Image Credits: mistral.ai

Image Credits: mistral.ai

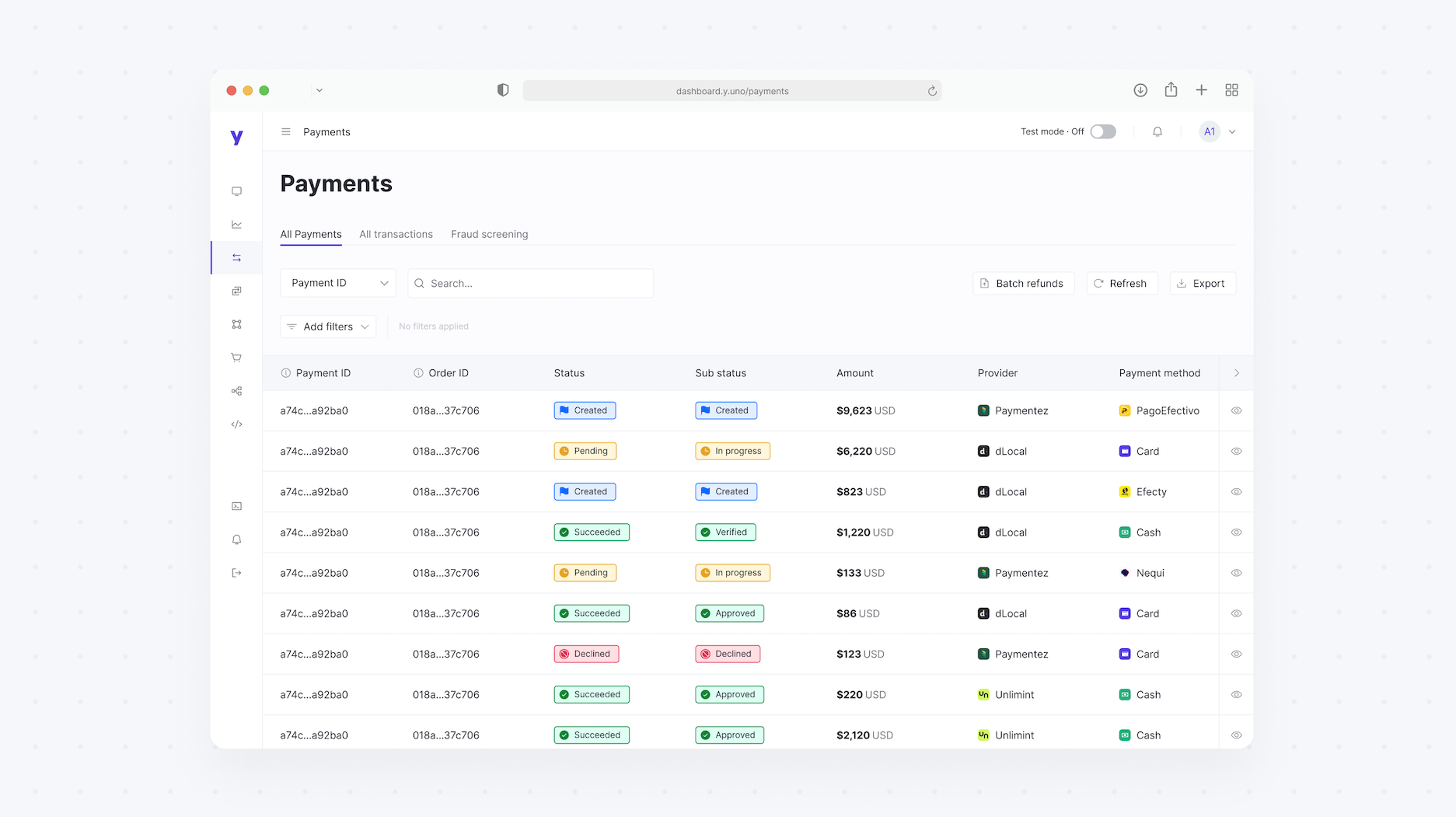

Paris-based Mistral AI, a startup working on open source large language models — the building block for generative AI services — has been raising money at a $6 billion valuation, three times its valuation in December, to compete more keenly against the likes of OpenAI and Anthropic, TechCrunch has learned from multiple sources. We understand from close sources that DST, along with General Catalyst and Lightspeed Venture Partners, are all looking to be a part of this round.

DST — a heavyweight investor led by Yuri Milner that has been a notable backer of some of the biggest names in technology, including Facebook, Twitter, Snapchat, Spotify, WhatsApp, Alibaba and ByteDance — is a new name that has not been previously reported; GC and LSVP are both previous backers and their names were reported earlier today also by WSJ. The round is set to be around, but less than, $600 million, sources told TechCrunch.

We can also confirm that one firm that has been mentioned a number of times — SoftBank — is not in the deal at the moment.

“SoftBank is not in the frame,” a person close to SoftBank told TechCrunch. That also lines up with what our sources have been telling us since March, when this round first opened up, although it seems that not everyone is on the same page: Multiple reports had linked SoftBank to a Mistral investment since then.

Mistral’s round is based on a lot of inbound interest, sources tell us, and it has been in the works since March or possibly earlier, mere months after Mistral closed a $415 million round at a $2 billion valuation.

Mistral, per PitchBook data, has some 36 current investors, with the list also including the likes of Andreessen Horowitz (which led that Series A in December), Redpoint, Headline, New Wave, Emerson Collective, French banking giants bpifrance and BNP Paribas, as well as a number of strategic backers including Databricks, Nvidia, Salesforce, Snowflake and most recently OpenAI’s biggest backer, Microsoft.

