When Kinnect dropped a new app that’s all about preserving epic family tales and awkward holiday moments for generations to come, I knew I needed to take a closer look at its angel deck.

The app is clever and can be thought of as a digital family scrapbook on steroids. This app isn’t just about stashing photos; it’s also got video and audio recording, plus a nifty timeline feature to organize your memories like a pro. Kinnect’s grand plan is to make sure your grandkids get to hear straight from the source about that time Uncle Bob got stuck in a tree at the family reunion.

In a world where our heritage can get lost in the shuffle of everyday life, Kinnect is here to remind us that family stories are worth saving — and, of course, that’s all about storytelling. How well did the company tell its own story in the form of its angel pitch deck? Let’s take a look.

We’re looking for more unique pitch decks to tear down: here’s how you to get involved. Read all our 90+ Pitch Deck Teardowns here.

Slides in this deck

Cover slideTeam (founder) slideVision slideProblem slideProduct slideBusiness model and market size slideProblem impact slideMarket potential slideSolution slideWhy now / personal story slideTraction slide“Why will I win?” slide.Testimonial slide 1Testimonial slide 2

Three things to love about Kinnect’s pitch deck

The Kinnect pitch deck is playing on the heart strings in a big way, which is a great approach to storytelling when you are talking about startups that offer a human touch.

Powerful problem slide

The problem slide in Kinnect’s pitch deck is compelling and well-executed. The team has clearly articulated a significant pain point, one that resonates deeply and is immediately relatable. The statistics cited are particularly impactful: Approximately 44 million American adults are significantly lonely, with about 30% of older adults feeling isolated. This alone paints a stark picture of the social isolation epidemic.

Even more powerful is the revelation that over half of Americans frequently feel misunderstood or unknown by those around them. The use of emotive and powerful language effectively underscores the urgency and magnitude of the issue, making it clear that this is a widespread and pressing problem.

However, while the problem identified is undeniably significant, it also feels somewhat nebulous. It’s hard to imagine a single product that can address all these diverse and deeply rooted issues of loneliness and disconnection. Tightening the focus of the problem statement might help in presenting a more cohesive and actionable solution. A slightly narrower and more focused problem could make the pitch even stronger and more believable.

Explain the impact of the problem

The “Insights” slide in Kinnect’s pitch deck is a great example of powerful storytelling. By combining the problem with its impact, the team has effectively highlighted how big and important this problem really is.

Kinnect has painted a vivid picture of the problem’s effects, which helps investors understand the depth of the issue and dream big about the potential market for Kinnect. It makes the problem feel more tangible and sets the stage for the solution, showing that there’s a real and urgent need for what they’re building.

However, I also need to add that I don’t love this slide. Many parts of it can be seen as arguments against the app: Being unaware of existing solutions, for example, means that there may just not be a real market for this. And the differentiation between family and chosen family is a strange thing to highlight as an advantage. If distinguishing between the two is important to people, the competition could easily address this, so it isn’t as much of a competitive advantage as you might think.

A little more focus and clarity could help strengthen the argument.

A personal touch

The “Why me?” type of information is typically included in the founder or team slide, but using it as a storytelling point here works well. Including the personal drive behind the venture can be incredibly powerful, as it explains why the founder will never give up on solving this problem.

Omar’s personal experiences — losing his grandfather to Alzheimer’s a few years ago and a friend to leukemia a month ago — are heart-wrenching and paint a vivid picture of his motivation. It shows that this is not just a business endeavor for him. It’s a deeply personal mission.

Founders, let’s get real. Every slide in your deck should scream, “Invest in me!” If it doesn’t, it’s dead weight. Sure, personal stories tug at the heartstrings, but investors aren’t here for that. They want to know why your sob story makes them money. The “Why Omar is doing this” slide? Sweet, but vague. If it doesn’t clearly tie back to why your company will crush it. It’s just fluff. Remember, if it doesn’t make an investor reach for their wallet, it doesn’t belong in your deck.

Three things that Kinnect could have improved

There’s a ton of information missing from the deck. Crucial details like the go-to-market strategy, user acquisition plans, specific team member credentials, and concrete milestones are absent. Filling in these gaps is essential to provide a comprehensive and convincing pitch. Use a checklist to make sure you have everything covered!

