Trending News

18 October, 2024

14°C New York

African e-commerce company Jumia is selling 20 million American depositary shares over the next couple of weeks, TechCrunch has learned. The at-the-market transaction is to take advantage of strong results despite a volatile market.

Given Jumia’s share price of around $5.70 when the stock market opened on Tuesday, the e-commerce company could potentially raise approximately $100 million through its new share offering. However, the final amount will depend on the share price, which has since dropped to $4.90. This decline, from around $11 as of Monday following a 200% rally in the last three months, may be attributed to shareholders reacting unfavorably to news of dilution, the impact of global carry trades, or both.

It’s not the first time Jumia has taken this approach. Between 2020 and 2021, the e-tailer raised almost $600 million through the sale of secondary shares.

CEO Francis Dufay, who is undertaking his first secondary share sale, said on a call with TechCrunch that this time, Jumia is raising this money to accelerate its business after making significant progress on cost management and efficiency.

“The new funding will be used to expand our supply chain network, particularly by enhancing logistics to reach smaller cities and broadening our overall network,” Dufay remarked. “We also plan to invest in technology, focusing on marketing and vendor technology, which we believe will significantly impact growth. Bottom line, after deep, fundamental, hard work on cost and efficiency, we believe the time is right to shift the cursor towards growing and invest some extra money so we can scale the company faster and break even faster.”

Specifically, the funds will improve Jumia’s cash position, which currently stands at $92.8 million (comprising $45.1 million in cash and cash equivalents and $47.7 million in term deposits and other financial assets) from its Q2 2024, its most recent financial report. That’s compared to the platform’s liquidity position of $120.6 million in Q4 2023 and $101.5 million in Q1 2024.

The funds raised will also be used for other purposes, including customer acquisition, product assortment, supply retention and adding more vendors to its marketplace.

Jumia’s active customer base has hovered around two million for several quarters. The number represents a 6.0% quarter-over-quarter compared to Q1 2024 and flat year-over-year growth between Q2 2023 and Q2 2024. “Our customer base is still relatively small, around two million active consumers per quarter, while we work in markets with over 600 million people. So we can do much more on the customer base,” said Dufay.

Subsequently, orders increased 7% year over year to 4.8 million. Jumia ascribes the growth to the diversification of its product assortment, another area it intends to double down on with the new capital raised.

However, despite the increase in orders, Jumia’s GMV and revenue declined 5% and 17% year-over-year to $170.1 million and $36.5 million, respectively. As with most of Jumia’s financial reports, since new management took over in Q4 2022, a recurring theme has been that these numbers typically highlight a year-over-year improvement on a constant currency basis but fluctuate in dollar terms due to devaluation. For instance, Jumia’s GMV in constant currency grew 35.0% year-over-year while revenue increased 15%.

“The devaluation that happened both in our two biggest potential markets, Egypt and Nigeria, at the end of Q1 had a significant impact on our revenues quarter over quarter,” Dufay said. “However, we have seen some signs of stabilization and a sharp reduction of the spread between the official and parallel market rates. More importantly, our ability to drive GMV growth in constant currency illustrates that our value proposition is working.”

Turning to profitability, Jumia’s adjusted EBITDA loss, which excludes finance costs, decreased 10% to $16.3 million — in line with the reduction in operating loss, down 8% year-over-year to $20.2 million — and driven primarily by cost-savings initiatives.

While Jumia has long used both adjusted EBITDA and operating loss to measure its losses and path to profitability for years, Dufay insisted on the call that the 12-year-old e-commerce platform is keener to report loss before income tax from continuing operations, which includes finance costs, such as the impact of FX and the cost of cash repatriation. Loss before income tax from continuing operations was $22.5 million, down 27% year-over-year.

“We’ve emphasized this KPI more over the past quarters due to the currency volatility and the associated costs it creates. Reporting the full picture is essential for companies exposed to such volatility. For instance, Mercado Libre in Latin America also prefers to look at the loss before income tax rather than EBITDA,” said the CEO. “During their recent results announcement, they highlighted how currency volatility in Argentina impacts finance costs. Therefore, focusing on loss before income tax offers a more comprehensive view when operating across multiple markets with currency fluctuations.”

African e-commerce company Jumia is selling 20 million American depositary shares over the next couple of weeks, TechCrunch has learned. The at-the-market transaction is to take advantage of strong results despite a volatile market.

Given Jumia’s share price of around $5.70 when the stock market opened on Tuesday, the e-commerce company could potentially raise approximately $100 million through its new share offering. However, the final amount will depend on the share price, which has since dropped to $4.90. This decline, from around $11 as of Monday following a 200% rally in the last three months, may be attributed to shareholders reacting unfavorably to news of dilution, the impact of global carry trades, or both.

