Trending News

16 October, 2024

6.28°C New York

Construction companies deal with a lot of documents — so many that it can be difficult to process and manage them all. According to one recent survey, a third of construction professionals found accessing documents to be a challenge in completing a project, while a fourth said that inaccurate project paperwork has contributed to a construction delay.

Sarah Buchner knows this well. Originally a carpenter, she founded a startup, Trunk Tools, that provides automation tools to organize unstructured construction documentation.

“I grew up in a poor environment in a small village in Austria and started working as a carpenter at age 12,” Buchner told TechCrunch. “After many years in carpentry, I switched over to the general contractor side and worked my way up from superintendent to project manager to group leader. My PhD research made me realize that I could have a greater impact on my field by developing disruptive construction technology, and this inspired me to move across the world to Silicon Valley to attend Stanford and get my MBA.”

Trunk Tools’ platform can take in files like PDFs, spreadsheets, drawings, blueprints and tables and answer questions about them in a chatbot-like interface (e.g. “What type of power outlets are in the art studio?”). Trunk Tools can also “link” scheduled construction activities with supporting documentation, attempting to spot potential project issues and surface insights.

“Traditional construction software, like Procore, is centered around documenting workflows and storing data within a predefined system,” Buchner said. “In contrast, we’re introducing a paradigm shift where Q&A and AI enable construction teams to interact with information using natural language.”

Buchner says that for one customer’s $500 million high-rise condo in NYC, there were 3.6 million pages of documentation. Given the amount of time it takes to sort through file folders that massive, it’s not exactly surprising that construction industry workers loathe paperwork.

A poll by Dodge Data and Viewpoint, a construction accounting software vendor, found that only 28% of contractors were okay using paper processes, while just 47% said they were satisfied with spreadsheets. Seventy-nine percent of respondents to the poll expressed a willingness to adopt construction management tooling.

“If printed and stacked, the 3.6 million pages would be 3x the height of the building itself,” Buchner said. “It would take a human 50 years to read — it takes Trunk Tools seconds to structure and give insights.”

Occupying a construction software market that could be worth $7.5 billion by 2032, Trunk Tools competes with vendors like Briq (which uses AI to automate construction financial processes), Join (a “decision-making” platform for construction) and PlanRadar (which digitizes construction and real estate docs).

Trunk Tools appears to be holding its own, however, with a “double digit” number of construction industry customers and thousands of users. Buchner says that the company is targeting a 4x revenue to burn rate ratio.

To help get it there, Trunk Tools this month closed a $20 million Series A funding round led by Redpoint. Bringing the company’s total raised to $30 million, the new cash will be put toward growing Trunk Tools’ 30-person, New York-based team as well as developing new services like Trunk’s recently launched construction worker incentive program, Buchner says.

“Construction technology so far has focused mainly on digitizing — taking what we used to do on paper and doing it on computers,” Buchner said. “Slipped timelines and rework can completely crush the razor-thin margins of construction projects, and Trunk Tools can alleviate both.”

ContributorDan Allred is Liquidity Group’s North America CEO. Allred is a fintech professional and spent two decades at Silicon Valley Bank (SVB), most recently as a Senior Market Manager and Head of the National Fintech practice. He is also a member of the board of directors for FS Vector and an adviser for Modern Treasury.

When should you hire a CFO?

Startup founders wear a lot of hats. They have to build, they have to hire, and they have to inspire. They have to test, confirm, and pivot.

And they have to manage their finances.

When it comes to startup finances, things can get hairy quickly. But when is the right time to hire a CFO, and is a full-time CFO even necessary in this age of C-level-as-a-service?

I’ve worked with founders and chief financial officers for my entire career. The skill sets needed for each job are completely different, but their complementary personas can be exactly what drives a company forward. I also asked a few experienced financial operators and CEOs for advice on this crucial question.

CFOs are responsible for managing cash flow, overseeing financial planning, and managing regulatory compliance. This ensures that the business has enough liquidity to support its operations and growth. They also play a vital role in financial planning, guiding the company’s strategic financial decisions and guaranteeing compliance with relevant regulations.

