In an era where data is king and its volume and complexity are exploding, Protecto aims to eliminate the long-standing dilemma businesses face between leveraging AI’s power while ensuring data privacy. As the adoption of generative AI tools like ChatGPT skyrockets, wayward data becomes easier to find, process and do naughty things with. Protecto’s APIs are designed to protect sensitive data across the AI life cycle while maintaining its utility.

The company announced it raised a $4 million seed funding round led by Together Fund, with contributions from Better Capital, FortyTwo VC, Arali Ventures and Speciale Invest. This round boosts Protecto’s total funding to $5 million.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Protecto made redactions to the short-term and five-year goals and to specific details of the near-term product roadmap before submitting its deck to TechCrunch. The timeline for the goals and milestones related to the seed funding round was also redacted. Still, there’s plenty to learn from the 14-slide deck:

Cover slideProblem slideUrgency slidePlatform interstitial slideTechnology overview slideResults slideSolution slideCase study slide 1Case study slide 2 Competitive alternatives slide Team slide Go to market slide Roadmap slide Ask and use of funds slide

Three things to love about Protecto’s pitch deck

There’s a lot missing from this deck, but there are some good things to highlight, too.

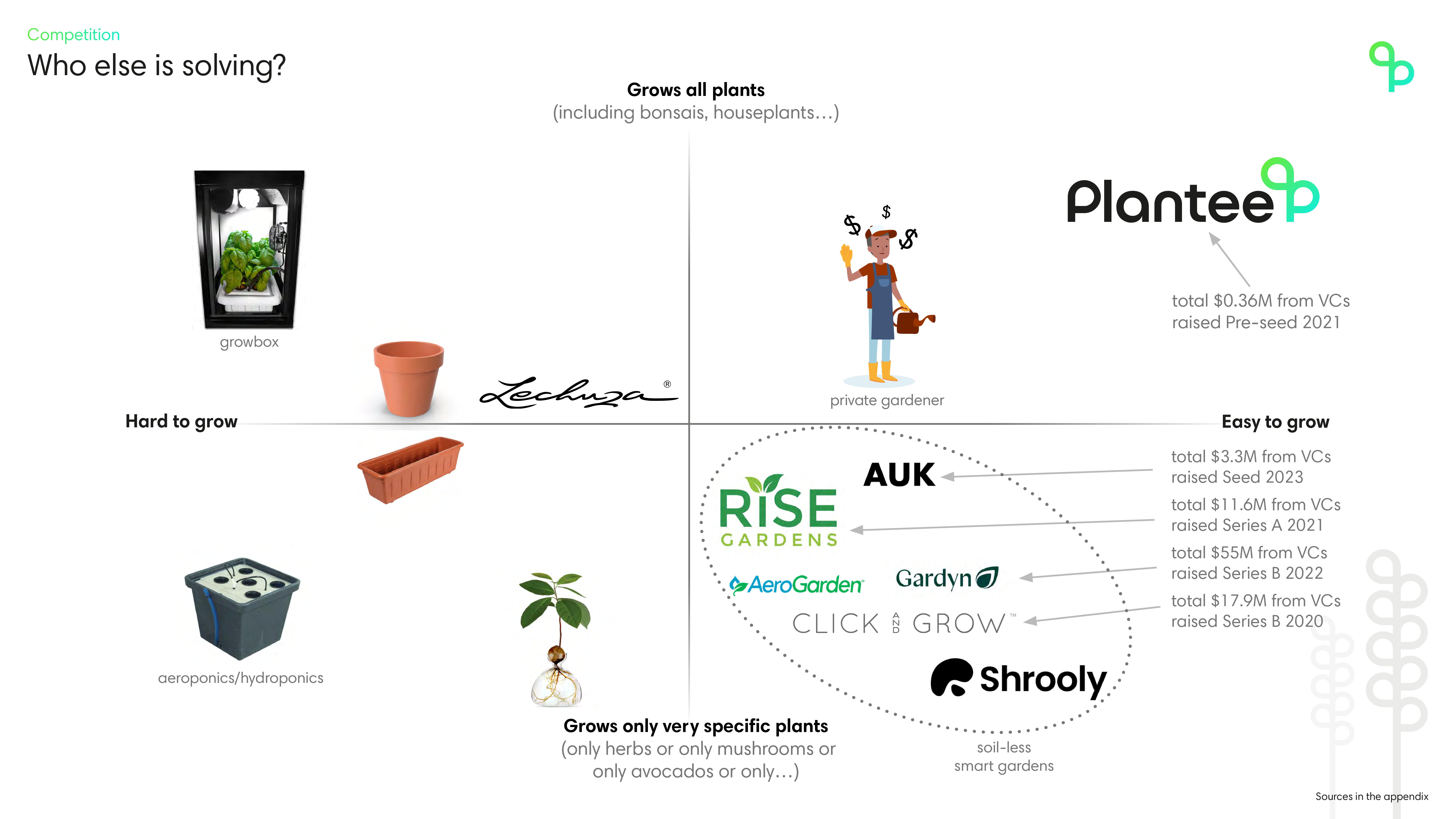

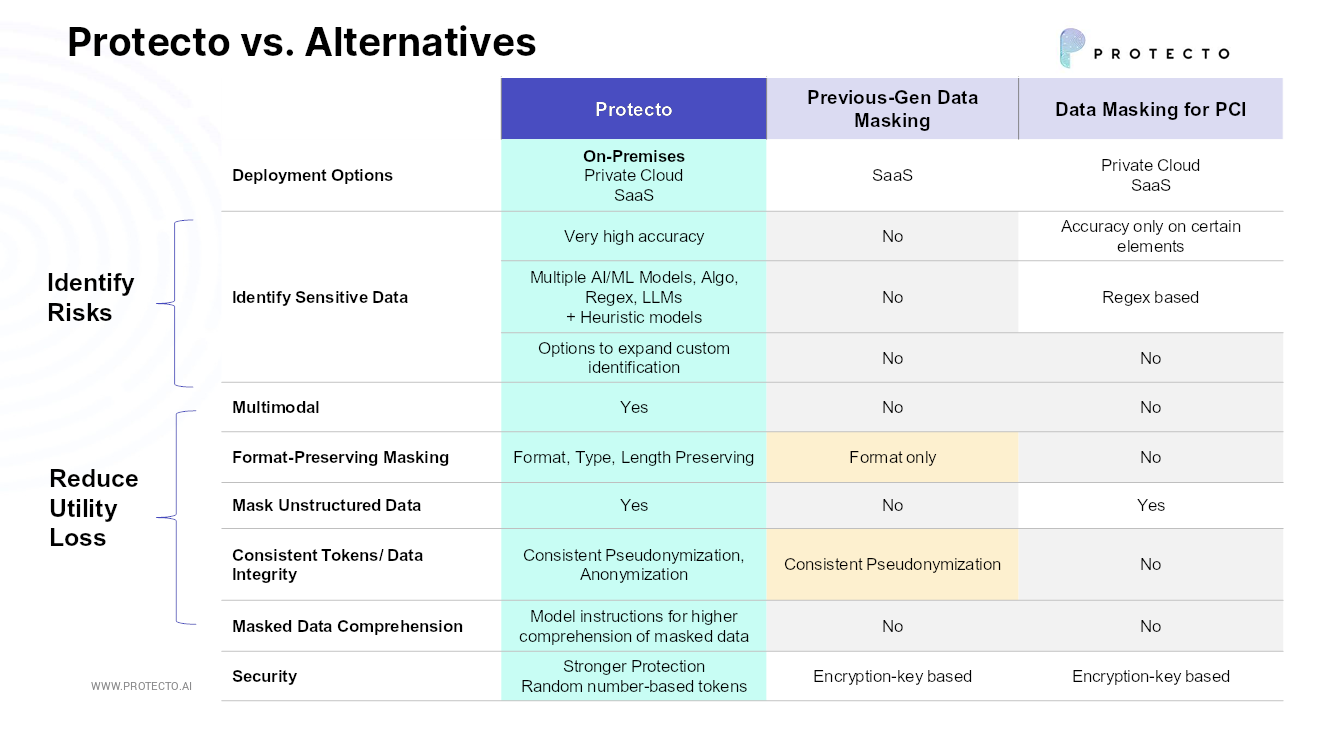

Competitive alternatives

This slide doesn’t talk about direct competitors (there are one or two). But the company does a good job showing this information anyway:

Competitive alternatives are businesses, methods or approaches that are different from yours but that satisfy the same customer needs or solve the same problems. For instance, if you run a coffee shop, a direct competitor would be another coffee shop, while a competitive alternative might be a teahouse or a fast-food restaurant that also sells coffee among other beverages. These competitors matter because they represent alternative solutions for your customers, highlighting the importance of understanding broader market dynamics and customer preferences.