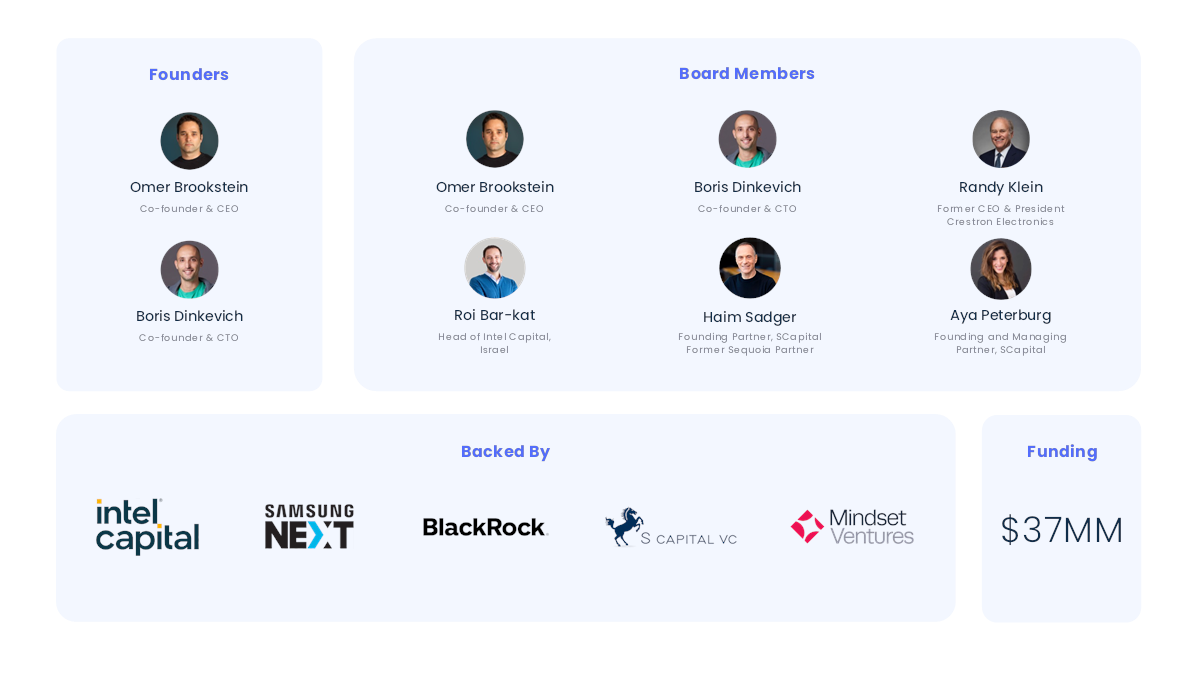

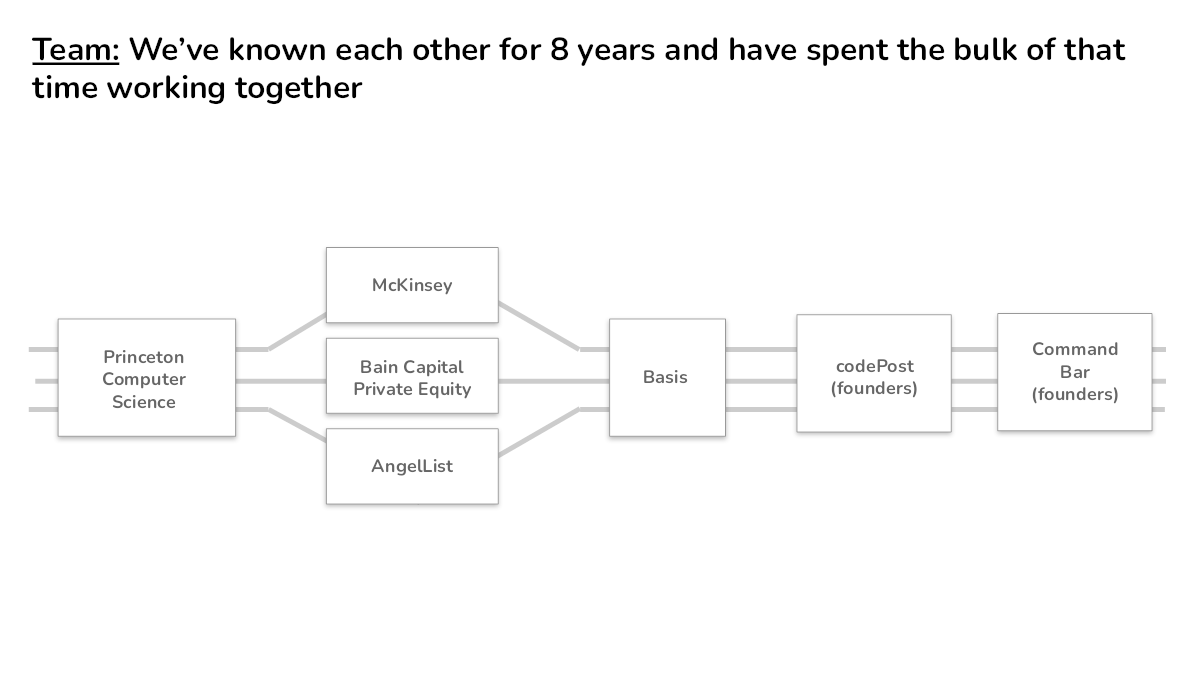

Dubious team

The “Founder” slide needs some polishing to really shine. Omar’s 10+ years of experience in performance brand and product marketing is impressive on the surface, but it’s crucial to tie that specific experience directly to Kinnect. Highlighting past roles or projects that are particularly relevant to the company’s mission would strengthen this slide significantly. Investors want to see how his background directly contributes to the success of Kinnect.

Omar doesn’t mention his last name anywhere in the deck, which raises a red flag. Investors need to be able to quickly look up and verify the founder’s background. Including his full name and a link to his LinkedIn profile would add credibility and transparency. Speaking of LinkedIn, it’s a bit concerning that Omar’s profile doesn’t reflect the 10 years of experience mentioned here. Ensuring that his LinkedIn is up-to-date and consistent with the information in the pitch deck is crucial. Investors will check, and inconsistencies can undermine trust. Without job titles and just a vague idea of how the founder’s past experience maps to the current venture, it’s all a bit fuzzy.

There also seems to be a lack of clear founder/market fit. The slide mentions a passion for storytelling, human connection and mental wellness, but it’s not immediately obvious how this translates into a strategic advantage for Kinnect. To wit: I, too, have a passion for storytelling, human connection and mental wellness, but I probably wouldn’t be a great founder for this particular startup. Get specific, connect the dots.

Drawing a direct line between Omar’s experience and the company’s goals will make this slide much more compelling. Adding more specific, verifiable information and making sure it’s consistent across all platforms would significantly improve the founder/market fit part of the story.

Pie-in-the-sky business model

The “Subscription Model” slide presents an ambitious goal: a potential yearly subscription revenue of $204.8 million. That’s certainly venture-scale, so kudos for aiming high. However, there are several aspects that need further clarification and support.

My immediate response is that it’s going to be hard to find customers. I want to see predicates or comparable examples. This doesn’t feel like an urgent need, so showing other types of products or services that families are willing to pay $80 per year for would strengthen the argument. It’s essential to demonstrate that there is a precedent for this kind of spending — and I can’t think of any offhand.