It is common for founders to think narrowly about accounting when considering whether to hire a CFO. Instead, they should think about the finance function more broadly. Sure, clean books and financial controls matter, but a true financial executive brings a lot more than just good housekeeping on that front. An experienced CFO is going to look at the business from the perspective of allocating resources and optimizing capital.

For instance, a good CFO will be able to plan for and secure different types of capital (i.e., loans, leases, etc.) and align cost to return, keeping the company’s more dilutive and expensive venture capital free for product development, team building, and market expansion. This, in turn, will drive even more ROI (return on investment).

Startup coach and CFO Evgeny Popov said that hiring a CFO was a no-brainer, akin to finding a CTO for your tech company.

“CFO is a crucial role for every business no matter how large it is, especially in the case of a tech startup aiming to expand,” he said. “Unfortunately, hiring a CFO is not an obvious move for founders because most founders come from the product or tech worlds and don’t see the CFO as vital to growth.”

They’re wrong, said Popov. He also recommends looking at CFO services before giving up equity to a dedicated C-level executive.

“I support the position that at an early stage, you can use a part-time CFO — but not an accountant. Later, when funding changes and operations change, the company absolutely must have a full-time CFO on board,” he said.

Let’s get the biggest question out of the way first: Do you need a full-time or fractional CFO?

During my time working with venture-backed tech companies, I have seen the timeline for hiring a CFO shift later and later, partly because there are so many contract-based and outsourced CFOs in the market and partly because of increased efficiency in managing finance and accounting via tools from fintechs and services from other providers.

These tools are getting better, and with the addition of generative AI in the mix, you can get away without a CFO well into the Series A round. That said, every business is different, just as every fractional CFO is different. Finding the right fractional CFO who is capable, competent, and hardworking is surprisingly difficult. When you find the right one, however, it’s like striking gold. I recommend finding a freelance CFO and then offering them a full-time position when the time is right.

“Most companies that are still finding product-market fit don’t need a full-time CFO,” said the founder of Sudozi, Rose Punkunus. “That being said, you can get a good CFO who is part-time, but by the nature of only spending part of their time on the business, you won’t get the full value of that person.”

In other words, having a part-time CFO works until it doesn’t.

“The moment you decide to raise or plan an IPO, you suddenly realize you need to fill out a lot of paperwork,” said Oleg Tsarev, VP of engineering for Truvity. “That’s where the dedicated CFO comes in.”

Remember that the time needed to prepare for a fundraising event is longer than you realize. CFOs are very good at putting themselves in the mindset of the bankers and investors who drive fundraising events. They know what “money people” want to see and how they want to see it. That said, professionalizing financials, pipelines, forecasts, projections, and pitch decks takes time, so err on the side of getting a CFO engaged early so they know your story and can start to make it their own before you need to do a fundraising roadshow.

“In addition to the paperwork, you quickly realize that you need a CFO to fix your finances, change your working processes, and maintain your budgeting procedures,” said Tsarev. “Without a CFO, there’s no way to IPO. Having a good CFO from the beginning will help you to be prepared for this future.”

“Exactly when a company requires a CFO is dependent on several factors, including revenue size, growth rate, and complexity of the organization and its financial model,” said Ed Goldfinger, who runs a CFO coaching and consulting practice. “In the fast-growing tech world where I come from, you’re pushing it if you don’t have a CFO in place by about $15–20 million in revenue. Can you get by? Perhaps, but the money and equity you will save by delaying the hire of a CFO at this point will be far outweighed by the economic inefficiencies and risks you expose the business to by not establishing the decision frameworks, systems, operational controls, and measurement disciplines needed to scale effectively.”

Signs that indicate a need for a CFO in your startup include unmanageable finances, a lack of experienced business perspective, and a struggle to allocate investment funds effectively. Situations such as rapid revenue growth, budget increases, and high growth expectations also signal the need for a CFO. It is essential to hire a CFO based on annual revenue thresholds, budget increases, and growth expectations to ensure effective financial management.