Understanding and analyzing these competitive alternatives can be powerful as an additional layer of insight, uncovering potential opportunities for differentiation and helping to identify unmet customer needs. Having said all of that, Protecto should have included direct competitors, but this slide is still a great example of how a startup can explore its position in the market.

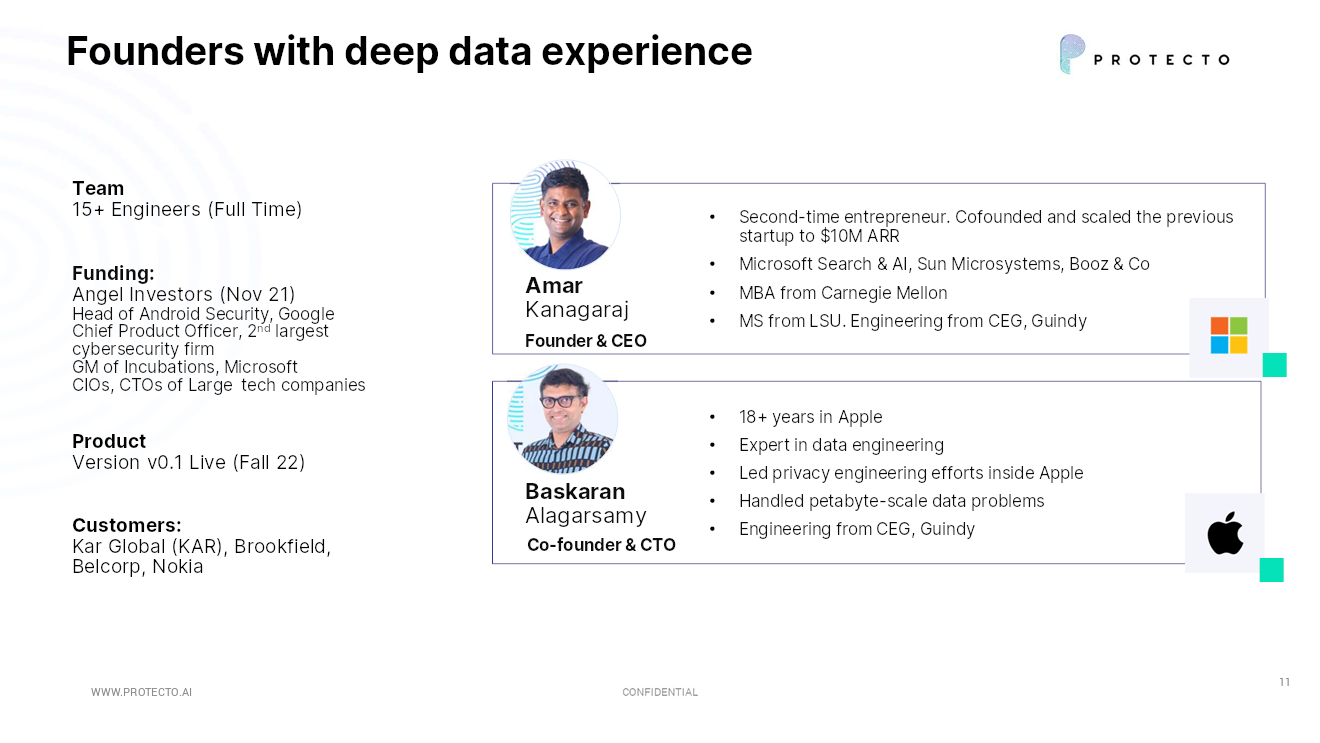

Helloooo, team

This team slide is so solid — the only downside is that they put it as the 11th slide:

To stand out in a suddenly crowded AI space, you’d best bring receipts that show you’ve got the chops to pull it off. The left-hand side of the slide has too much info (why are funding, product and customers on the team slide?) but the part on the right has a ton of great information.

