A new luxury goods e-commerce startup dubbed Long Story Short has a provocative concept: it’s $1,000 per month to join for the privilege of shopping its curated collection. Shocking as that sounds, founder Joseph Einhorn believes he understands this sliver of the e-commerce market, and why many online luxury ventures to date have failed to work. The founder, known best for his 2010s e-commerce site The Fancy, an upscale shoppable Pinterest rival, says high-net-worth individuals demand more in terms of privacy and security from their online experience — something that shopping a luxury marketplace often does not provide.

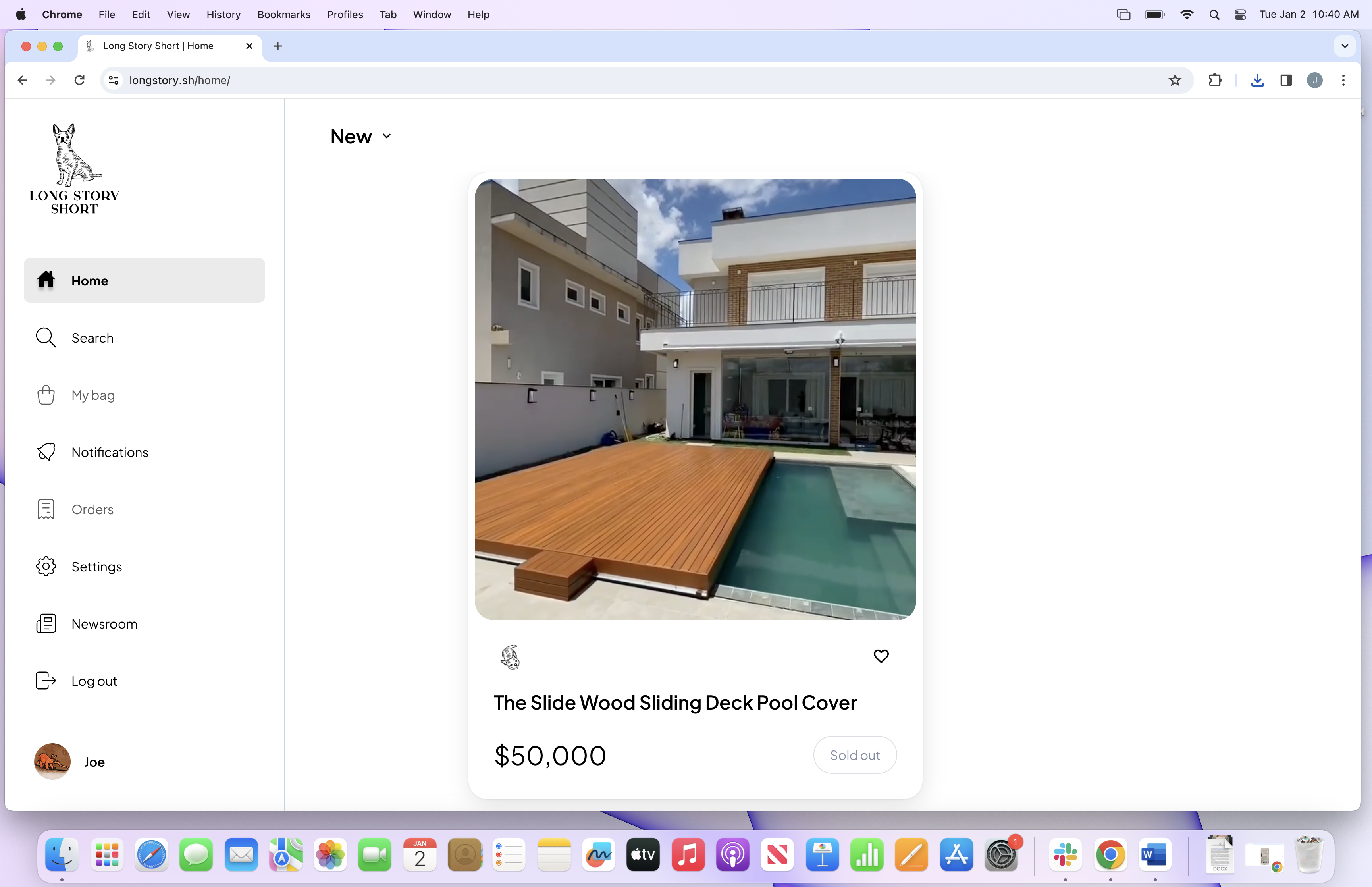

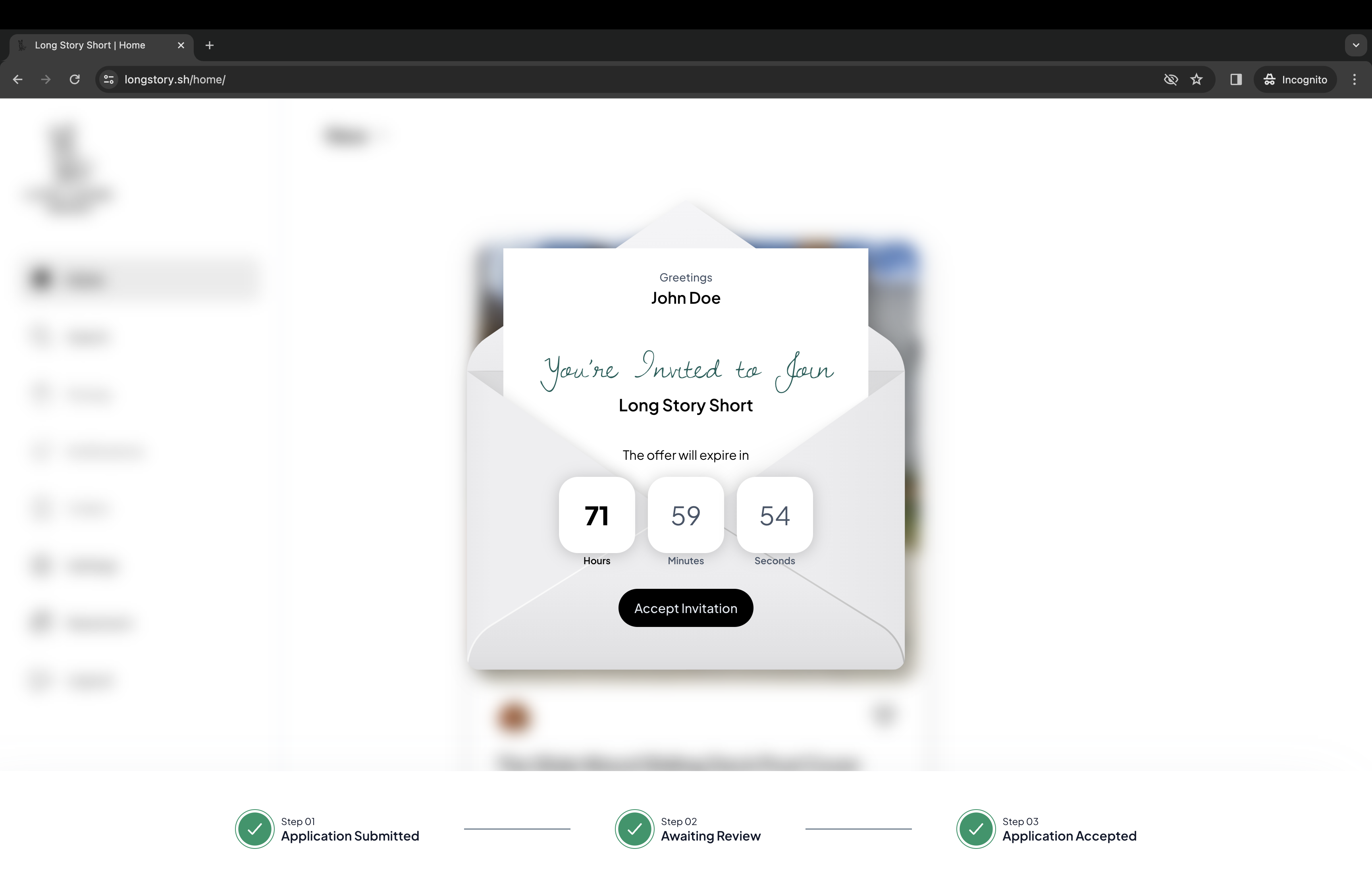

At Long Story Short, the private shopping club takes a different approach than other shopping sites.