In addition to the growth drivers discussed above, certain types of businesses demand CFO attention sooner rather than later. These tend to be businesses with either complex business models or those reliant on multiple sources and types of capital. Business model complexity often comes when a business is touching customer funds in some way — think marketplaces and other businesses where funds are flowing through your books and your company is taking a piece of that value as its revenue.

Processes and controls are important in these businesses, as is understanding how your company’s enterprise value derives from the gross transaction volume relative to the net revenue and other factors as well. As for multiple sources and types of capital, this often comes into play with fintech and asset-heavy tech businesses where debt and other forms of nondilutive financing make up a significant part of the capital stack.

Ask yourself a few essential questions to determine when to hire a CFO, such as the ability to work with future planning models, handle tax and other compliance issues, secure funding, and understand and explain financial statements. These considerations will help you assess whether your startup is ready for the expertise and guidance a CFO provides in managing finances, optimizing investments, and ensuring fiscal responsibility. If your startup is experiencing rapid growth, struggling with financial management, or facing complex investment decisions, it may be time to consider hiring a CFO to navigate these challenges effectively.

It’s easy to focus on the functional value of the CFO, but they also bring lots of value as a teammate, especially to the CEO. Of course, the CFO is going to lead in areas like budgeting, planning, allocating financial resources, etc., but the CFO often plays a trusted adviser role to the CEO. It is a lonely job being a CEO, as many founders quickly learn. The CFO typically brings pattern recognition and an ROI-oriented perspective that most BOD members also have. On top of that, CFOs have been conditioned to keep conversations confidential because of the types of projects and initiatives for which they are responsible. All of this adds up to being the perfect sounding board for the CEO. Founders should keep this in mind as they consider when to hire a CFO, as they often get a lot more out of it than just the financial expertise.

“CEOs should be expansive in their thinking about the market opportunity and the company’s vision — they should allow themselves to dream about the possibilities,” said Goldfinger. “And they should have strong CFOs as strategic partners to help translate those visions into financially viable and valuable realities. The relationship between the CEO and CFO is, for this reason, absolutely critical. It needs to be built on a rock-solid foundation of trust and allow for healthy debate.”

For the most part, the fractional CFO solution is a great one but temporary. Just be honest with yourself about when you and your business need to bring on a CFO full-time. Consider it another successful milestone on the long and winding road to success.

Contributor

Dan Allred is Liquidity Group’s North America CEO. Allred is a fintech professional and spent two decades at Silicon Valley Bank (SVB), most recently as a Senior Market Manager and Head of the National Fintech practice. He is also a member of the board of directors for FS Vector and an adviser for Modern Treasury.

When should you hire a CFO?

Startup founders wear a lot of hats. They have to build, they have to hire, and they have to inspire. They have to test, confirm, and pivot.

And they have to manage their finances.

When it comes to startup finances, things can get hairy quickly. But when is the right time to hire a CFO, and is a full-time CFO even necessary in this age of C-level-as-a-service?

I’ve worked with founders and chief financial officers for my entire career. The skill sets needed for each job are completely different, but their complementary personas can be exactly what drives a company forward. I also asked a few experienced financial operators and CEOs for advice on this crucial question.

CFOs are responsible for managing cash flow, overseeing financial planning, and managing regulatory compliance. This ensures that the business has enough liquidity to support its operations and growth. They also play a vital role in financial planning, guiding the company’s strategic financial decisions and guaranteeing compliance with relevant regulations.

It is common for founders to think narrowly about accounting when considering whether to hire a CFO. Instead, they should think about the finance function more broadly. Sure, clean books and financial controls matter, but a true financial executive brings a lot more than just good housekeeping on that front. An experienced CFO is going to look at the business from the perspective of allocating resources and optimizing capital.

For instance, a good CFO will be able to plan for and secure different types of capital (i.e., loans, leases, etc.) and align cost to return, keeping the company’s more dilutive and expensive venture capital free for product development, team building, and market expansion. This, in turn, will drive even more ROI (return on investment).

Startup coach and CFO Evgeny Popov said that hiring a CFO was a no-brainer, akin to finding a CTO for your tech company.