According to his LinkedIn, CEO Amar Kanagaraj spent almost eight years at Microsoft, including a stint in search and AI. CTO Baskaran Alagarsamy spent seven years as a “manager” at Apple India. I’d have loved to see more detail on exactly what he was managing there (and why this slide says 18 years, while his LinkedIn says seven years), but this is the beginning of a really solid team. If I were investing in this space, a team of this caliber would pique my interest and I would probably set up a meeting.

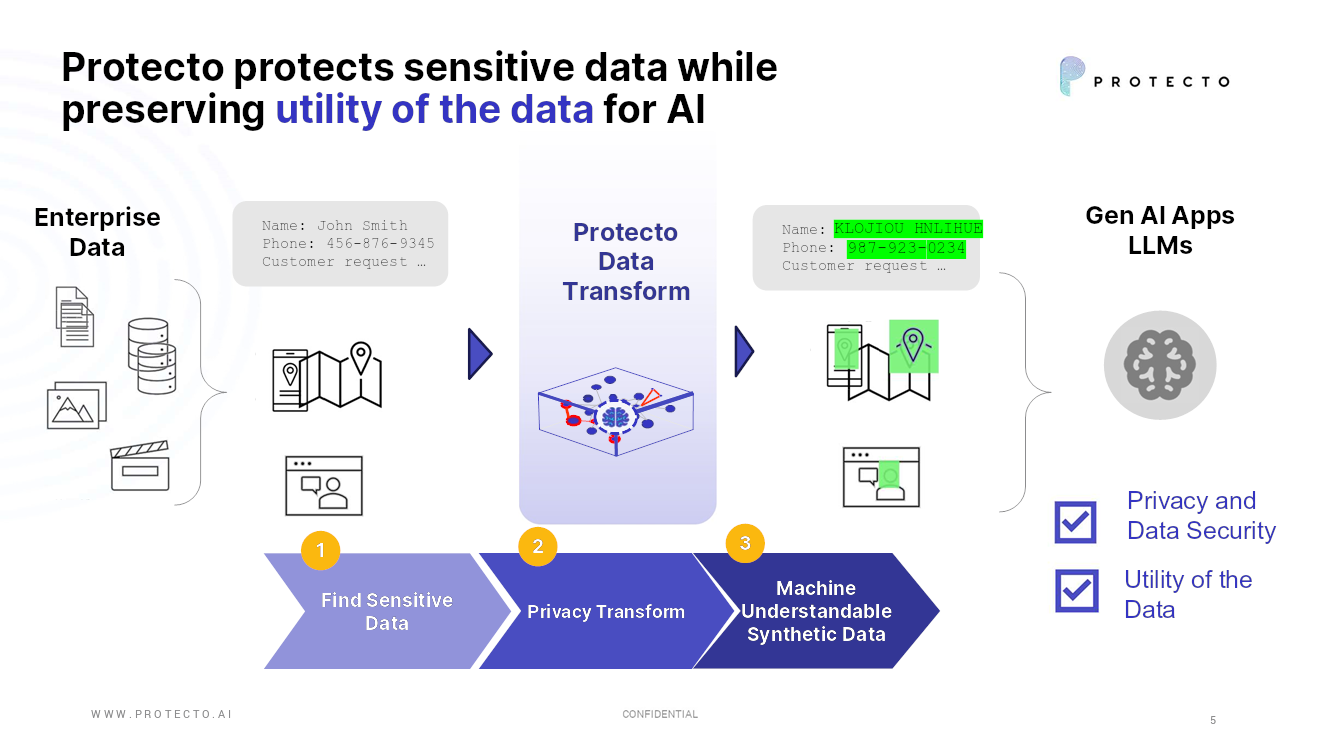

An elegant solution

Privacy and AI can get brain-achingly complicated, fast. I appreciate Protecto’s efforts to simplify it to a point where most people can fathom what’s going on in the tech.

Three things that Protecto could have improved

Pitch deck design isn’t usually that important, but the design of this deck is particularly bad. There are also far more serious flaws hidden among these pages.