This latest fundraise has been the subject of a lot of speculation in the last few months (see here, here and here), but it’s been a moving target, with the investors, round size and valuation all changing. Some investors have looked and walked away, possibly due to the price.

“We love the company, and we love Arthur,” one prominent investor told me this week referring to Arthur Mensch, the CEO and co-founder. “We love how fast they’re moving, but we’re not talking.”

Mistral, unlike some of the other LLM builders like OpenAI and Anthropic, is focused on taking an open source approach to its work. It’s one of the youngest of the LLM players in the market, and notable also for being a major effort to come out of Europe (a “European champion,” as it’s sometimes called). Its French roots also tap into Paris as a notable hub for AI R&D, with Meta, Hugging Face, Photoroom, Nabla and many others building there.

What’s significant about Mistral AI raising at a $6 billion valuation (post money, sources have confirmed) is that the valuation has gone up from a $5 billion target in a matter of weeks.

Since Mistral launched its first LLM in September 2023, it has released two more. But it has not disclosed how many users it has nor what its revenues are looking like (it offers a range of prices to access its APIs, with pricing plans covering tokens for the three models it’s released to date, plus some customizations that Mistral has built).

All of this is to say that for now it’s not clear how closely investor interest is anchored to current business funnels versus hopeful projections for the future.

That points to a very heated market for the startup and for AI in general — despite the exit challenges that scaled-up, privately held technology companies are facing.

SoftBank side step

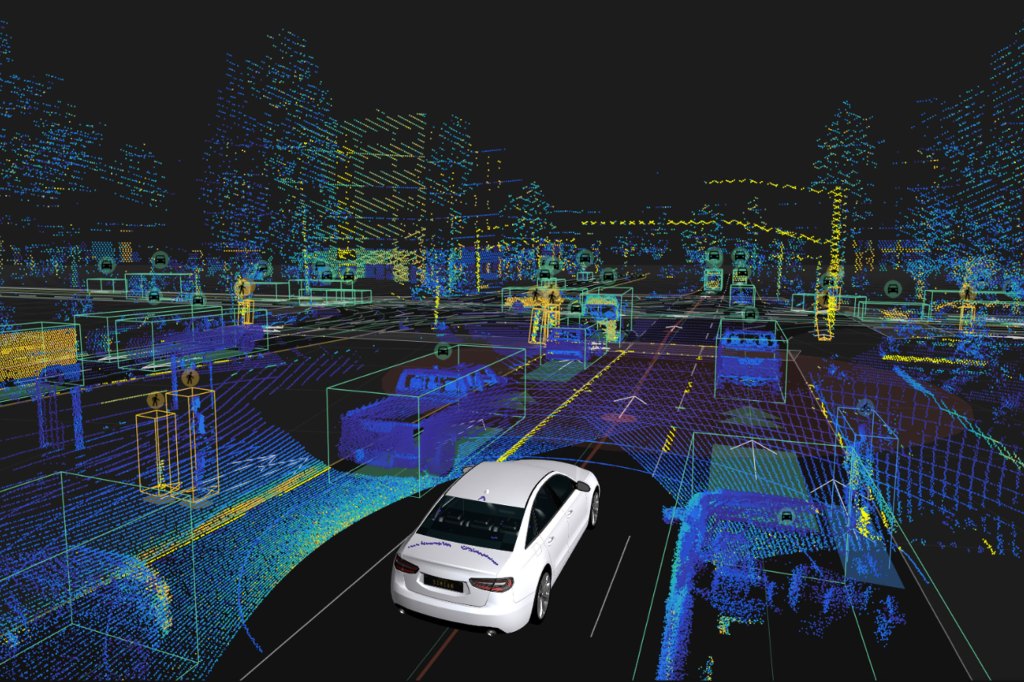

It is true that SoftBank is very keen to get into more AI deals, even if it’s not investing in Mistral (not now, anyway). On the back of a turnaround strong performance for the Vision Fund earlier this year, the firm is spinning up more AI activity. That has included slapping down hundreds of millions of dollars to lead a $1 billion funding round for Wayve earlier this week.

And sources close to Graphcore have confirmed to TechCrunch that SoftBank is indeed looking at possibly buying the troubled U.K. AI chip designer, too — confirming other reports from the last several months.

Graphcore’s backstory is one of AI clouds rather than silver linings and is emblematic of some of the problems that some later-stage startups are seeing right now. The chip design company spotted the opportunity for more efficient AI chips early on, and with some interesting IP in hand, it raised hundreds of millions of dollars over the years from investors like Sequoia, Microsoft, Dell Technologies and individuals like Greg Brockman and Ilya Sutskever of OpenAI, among many others.

But it’s in a market entirely dominated in sales and mindshare by a major player, Nvidia. Graphcore’s last fundraise, at a $2.8 billion valuation, was now more than three years ago, and it’s been inching closer to the end of its runway. That’s led to a lot of speculation about it selling for considerably less than that amount, potentially for as little as between $500 million and $600 million. We understand the startup has had better than expected revenues in the last several months, however, which has both extended its runway and possibly given it more options.

SoftBank would have also talked to Graphcore about investing, we understand from our source, so that might also be one outcome. “Stretching it” is how one investor described the rumors that SoftBank was anywhere close to a deal one way or the other.

But SoftBank does have a special place in its heart for chips. It still owns a giant chunk of Arm, and the firm has been working on a $100 billion fund just for AI chips alone. That spans more than just software: The company is indeed looking at getting involved with Graphcore, a U.K.-based AI chip designer.

Mistral declined to comment for this story. DST and General Catalyst have not responded to requests for comment. LightSpeed declined to comment on speculation. We’ll update as we learn more.