“CFO is a crucial role for every business no matter how large it is, especially in the case of a tech startup aiming to expand,” he said. “Unfortunately, hiring a CFO is not an obvious move for founders because most founders come from the product or tech worlds and don’t see the CFO as vital to growth.”

They’re wrong, said Popov. He also recommends looking at CFO services before giving up equity to a dedicated C-level executive.

“I support the position that at an early stage, you can use a part-time CFO — but not an accountant. Later, when funding changes and operations change, the company absolutely must have a full-time CFO on board,” he said.

Let’s get the biggest question out of the way first: Do you need a full-time or fractional CFO?

During my time working with venture-backed tech companies, I have seen the timeline for hiring a CFO shift later and later, partly because there are so many contract-based and outsourced CFOs in the market and partly because of increased efficiency in managing finance and accounting via tools from fintechs and services from other providers.

These tools are getting better, and with the addition of generative AI in the mix, you can get away without a CFO well into the Series A round. That said, every business is different, just as every fractional CFO is different. Finding the right fractional CFO who is capable, competent, and hardworking is surprisingly difficult. When you find the right one, however, it’s like striking gold. I recommend finding a freelance CFO and then offering them a full-time position when the time is right.

“Most companies that are still finding product-market fit don’t need a full-time CFO,” said the founder of Sudozi, Rose Punkunus. “That being said, you can get a good CFO who is part-time, but by the nature of only spending part of their time on the business, you won’t get the full value of that person.”

In other words, having a part-time CFO works until it doesn’t.

“The moment you decide to raise or plan an IPO, you suddenly realize you need to fill out a lot of paperwork,” said Oleg Tsarev, VP of engineering for Truvity. “That’s where the dedicated CFO comes in.”

Remember that the time needed to prepare for a fundraising event is longer than you realize. CFOs are very good at putting themselves in the mindset of the bankers and investors who drive fundraising events. They know what “money people” want to see and how they want to see it. That said, professionalizing financials, pipelines, forecasts, projections, and pitch decks takes time, so err on the side of getting a CFO engaged early so they know your story and can start to make it their own before you need to do a fundraising roadshow.

“In addition to the paperwork, you quickly realize that you need a CFO to fix your finances, change your working processes, and maintain your budgeting procedures,” said Tsarev. “Without a CFO, there’s no way to IPO. Having a good CFO from the beginning will help you to be prepared for this future.”

“Exactly when a company requires a CFO is dependent on several factors, including revenue size, growth rate, and complexity of the organization and its financial model,” said Ed Goldfinger, who runs a CFO coaching and consulting practice. “In the fast-growing tech world where I come from, you’re pushing it if you don’t have a CFO in place by about $15–20 million in revenue. Can you get by? Perhaps, but the money and equity you will save by delaying the hire of a CFO at this point will be far outweighed by the economic inefficiencies and risks you expose the business to by not establishing the decision frameworks, systems, operational controls, and measurement disciplines needed to scale effectively.”

Signs that indicate a need for a CFO in your startup include unmanageable finances, a lack of experienced business perspective, and a struggle to allocate investment funds effectively. Situations such as rapid revenue growth, budget increases, and high growth expectations also signal the need for a CFO. It is essential to hire a CFO based on annual revenue thresholds, budget increases, and growth expectations to ensure effective financial management.

In addition to the growth drivers discussed above, certain types of businesses demand CFO attention sooner rather than later. These tend to be businesses with either complex business models or those reliant on multiple sources and types of capital. Business model complexity often comes when a business is touching customer funds in some way — think marketplaces and other businesses where funds are flowing through your books and your company is taking a piece of that value as its revenue.

Processes and controls are important in these businesses, as is understanding how your company’s enterprise value derives from the gross transaction volume relative to the net revenue and other factors as well. As for multiple sources and types of capital, this often comes into play with fintech and asset-heavy tech businesses where debt and other forms of nondilutive financing make up a significant part of the capital stack.

Ask yourself a few essential questions to determine when to hire a CFO, such as the ability to work with future planning models, handle tax and other compliance issues, secure funding, and understand and explain financial statements. These considerations will help you assess whether your startup is ready for the expertise and guidance a CFO provides in managing finances, optimizing investments, and ensuring fiscal responsibility. If your startup is experiencing rapid growth, struggling with financial management, or facing complex investment decisions, it may be time to consider hiring a CFO to navigate these challenges effectively.

