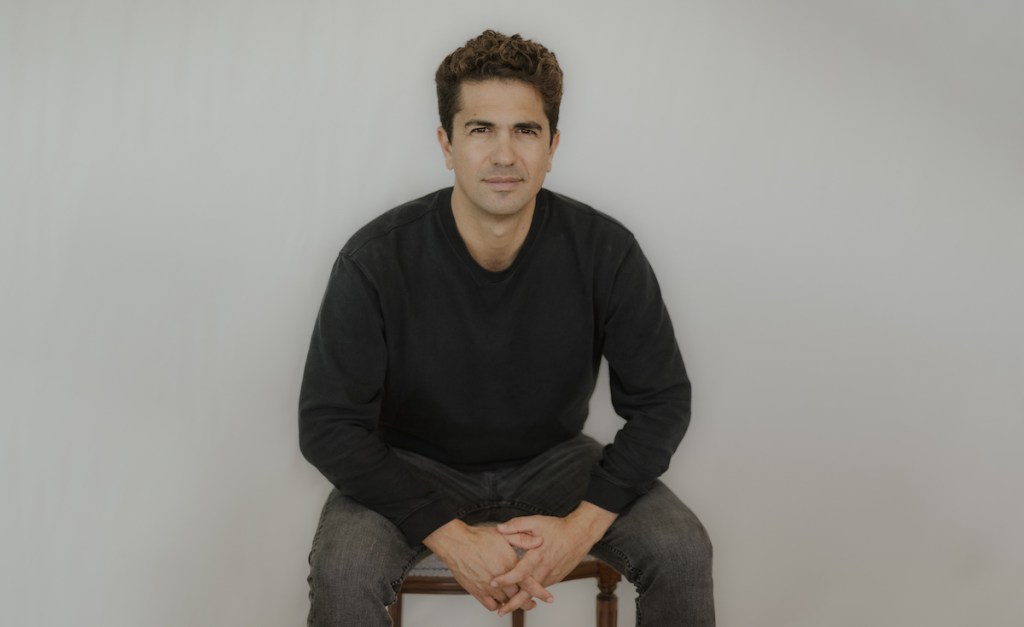

Some years after a shakeup at venture capital fund Kleiner Perkins, one of its star B2B investors, Ted Schlein, sort of left to start his own firm. Two years ago, he launched Ballistic Ventures with an inaugural $300 million fund, a laser focus on cybersecurity, an interesting business model and a who’s-who of co-founders as general partners.

Now Ballistic has already closed a second fund, even bigger than the first.

“We set out to raise a second $300 million fund and stopped at $360 million,” Schlein told TechCrunch.

The last few months involved many calls with prospective limited partners (LPs) who asked them about everything ranging from their backgrounds to “if you were a cat, what kind of cat would it be?” But they hit their goal surprisingly fast given the current VC bear market. Ballistic formally registered its plans for a second fund just four months ago, in November, TechCrunch was first to report.

Hands-on with their startups

In an age when some VCs say that being “founder-friendly” means keeping their VC claws out of operations, Ballistic has the polar opposite philosophy.

For instance, Founders Fund partner and Anduril co-founder Trae Stephens told the crowd at TechCrunch’s Strictly VC LA event in February: “The more that a VC says, ‘I’m going to add value,’ the more you should hear them say, ‘I’m going to annoy the ever-living crap out of you for the rest of the time that I’m on the cap table.’”

The Ballistic crew scoff at the thought. They always take board seats. They talk to their founders “many times a week,” Schlein says. Because all of them have run cybersecurity businesses — and they only invest in security — their secret sauce is their involvement coupled with their massive network of contacts, they say.

“I’ve been at this for almost 30 years, and I almost always helped deliver the first 10 customers to every company that I have ever been on the board of,” Schlein said.

General partner Jake Seid says that all of Ballistic’s crew works with all of their portfolio companies, routinely bringing in the first three to four million dollars of annual recurring revenue or helping hire their first engineers.

Seid cut his teeth at Cisco and startups, but is best known as an early Lightspeed partner and for his own StoneBridge Ventures firm. Ballistic general partners Roger Thornton and Barmak Meftah were leaders of threat-hunting exchange AlienVault when AT&T acquired it. The Ballistic co-founding team also includes Kevin Mandia, the former CEO of Mandiant, which sold to Google in 2022.

Schlein only makes new investments from Ballistic’s fund but remains a partner at Kleiner, overseeing his previous investments/board seats and retaining his “carry” — the percent of profits — if these startups do well.

Early success

Two years in, Ballistic’s methods appear to be working so far. Although they haven’t even fully deployed their first fund, they’ve already had one successful exit of portfolio company Talon Cyber Security, bought by Palo Alto Networks in a deal valued at at $625 million, TechCrunch reported.

It’s impossible to know how many more successes they will have. But because Ballistic only invests in early startups where it can be the first institutional money on the cap table and takes a board seat, they have more control than other VCs have.

This helps them, for instance, protect their investments from terms from later investors that could hurt them, such as “liquidation preferences” that would give another investor priority to the cash from an acquisition.

And Ballistic incubates startup ideas internally, finding people to build and run their ideas. There are two such startups in stealth from Fund 1 at the moment, the partners say.

Ballistic expects to wrap up investing out of Fund 1 after, perhaps, two more startups, bringing its total Fund 1 portfolio to around 20 companies, and to begin investing out of the second fund in another two months, Seid said.