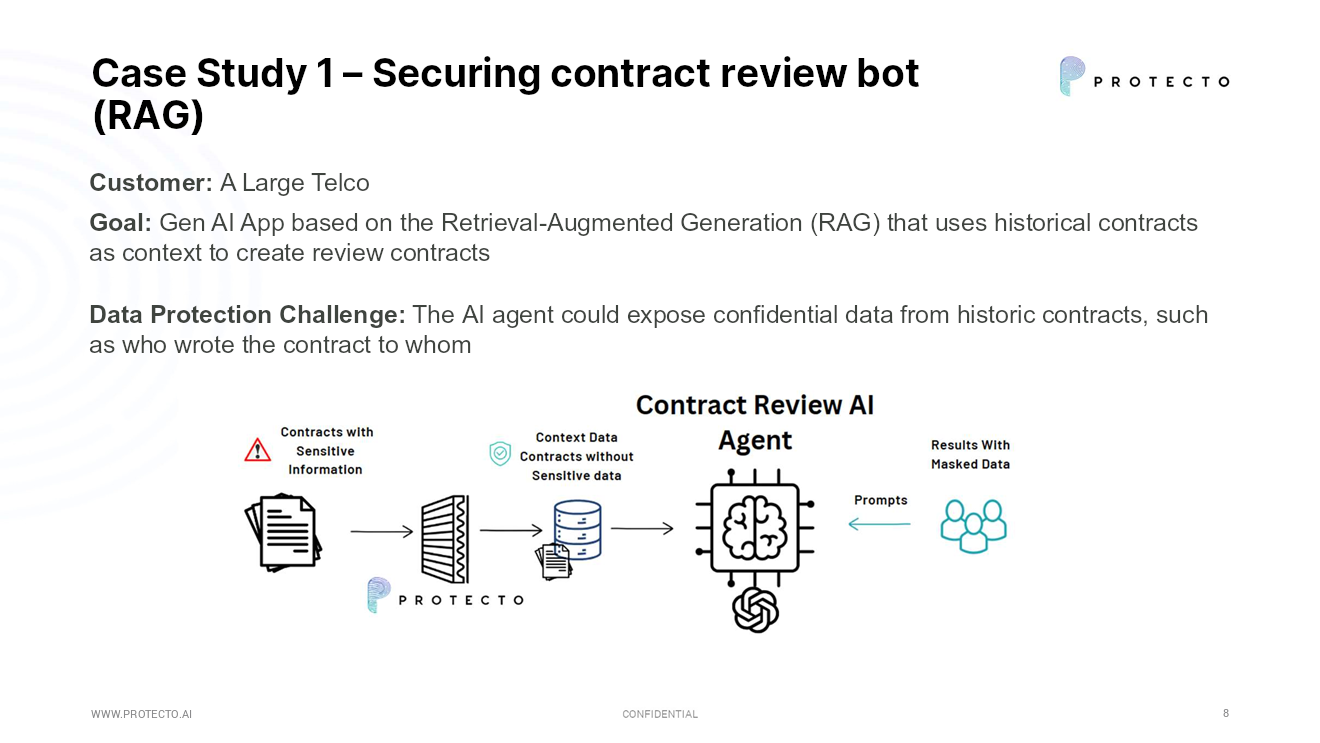

These case studies aren’t case studies

In a 14-slide deck, Protecto wastes slide 4 as an interstitial (it just says “our platform”). It then wastes two slides with the title “case studies.” However, a more accurate term would be “use cases.”

A full case study would include a lot more information about how successful it was (did the product succeed in removing all the confidential data? How was that measured?), how long it took to integrate, and how happy the customer was with the solution. Slide 9 is another “case study” that is similar: a use case, not a case study.

The headline of a slide is a promise the rest of the slide has to fulfill. In this case, I was let down both times, expecting one type of information and getting another. Proper case studies would have been really helpful in telling the story here.