The term “family” needs more definition in this context. What are we memorializing, and how does it resonate with potential users? It’s also unclear what Kinnect offers that can’t be accomplished by existing free services like Facebook. Basically, this deck doesn’t answer why families would choose to pay for Kinnect when they have free alternatives available.

Nowhere in the deck is there a go-to-market plan, which means that I’m further worried how the founders plan to convince customers to shell out $80 per year. Without a clear strategy, it’s difficult to see how they will reach and convert their target audience. Providing a detailed plan on customer acquisition and retention would make the deck far more compelling overall and this slide more believable.

Wait, this isn’t traction

The “Traction” slide is supposed to showcase Kinnect’s progress, but it doesn’t quite hit the mark. Here’s why:

Stating that Kinnect is backed by TechStars through the Rising Stars Fund might sound impressive, but TechStars isn’t exactly in its golden era right now. Plus, raising money from an accelerator isn’t the slam dunk of traction it’s being made out to be. Investors want to see actual proof that people care about what’s being built, not just a pat on the back from an accelerator.

The slide claims the team is 100% working on Kinnect. What does that even mean? Have the founders quit their day jobs and are now living on ramen while they hustle? Founders being fully committed is the bare minimum; the slide should explain what this dedication has achieved.

There’s also the boast about recruiting a phenomenal founding team, but the team slide shows only one person, Omar. Where’s the rest of this supposed dream team, and what makes them phenomenal? Investors need names, roles and impressive backgrounds.

Then there’s the mention of being a member of Chicago’s 1871 innovation hub. Cool, but what does that actually mean? Why does being part of this hub give Kinnect a competitive edge? Without context, it’s just another buzzword.

None of these points really screams “traction.” Investors are looking for real, tangible progress, like user growth, revenue, partnerships — not fluff. It’s time to dig deeper and show the hard facts that prove Kinnect is on the path to success.

The full pitch deck

If you want your own pitch deck teardown featured on TechCrunch, here’s more information. Also, check out all our Pitch Deck Teardowns all collected in one handy place for you!