We’re excited to reveal the complete agenda, packed with keynote stage speakers and interactive roundtable sessions. From fundraising insights to growth strategies, join us as we navigate the startup landscape together at TechCrunch Early Stage 2024 on April 25 in Boston.

Don’t miss out — secure your spot now for an unforgettable experience of learning, connection, and inspiration. Prices go up at the door!

The Agenda

Women in Tech Sunrise Breakfast: How AI Is Impacting Founders

Lily Lyman, Partner, Underscore VCRudina Seseri, Co-founder and Managing Partner, Glasswing VenturesMilo Werner, General Partner, Engine Ventures

Selecting the Right Accelerator or Incubator

Emily Knight, President, The Engine Accelerator

The Ins and Outs of Seed Funding — Roundtable

Sponsored by: Latham & Watkins LLP

Spencer Ricks, Partner, Latham & Watkins LLPNaomi Smith, Associate, Latham & Watkins LLPDan Hoffman, Partner, Latham & Watkins LLPStephen Ranere, Partner, Latham & Watkins LLP

Adapt & Thrive: Mastering the Chameleon Mindset — Roundtable

Sponsored by: Prepare 4 VC

Christopher Dube, Chief Innovation Officer, Prepare 4 VCJason Kraus, CEO, Prepare 4 VC

Preparing to Raise: Cap Table Best Practices to Help You Close Fast

Sponsored by Fidelity Private Shares

Kristen Craft, Vice President and Business Partner Manager, Fidelity Private SharesLaura Stoffel, Partner, Gunderson DettmerMelissa Withers, Founder and Managing Partner, RevUp Capital

Exiting via M&A: What Acquirers Are Looking for and How You Can Prepare for a Successful Acquisition — Roundtable

Dana Louie, Senior Manager, Corporate Development, HubSpot

Grabbing Investors’ Attention in a Competitive Market: Tips for Early-Stage Startups — Roundtable

Sergey Gribov, Partner, Flint Capital

From Inception to Cash: How I Wandered into an Idea and Jump-Started a Company

Sponsored by HomeHQ.ai

Oliver Palnau, Co-founder & CEO, HomeHQ.aiVinny Romano, Co-founder and COO, HomeHQ.ai

Archetypes for Product-Market Fit

Jess Lee, Partner, Sequoia

PR 101 for Founders: Branding Strategies to Win Over Investors, Customers and Partners — Roundtable

Edith Yeung, General Partner, Race Capital

Never Raise VC Money (and How to Keep More of Your company if You Do) — Roundtable

Jake Cohen, Partner, Vinyl Capital

How to Build an MVP and Navigate the Startup-Industrial Complex

James Currier, General Partner, NFX

Building the Investor Relationships You Need — Before You Need Them and in the Right Way

Lily Lyman, Partner, Underscore VC

Product Myth Buster: The (Actual) Right Time to Hire a Product Leader as an Early-Stage Company — Roundtable

Rachel Weston Rowell, SVP, Onsite Product & Tech Center of Excellence, Insight Partners

Scaling Through Chaos: The Art & Science of GTM

Paris Heymann, Partner, Index Ventures

How to Raise Money and Come Out Alive

Tom Blomfield, Group Partner, Y Combinator

Getting to Series A: Common Pitfalls to Avoid as a Founder

Alex Kayyal, Partner, Lightspeed Venture Partners

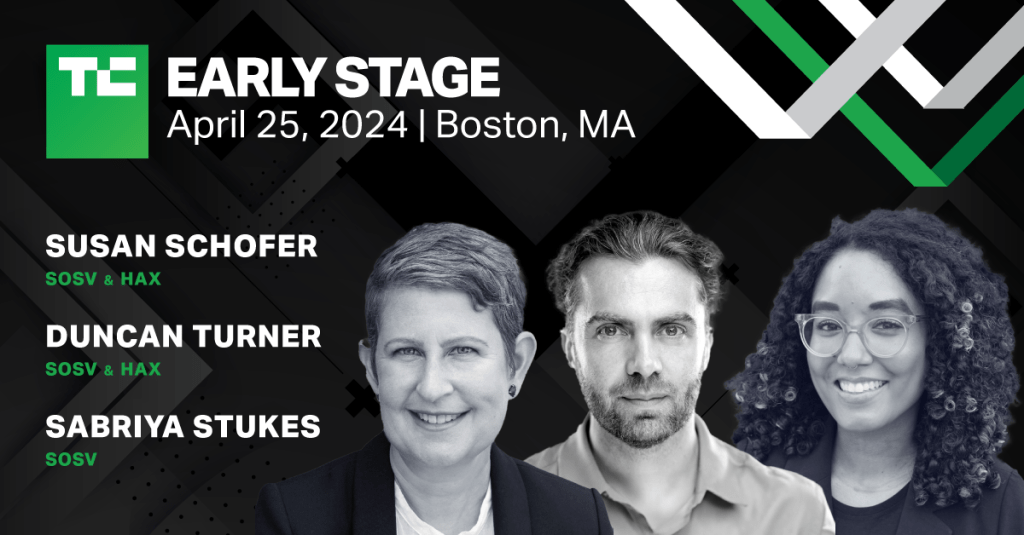

Hard Tech for Early-Stage Founders: HAX Invests in Startups Solving the Hardest Problems in Climate, Industrial Independence, and Healthcare

Sponsored by HAX

Susan Schofer, SOSV Partner and HAX Chief Science Officer, HAXSabriya Stukes, SOSV Partner and IndieBio Chief Science Officer, SOSVDuncan Turner, SOSV General Partner and Managing Director of HAX

How to Intelligently Calculate Your TAM and Wow Investors

Tobi Coker, Deal Partner, FelicisJulia Neagu, Co-founder and CEO, Quotient AINabiha Saklayen, Co-founder and CEO, Cellino

How to Evolve Your Tech and Staff Strategies for Future Rounds

Sponsored by Sand Technologies

Brad Stanton, Managing Director, Sand Technologies

Early-Stage Fundraising: Convertible Notes, SAFE and Series Seed Financing

Rebecca Lee Whiting, Founder and Fractional General Counsel, Epigram Legal P.C.

The VC Pitch Blueprint: Strategies for Success

Sara Choi, Partner, Wing Venture Capital

Racing the Clock to $1M In ARR: Best Practices for Learning Fast from Launch Partners

Rudina Seseri, Co-Founder and Managing Partner, Glasswing Ventures

Finance Fundamentals Before Your First Finance Hire: A Founder’s Guide to Navigating Early Financial Decisions

Dan Kang, VP of Finance, Mercury

So You Think You Can Pitch?

Paris Heymann, Partner, Index VenturesRachel Weston Rowell, SVP, Onsite Product and Tech Center of Excellence, Insight PartnersEdith Yeung, General Partner, Race Capital