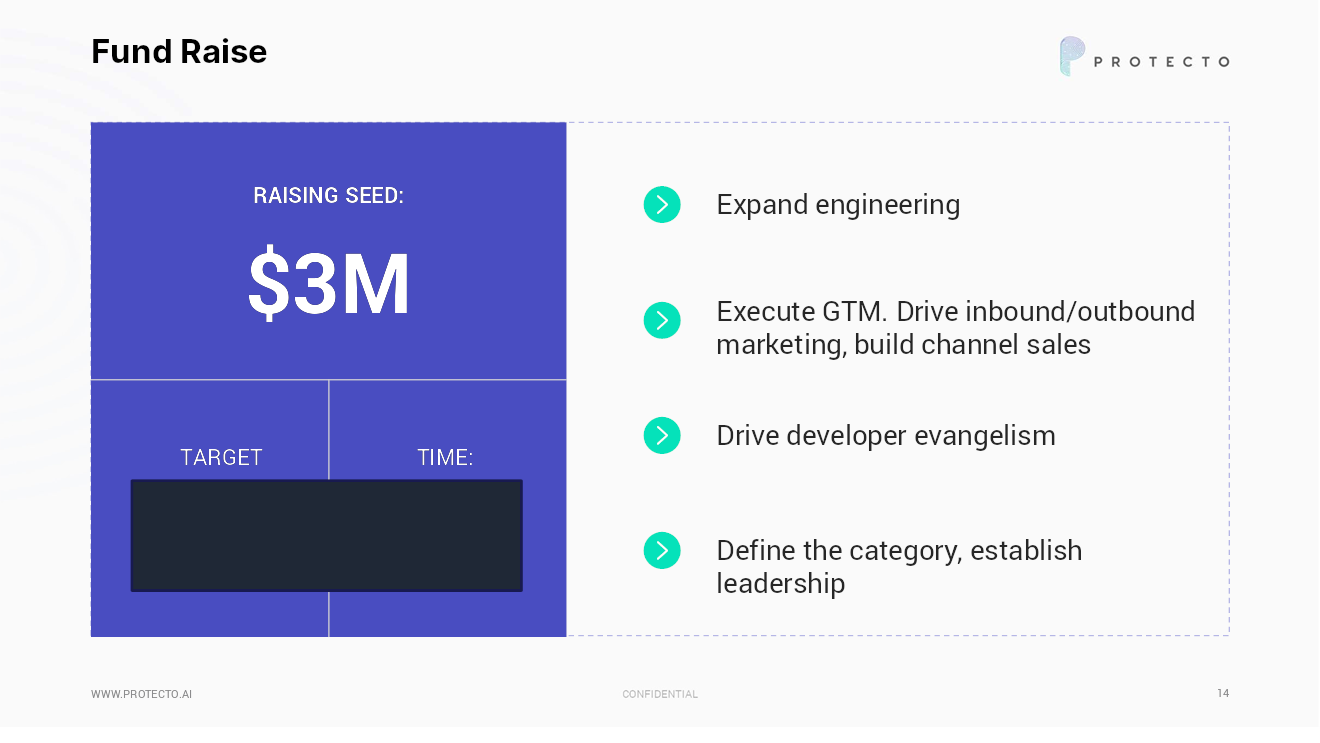

Not a great “use of funds” slide

Redactions aside, there’s not much here.

The company set out to raise $3 million. The use of funds, however, is so fluffy; every bullet point here makes me want to ask: “But how do you know it is working?”

Expand engineering: Yes, but why, with what goal, and how much?Drive marketing: Yes, but with what goals? By when? How much growth?Build channel sales: Yes, but which channels are you going after first? Why?Drive developer evangelism: What does that even mean?Define the category: ???

Basically, all of this is just corporate-grade jargon. Even if the founders themselves buy it, investors probably won’t.

The one slide 95% of founders get wrong when fundraising

Yes, it’s scary to get predictive and specific. What if you fail? All plans and projections are predictions. We know. The investors know. The point is to show how you’re thinking through these predictions; investors can learn a lot about you as a founder. That’s extremely valuable — and not optional.