It’s not the first time Jumia has taken this approach. Between 2020 and 2021, the e-tailer raised almost $600 million through the sale of secondary shares.

CEO Francis Dufay, who is undertaking his first secondary share sale, said on a call with TechCrunch that this time, Jumia is raising this money to accelerate its business after making significant progress on cost management and efficiency.

“The new funding will be used to expand our supply chain network, particularly by enhancing logistics to reach smaller cities and broadening our overall network,” Dufay remarked. “We also plan to invest in technology, focusing on marketing and vendor technology, which we believe will significantly impact growth. Bottom line, after deep, fundamental, hard work on cost and efficiency, we believe the time is right to shift the cursor towards growing and invest some extra money so we can scale the company faster and break even faster.”

Specifically, the funds will improve Jumia’s cash position, which currently stands at $92.8 million (comprising $45.1 million in cash and cash equivalents and $47.7 million in term deposits and other financial assets) from its Q2 2024, its most recent financial report. That’s compared to the platform’s liquidity position of $120.6 million in Q4 2023 and $101.5 million in Q1 2024.

The funds raised will also be used for other purposes, including customer acquisition, product assortment, supply retention and adding more vendors to its marketplace.

Jumia’s active customer base has hovered around two million for several quarters. The number represents a 6.0% quarter-over-quarter compared to Q1 2024 and flat year-over-year growth between Q2 2023 and Q2 2024. “Our customer base is still relatively small, around two million active consumers per quarter, while we work in markets with over 600 million people. So we can do much more on the customer base,” said Dufay.

Subsequently, orders increased 7% year over year to 4.8 million. Jumia ascribes the growth to the diversification of its product assortment, another area it intends to double down on with the new capital raised.

However, despite the increase in orders, Jumia’s GMV and revenue declined 5% and 17% year-over-year to $170.1 million and $36.5 million, respectively. As with most of Jumia’s financial reports, since new management took over in Q4 2022, a recurring theme has been that these numbers typically highlight a year-over-year improvement on a constant currency basis but fluctuate in dollar terms due to devaluation. For instance, Jumia’s GMV in constant currency grew 35.0% year-over-year while revenue increased 15%.

“The devaluation that happened both in our two biggest potential markets, Egypt and Nigeria, at the end of Q1 had a significant impact on our revenues quarter over quarter,” Dufay said. “However, we have seen some signs of stabilization and a sharp reduction of the spread between the official and parallel market rates. More importantly, our ability to drive GMV growth in constant currency illustrates that our value proposition is working.”

Turning to profitability, Jumia’s adjusted EBITDA loss, which excludes finance costs, decreased 10% to $16.3 million — in line with the reduction in operating loss, down 8% year-over-year to $20.2 million — and driven primarily by cost-savings initiatives.

While Jumia has long used both adjusted EBITDA and operating loss to measure its losses and path to profitability for years, Dufay insisted on the call that the 12-year-old e-commerce platform is keener to report loss before income tax from continuing operations, which includes finance costs, such as the impact of FX and the cost of cash repatriation. Loss before income tax from continuing operations was $22.5 million, down 27% year-over-year.

“We’ve emphasized this KPI more over the past quarters due to the currency volatility and the associated costs it creates. Reporting the full picture is essential for companies exposed to such volatility. For instance, Mercado Libre in Latin America also prefers to look at the loss before income tax rather than EBITDA,” said the CEO. “During their recent results announcement, they highlighted how currency volatility in Argentina impacts finance costs. Therefore, focusing on loss before income tax offers a more comprehensive view when operating across multiple markets with currency fluctuations.”

No wonder YouTube launched Shorts. A new study of children’s online habits found that children ages 4 through 18 spent a global average of 112 minutes daily on TikTok’s short video app in 2023, an increase from 107 minutes the year prior. And although YouTube remains the world’s biggest streaming app among this demographic, kids spent 60% more time on TikTok last year. The data, from a new study on kids’ digital media, also examined kids’ use of novel technologies like OpenAI’s ChatGPT.

The study, which takes into account the digital media habits of over 400,000 families and schools worldwide, hails from parent control software maker Qustodio. In its annual report, the company paints a picture of the digital habits of kids and their technology usage across mobile and desktop devices, with deep dives into select markets, including the U.S., U.K., Spain, Australia, and France. What’s unique about its dataset is that it comes from kids’ real-world usage of technology, rather than panelist questions. However, the data may not be fully representative of kids’ digital media habits, since its slice of the market represents those households and schools using its parental control software.