It’s easy to focus on the functional value of the CFO, but they also bring lots of value as a teammate, especially to the CEO. Of course, the CFO is going to lead in areas like budgeting, planning, allocating financial resources, etc., but the CFO often plays a trusted adviser role to the CEO. It is a lonely job being a CEO, as many founders quickly learn. The CFO typically brings pattern recognition and an ROI-oriented perspective that most BOD members also have. On top of that, CFOs have been conditioned to keep conversations confidential because of the types of projects and initiatives for which they are responsible. All of this adds up to being the perfect sounding board for the CEO. Founders should keep this in mind as they consider when to hire a CFO, as they often get a lot more out of it than just the financial expertise.

“CEOs should be expansive in their thinking about the market opportunity and the company’s vision — they should allow themselves to dream about the possibilities,” said Goldfinger. “And they should have strong CFOs as strategic partners to help translate those visions into financially viable and valuable realities. The relationship between the CEO and CFO is, for this reason, absolutely critical. It needs to be built on a rock-solid foundation of trust and allow for healthy debate.”

For the most part, the fractional CFO solution is a great one but temporary. Just be honest with yourself about when you and your business need to bring on a CFO full-time. Consider it another successful milestone on the long and winding road to success.

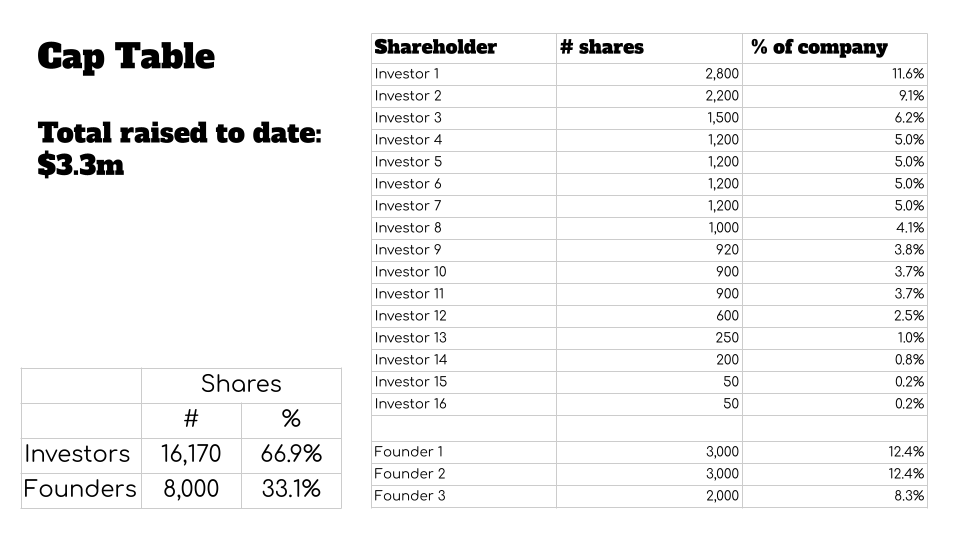

The CEO of a Norwegian hardware startup shared a pitch deck with me that had an unusual slide: It included the company’s capitalization table — the breakdown of who owns what part of the company. Typically, cap tables are shared in the diligence phase of investing.

Taking a closer look at the table, something is significantly amiss:

The problem here is that the company has given up more than two-thirds of its equity to raise $3.3 million. With the company starting a $5 million fundraising round, that represents a serious hurdle.

TechCrunch spoke to a number of Silicon Valley investors, posing the hypothetical of whether they would invest in a founder who presented a cap table with similar dynamics as the one shown above. What we learned is that the cap table as it stands today essentially makes the company uninvestable, but that there is still hope.