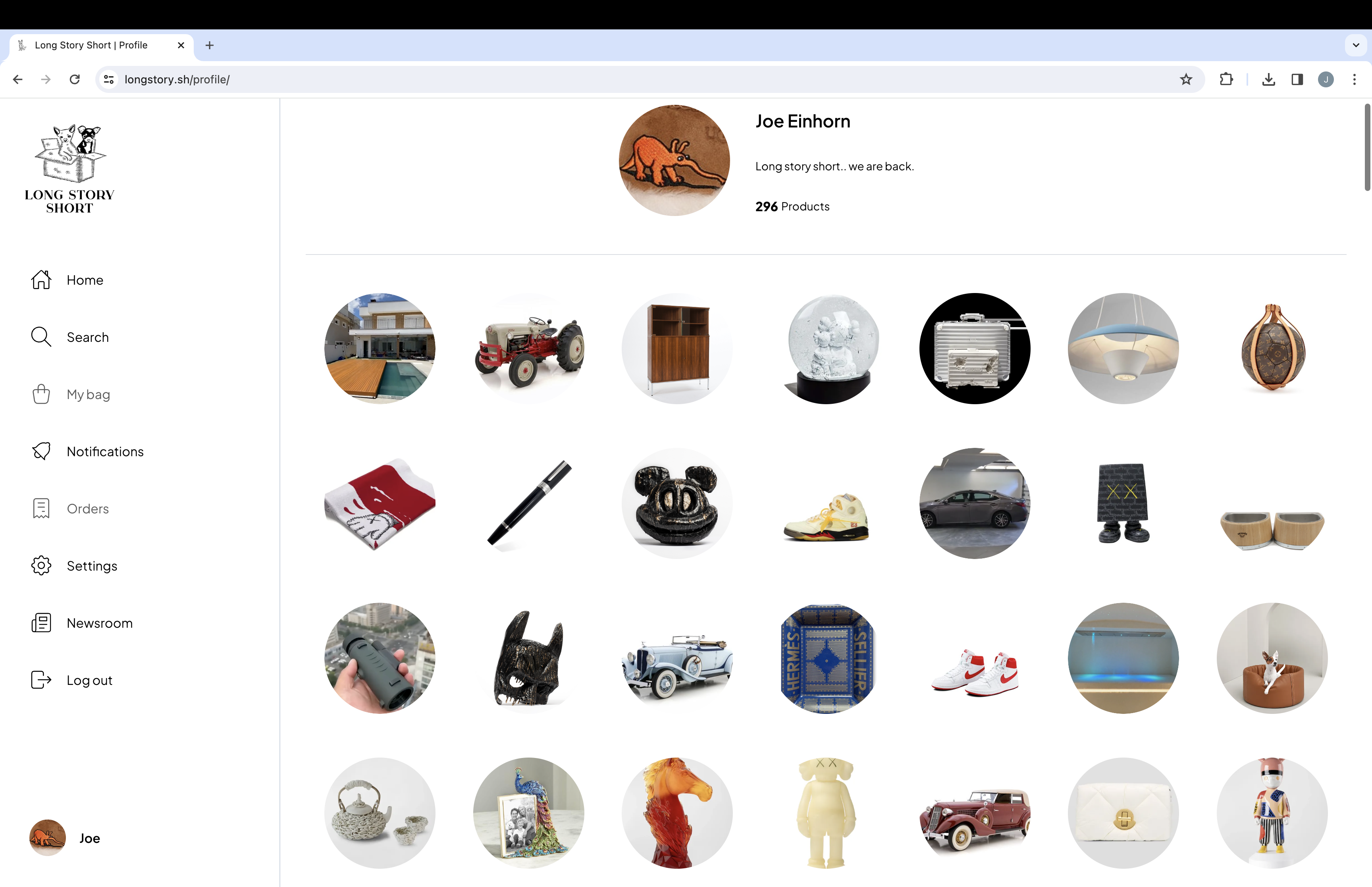

In addition to simply needing to have the funds to pay its $1,000 per month fee, potential customers must apply for acceptance. Once in, the customers can shop from the site’s 50,000 hand-selected luxury products, spanning categories like home décor, luxury apparel, art, cards, jewelry, watches, gadgets, and more, or they can request the LSS (Long Story Short) team to procure items on their behalf.

The value proposition — if such a word can be used for such a costly service — is that LSS will manage the transaction on the customer’s behalf. That means negotiating with vendors and sellers, acquiring the item, then inspecting and verifying the item for authenticity, before shipping it to the buyer. This allows the customer’s transactions to remain anonymous to the seller — something that’s prized among high-net-worth individuals due to the security risks involved with having their name, address, or phone number compromised.

While LSS will have this information, Einhorn’s experience in e-commerce means he’s already familiar with the world of online fraud and how to combat it and has built the new company with an eye on privacy. The company won’t detail its security practices so as to not invite hackers but notes that it trades security for convenience in some cases by not collecting or storing anything but necessary info. In addition, some of its systems aren’t even connected to the web.

The concept of a private shopping club is something that Einhorn likens to other efforts in catering to high-net-worth individuals, as with Pharrell’s launch of his own auction house last year, Joopiter. And, similar to offline luxury retail, LSS aims to provide the white-glove service that luxury shoppers expect.