Still, it’s a large body of data to pull from and reveals some overall trends that speak to how kids, both younger and older, are engaging with technology.

Notably, the firm for the first time this year looked into kids’ use of new technologies, including AI.

Because ChatGPT didn’t launch on iOS until May and on Android in July, Qustodio chose to look solely at the usage of OpenAI’s website. Globally, it found that almost 20% of kids accessed the site last year, making it the 18th most-visited site for the year. In the U.S., 18.7% of kids visited the site, and it was in 32nd place overall. Australia saw the largest adoption, as 24% of kids visited the site in 2023.

On the streaming front, children spent 27% more time watching streaming services than they did last year, though the price hikes at some services may have impacted their viewership numbers. The firm found that kids spent 4% less time watching Netflix in 2023, 23% less time on Disney+, and 12% less time on Hulu. Meanwhile, YouTube and its sister app YouTube Kids beat records, with watch time for the latter growing by 14% globally, reaching 96 minutes per day, on average — the highest figure Qustodio has seen since the start of its data collection in 2019. YouTube was at 70 minutes, up from 67 last year.

Though Netflix raised prices and cracked down on passwords in 2023, it still remained the second most popular streamer worldwide among kids, as 40% used the service. YouTube was in first place, with 63% of kids using it, and Disney+ was in third place, at 20%. However, Netflix was the only paid service to grow in popularity year-over-year, as other streamers saw their percentages drop, including Disney+, Amazon Prime Video, and Hulu, as well as livestreaming service Twitch, which dropped from 11% of kids using the service in 2022 to just 8% in 2023. Those who remained on Twitch this year boosted their viewing hours, watching 16% more livestreams globally at 22 minutes per day, on average.

Despite growing concerns among parents and legislators about social media’s harms, the use of social media apps among kids was as popular as ever in 2023, for better or for worse.

TikTok remained the most popular app globally, used by 44% of kids, and Facebook, proving its staying power, was the second most popular, used by 38%.

Elon Musk’s X seemed to live up to the mantra that “no press is bad press,” Qustodio says, as Twitter’s rebranding saw 38% of the younger demographic using the platform last year, up from 30% in 2022. (But it seems parents took note of the changes at X, too, making it the third most blocked service globally, behind TikTok and Instagram.)

Rounding out the list of most popular social apps globally were Reddit, Instagram, and Pinterest, at 32%, 32%, and 31% usage, respectively.

The list looks a little different in the U.S., though, as TikTok is followed by X, Reddit, Facebook, Pinterest, and then Instagram.

Still, TikTok gobbled up far more time than its rivals, with usage of 112 minutes per day, on average globally, compared with 63 minutes for Instagram, 19 for Facebook, 16 for Pinterest, 10 for X, and 9 minutes for Reddit.

Related, Meta’s WhatsApp maintained a top spot as the most popular messaging app globally, used by 37% of kids, ahead of Snapchat (35%), Discord (31%), Messages (28%), Skype (21%) and Google Duo (13%). However, Snapchat was by far the app kids spent the most time on, with an average of 74 minutes per day, well ahead of its next nearest rival, Discord, at 27 minutes per day. If it had been categorized among the social apps instead of the communication apps, that would have made it the No. 3 app by time spent.

Among gaming apps, Roblox was the most popular, used by 48% of kids for an average of 130 minutes per day globally, followed by Minecraft, Among Us, Clash Royale, Stumble Guys, and Magic Tiles 3.

Kids also continued to use popular learning apps last year, like those provided by their schools, such as Google Classroom, as well as those in the educational space, like top apps Duolingo, Photomath, Kahoot!, Quizlet, Simply Piano, and Brainly.

In addition to delving into market trends, the full report also deals with how parents should approach managing and monitoring their kids’ technology usage, and what to expect in the future. For the latter, Qustodio cautioned parents that AI tools are expected to grow by almost 40% per year between 2023 and 2030, though among younger kids (ages 10 to 13), only 6% said they were active users.

Instagram Threads now has more than 130 million monthly active users, Meta CEO Mark Zuckerberg announced during the company’s fourth-quarter earnings today. The text-based social networking app is one of the many new projects that have sprung up in the wake of Elon Musk’s 2022 acquisition of Twitter, now called X, where it competes with various startups and open source projects, including Bluesky, Mastodon, Nostr, Post, Spill and others.

Zuckerberg said that Threads is “growing steadily,” though characterized the app as having blown up before Meta was ready.