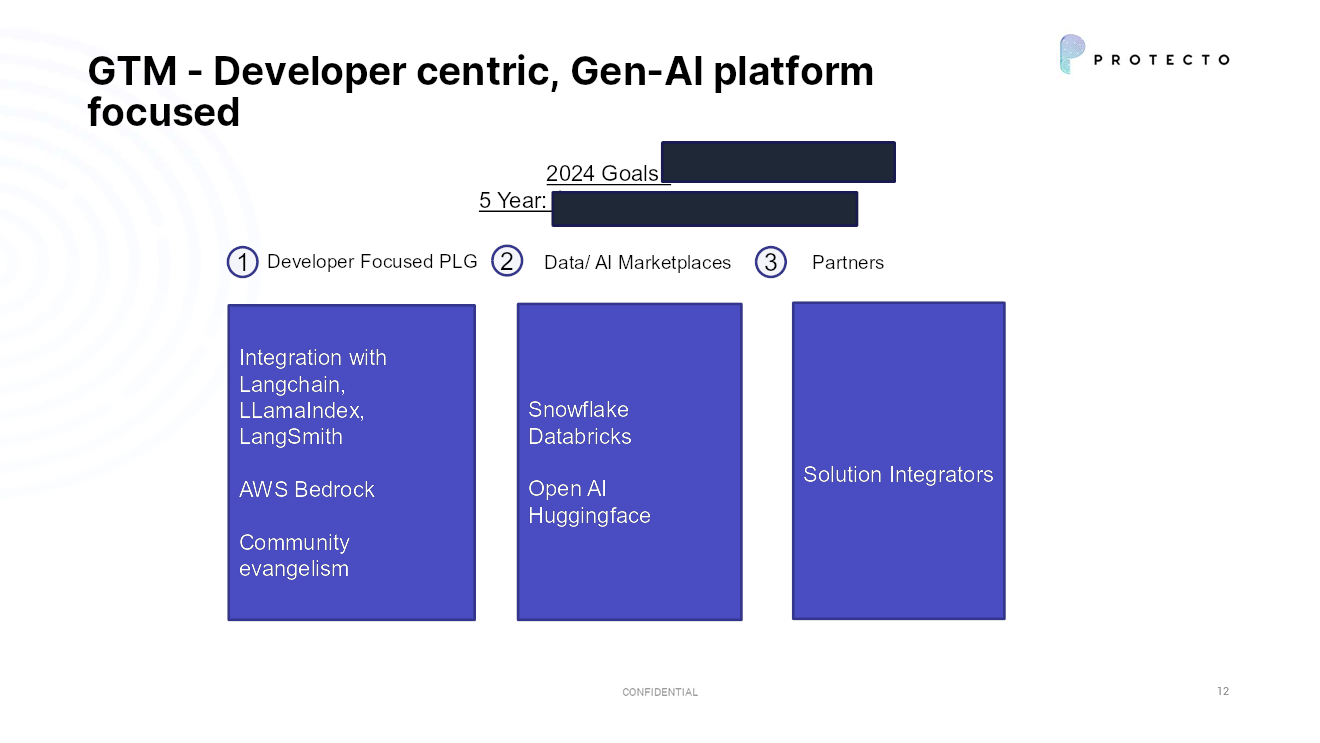

This is a brainstorm, not a plan

There’s a number of problems with this slide. The company is arguing it will grow through product-led growth. That’s great and all, but that rarely works in isolation — it needs to be done in conjunction with other marketing channels. “If you build it, they will come” is not a thing in the crowded startup ecosystem.

I would want to know what these integrations actually mean, and how customers find them. I’d like to understand how Snowflake and Databricks play into this plan. And what it is imagining with “solution integrators”?

This slide is a pile of words on a page, not an actionable, measurable go-to-market plan.

And then there’s all the stuff missing from the deck overall …

How big is the market for this sort of thing?What traction do you have to date? Did the “case studies” pay? If yes, how much? Did they continue to use the product?There’s nothing about the business model: How will they charge? How much?How is this defendable? Does the company have patents? Is there some sort of special magic sauce?

The problem with this deck overall is that it doesn’t explain why this problem is hard to solve and why this company is the one to solve it. Maybe it’s overly simplified in the deck, but just based on what’s here, I think I could round up a handful of developers and build most of this product over the span of a couple weeks. That cannot be true, can it? Because if so, there’s nothing here. But since that’s probably not the case, it means that there’s simply a problem with the storytelling. Yes, this is a big problem; now explain why it’s a hard-to-solve problem.

Your startup should solve an impossibly hard problem

The full pitch deck

If you want your own pitch deck teardown featured on TechCrunch, here’s more information. Also, check out all our Pitch Deck Teardowns all collected in one handy place for you!