In less sophisticated startup ecosystems, investors can be tempted to make short-sighted decisions, such as trying to take as much as 30% of a company’s equity in a relatively small funding round. If you’re not familiar with how startups work in the long run, that can seem like a sensible goal: Isn’t it an investor’s job to get as much as they can for the money they invested? Perhaps, yes, but hidden within that dynamic is a de facto poison pill that can limit how large a startup can possibly get. At some point, a company’s founders have so little equity left, that the cost/benefit analysis of the grueling death-march that is running a startup starts shifting against them continuing to give it their all.

“This cap table has one giant red flag: The investor base owns twice as much as the three founders combined do,” said Leslie Feinzaig, general partner at Graham & Walker. “I want founders to have a lot of skin in the game. The best founders have a very high earning potential — I want it to be unquestionably worth their time to keep going for many years after my investment in them … I want the incentives to be completely aligned from the get go.”

Feinzaig said that this company, as it stands, is “essentially uninvestable,” unless a new lead comes in and fixes the cap table. Of course, that, in itself, is a high-risk move that is going to take a lot of time, energy, money and lawyers.

“Fixing the cap table would mean cramming down existing investors and returning ownership to the founders,” Feinzaig said. “That is an aggressive move, and not many new investors are going to be willing to go to those lengths. If this is the next OpenAI, they have a fair shot at finding a lead who will help clean this up. But at the seed stage, it is brutally hard to stand out so clearly, let alone in the current VC market.”

With unmotivated founders, the company would potentially exit sooner than it might have otherwise. For those of us who live and breathe venture capital business models, that’s a bad sign: It leads to mediocre outcomes for startup founders, which limits the amount of angel investing they will be able to do, taking the entry-level funding out of the startup ecosystem.

Such an early exit would also limit potential upsides for the VCs. A company that exits later at a far higher valuation increases the chance of a huge, 100x fund-returning outcome from a single investment. That, in turn, means that the limited partners (i.e. the folks who invest in VC firms) see reduced returns. Over time, the LPs will get bored of that; the whole point of VC as an asset class is incredibly high risk, for the potential of ludicrously good returns. When the LPs go elsewhere for their high-risk investments, the entire startup ecosystem collapses due to lack of funds.

“We definitely want to try and keep seed and Series A cap tables looking ‘normal,’” Hunter Walk, general partner at Homebrew, told TechCrunch. “Typically investors own a minority of the company in total, the founders still have healthy ownership, which they’re vesting into, and the company/team/pool has the rest of the common [stock].”

I asked the CEO and founder of the hardware company in question how the company got itself into this mess. He asked to remain anonymous so as not to endanger the company or leave his investors in a bad spot. He explains that the team had a bunch of large-company experience but lacked experience in the startup world. That means they didn’t know how much work it would take to get the product to market. Internally, he said that the company accepted the terms “just for this round,” and will pursue a higher valuation for the next round. Of course, as the company kept running into delays and issues, the investors ran a hard bargain, and facing the choice of running out of money or taking a bad deal, the company decided to take the bad deal.

The CEO says the company is building a solution for a problem experienced by 1.7 billion people, and that the company has a novel, patent-pending product that it has been successfully testing for six months. On the face of it, it looks like a company with multibillion-dollar potential.

The current plan is for the company to raise the current $5 million round, and then make an attempt at correcting its cap table later. That’s a good idea in theory, but the startup has ambitions of raising from international investors who are going to have some opinions on the cap table itself. And that may raise questions about the founders themselves.

“Situations like these which deserve ‘clean up’ certainly aren’t automatic ‘passes’ but they require the company and cap table to be comfortable with some restructuring in order to fix the incentive structure alongside the financing,” Walk said. “If we feel like it’s going to be near impossible to reconcile (even if we play the ‘bad guy’ on behalf of the founders), we’ll often advise the CEO to solve it before raising more capital.”

Mary Grove from Bread & Butter Ventures agrees that it’s a red flag if founders own so little of their company at the seed stage — and in particular that the investors own the other 66%, rather than some of the equity having gone to key hires.

“We’d want to understand the reasons behind why the company has taken such dilution this early. Is it because they are based in a geography with limited access to capital and some early investors — either not experienced with VC or bad actors — took advantage?,” Grove told TechCrunch. “Or is there an underlying reason with the business that made it really hard to raise capital (take a look through revenue growth/churn, did the company make a major pivot that made it essentially start from scratch, was there some litigation or other challenge)? Depending on the reason, we could get behind finding a path forward if the business and team met our filter for investment and we believe it is the right partnership.”