“I’ll note that Threads now has more people actively using it today than it did during its initial launch peak,” said Zuckerberg. “So that one’s I think on track to be a major success.”

Last quarter, Zuckerberg also spoke highly of Threads, saying he believed the app had a good chance of reaching 1 billion users within a few years. At the time, Threads had north of 100 million monthly active users.

Meta said its family of apps, which also includes Facebook, Instagram, Messenger and WhatsApp, were used by 3.19 billion people daily in the fourth quarter, up from the 3.14 billion it saw in the quarter ending September 2023. Monthly active users were at 3.98 billion, up from 3.96 billion in the prior quarter.

We’ve seen evidence that Threads has been gaining traction in recent weeks. App intelligence provider Appfigures found that the Instagram-owned app had tripled its downloads in December to become the No. 6 most downloaded app in the month across the Apple App Store and Google Play. X, still struggling with its rebranding, was No. 36.

By leveraging Instagram’s friend graph, Threads had a record-breaking launch, reaching 100 million registered users within its first five days last July. But interest in Threads began to taper off in the fall, only returning to growth as Meta gave it a push by promoting Threads’ viral posts to Facebook users. That likely helped the app secure its spot in the top 10 most downloaded apps globally in December.

Zuckerberg’s comments were likely meant to head off concerns that had been raised during Threads’ downturn, which had some critics prematurely declaring it dead. That doesn’t appear to be the case any more — and a third-party tracker says Threads has an estimated 160 million total users.

As for Meta’s earnings, the company saw $40.1 billion in revenue in the quarter ending in December 2023, ahead of analysts’ estimates of $39.18 billion and earnings of $5.33 per share, ahead of estimates of $4.96. Net income was $14.02 billion. Revenue for the full-year 2023 was $134.90 billion.

Meta also announced its first cash dividend of $0.50 per share, which will be paid in March to Meta’s shareholders.