Plus, Einhorn argues that subscribing to LSS makes sense for anyone already spending at least $1,000 per month on luxury goods because of the savings it delivers. Today’s online marketplaces are often heavily marketing up their items, which means people are paying “at least $1,000” by being overcharged on “marketplace waste,” he argues.

“Number one, we’re recommending you items — you can see items that you probably didn’t know about that you can get involved in. And then, number two, let us get the best possible price, rather than just logging on somewhere everybody is being drawn into the same kind of marked-up overpriced item,” Einhorn explains.

He believes that the combination of eliminating the marketplace fees and establishing direct relationships with vendors and sellers, LSS’s savings could reduce the cost of luxury items by 20% to 40%. However, his thesis has not yet been tested, as the site is only now launching.

“What we hope is that by having this collective buying power of serious spenders — like serious shoppers — that we as a group will unlock better terms for everybody,” Einhorn says.

LSS, meanwhile, doesn’t mark up the items itself nor charge any other fees beyond the (pricey) subscription.

Still, Einhorn understands this business model will turn some heads, particularly in the current economic climate where housing prices are so high, young people can’t afford homes, layoffs are rampant, and the American dream, for many, has been put on hold.

“It’s not lost upon me that this is a provocative concept,” he tells TechCrunch.

Despite the state of the larger economy, rich people remain rich, meaning the startup already has a handful of customers signed up even ahead of today’s launch, including “executives at our favorite companies, athletes, entertainers, and people in technology,” Einhorn tells us. And thanks to its subscription price, LSS doesn’t need a large user base to break even or succeed. Even as little as 100 customers, “would be plenty,” he notes.

The founder believes LSS will go further than that, though, explaining that there’s a global market for luxury retail like this.

“We believe that in the USA, the Middle East, and China alone, there are hundreds of thousands of potential members in each of those markets that we’re going to try to go after today,” Einhorn says. In some cases, those customers are less interested in wearing luxury brands but are more interested in adding luxury goods to their homes, as in China. He also suggests that there’s an untapped market of young professionals who view luxury as an asset class for investment, the way they may also view something like crypto.

However, LSS aims to discourage customers from pooling their funds for a subscription by vetting applications. Instead, high-net-worth individuals can “sponsor” others, like their kids or assistants, by paying their monthly fees.

The founder’s e-commerce experience and ability to cultivate a following dates back to the early 2010s.

His debut shopping startup, Fancy, developed a following among the tech elite, like Twitter co-founder Jack Dorsey, Meta’s Chris Hughes, Apple’s Tim Cook, as well as investors like Allen & Company partner LeRoy Kim. Investors in Fancy, meanwhile, included VCs Marc Andreessen and Ben Horowitz, Allen & Company, General Catalyst, Esther Dyson, Celtics owner Jim Pallotta, MTV creator Bob Pittman, former eBay COO Maynard Webb, Eric Eisner, Jeff Samberg, and Ashton Kutcher. In later rounds, it also brought in Mexico’s Carlos Slim Domit and CCC, a Japanese holding company behind the Tsutaya chain of book and media retailers.

Though Fancy didn’t last, Einhorn went on to co-found other companies, including a New York–based comics books store for kids, an e-commerce software engine The Archivist (which also had Kutcher’s backing), and a social network for people who like walking, Way to Go.

With LSS, he’s returning to e-commerce with the support of new investors, Misfit Market co-founders Abhi Ramesh (CEO) and Edward Lando. The startup has raised around $500,000.

“[Lando has] always bugged me about revisiting the luxury world, and he’s the dream partner,” adds Einhorn.

Currently, New York–based Long Story Short is a team of seven and only plans to add headcount in service as its clientele grows.

For now, the e-commerce startup is available via the web and as a mobile app for iOS. The latter prompted TechCrunch to somewhat cheekily ask if LSS is, in a way, the modern-day “I Am Rich” — an early iPhone app whose presence on your Home Screen only served one purpose: that you could afford to buy it.

“I’m not surprised that you said that,” Einhorn says. “I do have thick skin. I know what I’m getting into by putting this out there. I think it’s a fair point,” he agrees.

However, he adds, “These products cost a lot of money and there’s a lot of them. There’s magic to it. That we think that they have enduring value and that that they’re worth it, I would say a private membership club for power shoppers, where somebody’s thinking about their privacy, and also somebody’s thinking about getting them the best deal . . . I think that that can exceed $1,000 a month in ROI pretty quickly,” Einhorn concludes.