the world.”

We should all be paying more attention to the PDD-Alibaba rivalry