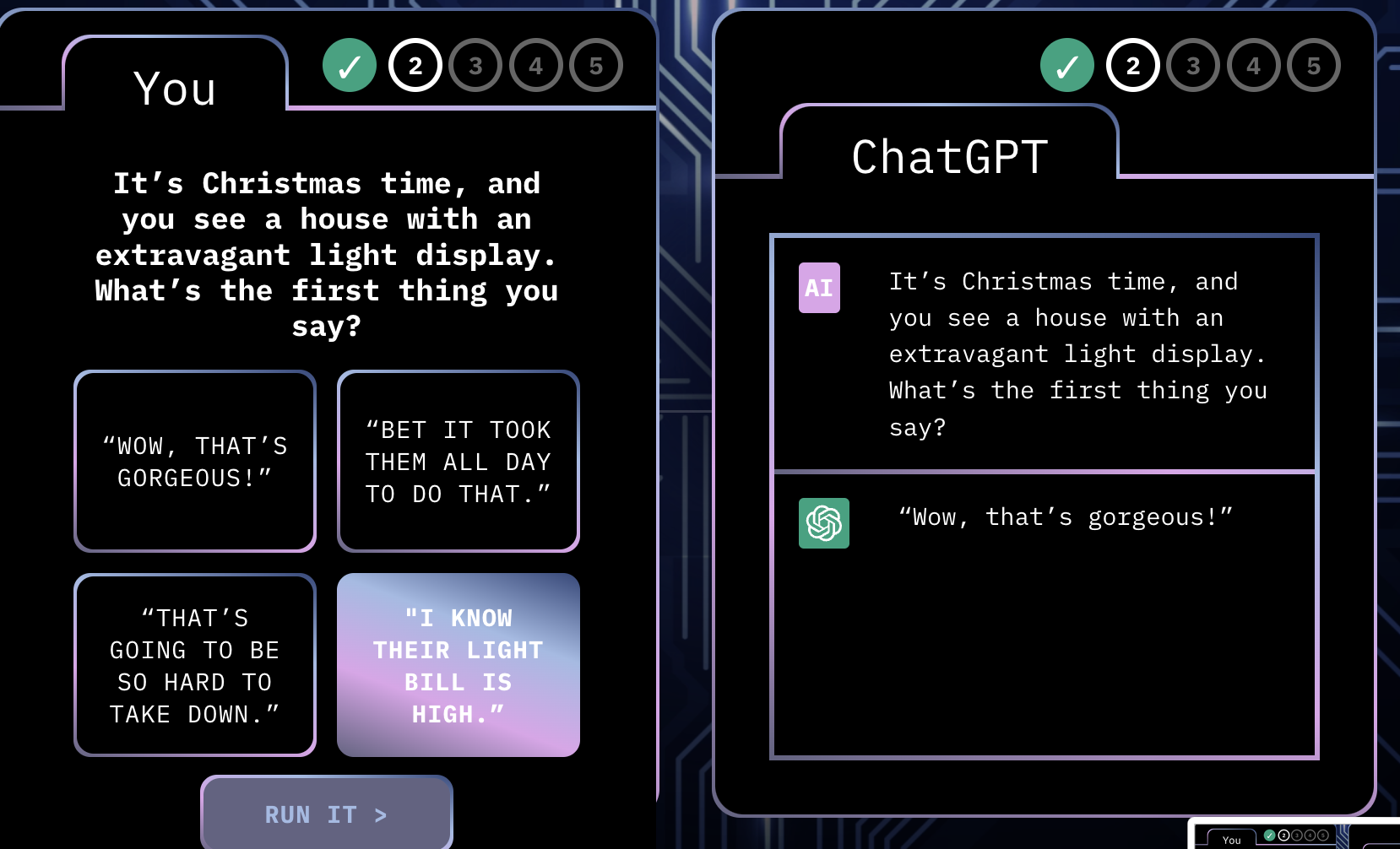

Creative ad agency McKinney developed a quiz game called “Are You Blacker than ChatGPT?” to shine a light on AI bias.

The game tests a person’s knowledge of Black culture against what ChatGPT has been trained to know about the Black community. It asks questions like, “What does it mean when someone says, ‘Not too much on them, now’?” and “What is your response if you are invited to an event?” When I took the quiz, both ChatGPT and I got the first one right — when someone says “not too much on them,” that usually means to go easy on them. But ChatGPT failed when it came to the second one. When someone invites you to an event, the stereotypical response in the Black community is, “Who else is going to be there?” But ChatGPT said it was, “Thanks for the invite!”

“It’s interesting because it’s billed as this bot that knows everything, and it’s like, clearly, you don’t know everything, especially when it comes to things that aren’t white-specific,” Meghan Woods, a copywriter at McKinney and one of the game’s creators, told TechCrunch.

Woods said the idea for the quiz came last year during a creative brainstorm at McKinney. It took a year for Woods and a Black-led team to create this product, with the purpose of playfully pointing out how out of touch ChatGPT is with Black users. She pointed out that a blind spot for ChatGPT seems to stem from the fact that a lot of Black cultural elements are not necessarily documented online; they are, instead, passed down in person or orally through generations. This means its algorithm misses a lot of nuances when scraping the internet for information about Black people.

“The blind spots can be pretty upsetting,” Woods said. “It’s pretty dangerous.”

AI might be on a hot streak, but women, Black and brown builders, and founders in the space, have long spoken of being ignored or pushed aside. The result is that AI innovation is being built without the cultural insight and complexities that would make it suitable for different cultures. At its most extreme, the dearth of diversity means cars are developed using AI that cannot detect Black skin, leading to an increasing number of accidents. On the other end, it simply means a chatbox that can’t distinguish between one Whitney Houston song and another.

Gerald Carter, founder of Destined AI, a company that helps detect and mitigate AI bias, said the McKinney quiz does a good job at gamifying and bringing more awareness to these AI gaps. “A lot of nuances can be addressed by including diverse perspectives at every level,” he said. “For AI to reach its full potential, it needs to work for everyone, everywhere.”

ChatGPT’s parent company, OpenAI, has received criticism for the lack of diversity on its board. Woods said it doesn’t seem like ChatGPT is learning from the quiz, either, based on the fact that it keeps getting the same answers wrong in many cases. “Our hypothesis is that it will never be able to fully grasp a lot of the things we ask it.”

We reached out to OpenAI for comment and will update this post when we hear back.

Carter said that ChatGPT could work better for more cultures with better sourcing and having more inclusive data collection. A more immediate approach is monitoring AI model drift and making improvements using tools focused on cultural perspectives.

While larger companies work on making AI useful for everyone, Black and brown builders in the space have taken matters into their own hands to ensure this next wave of AI is diverse.

Carter, for example, works with companies to help them source more inclusive data. Erin Reddick created ChatBlackGPT (no relation to OpenAI) to offer deeper insights into Black culture and history, and Tamar Huggins raised $1.4 million for her ChatGPT alternative, called Spark Plug, which translates classic literature texts into the African American Vernacular English (AAVE) dialect.

“Hiring, retention, making sure that people are in the room at the table,” Woods said, regarding what more needs to be done to make AI more inclusive. “I know it sounds cliché, but I do think that can start to have an impact.”