Grove said that Bread & Butter Ventures likes to see the founders own a combined 50-75% at this stage of the company — the inverse of what we see in our above reproduction — citing that this ensures alignment of interest and that founders are given recognition and incentive to build for the distance ahead for a venture-backed company. She suggests that her firm might have a term sheet that includes corrective measures.

“We would request that the founders receive additional option grants to bring their ownership up to the combined 50-75% prior to us leading or investing in the new round,” Grove says, but she points out the challenge in this: “This does mean existing investors on the cap table would also share in the overall dilution to make this reset happen, so if everyone is onboard with the plan, we’d hope to be all aligned on the path forward to support the founders and ensure they have ownership to execute their big vision and to take the company through to a big exit.”

Ultimately, the overall risk picture depends on the specifics of the company, and depends on how capital-intensive the business will be in the future. If one more raise could get the company to cash-flow neutral, with healthy organic growth from there, that’s one thing. If this is a type of business that will continue to be capital-intensive and will require multiple rounds of significant funding, that changes the risk profile further.

The CEO told me that the company’s first investor was a Norwegian corporate, which sometimes spins out its own companies based on technology innovations it has developed. In the case of this company, however, it made an external investment at what the founder now describes as “below-market terms.” The CEO also mentioned that existing investors on its board suggested raising money at low valuations. Today, he harbors regrets, understanding that the choices might put the company’s long-term success in jeopardy. He said he suspected that VCs wouldn’t think his company was investable, and making sure that this issue was front and center for future investors is why he put the cap table as a slide in the slide deck in the first place.

The problem may not be isolated to this one founder. In many developing startup ecosystems — such as Norway’s — good advice can be hard to come by, and the “norms” are sometimes decided by people who don’t always understand how the venture model looks elsewhere.

“I don’t want to alienate my investors; they do a lot of good things as well,” the CEO said.

Walk says that bad actors are, unfortunately, not as rare as he’d like, and that Homebrew often comes across situations where an incubator or accelerator owns 10% or more on “exploitive terms,” or where greater than 50% of the company already sold to investors, or where a large portion of the shares are allocated to fully vested founders who might no longer be with the company.

The upshot could be if non-local investors want to invest in early-stage companies in developing ecosystems, they have an incredible opportunity: By offering more reasonable terms to promising early-stage startups than the local investors are willing to give, they can pick the best investments and leave the local investors to fight over the scraps. But the obvious downside is that this would represent a tremendous financial drain from the ecosystem: Instead of keeping the money in the country, the wealth (and, potentially, the talent) goes overseas, which is precisely the kind of thing the local ecosystem is trying to avoid.

If you have news tips or information for Haje, you can share it with him over email or Signal.

Cyberattacks, regional conflict, weapons of mass destruction, terrorism, commercial spyware, AI, misinformation, disinformation, deepfakes and TikTok. These are just some of the top perceived threats that the United States faces, according to the U.S. government’s intelligence agency’s latest global risk assessment.

The unclassified report published Monday — sanitized for public release — gave a frank annual window into the U.S. intelligence community’s collective hive mind about the threats it sees facing the U.S. homeland based on its massive banks of gathered intelligence. Now in an election year, the top U.S. spies increasingly cite emerging technology and cybersecurity as playing a factor in assessing its national security posture.

In an unclassified session with the Senate Intelligence Committee on Monday, the top leaders across the U.S. government’s intelligence agencies — including the FBI, NSA, CIA and others — testified to lawmakers largely to answer their questions about the current state of global affairs.

Here’s what we learned from the hearing.

In the last few years, the U.S. government turned its attention to the government spyware industry, currently made of companies like NSO Group and Intellexa, and previously Hacking Team and FinFisher. In its annual report, the intelligence community wrote that, “from 2011 to 2023, at least 74 countries contracted with private companies to obtain commercial spyware, which governments are increasingly using to target dissidents and journalists.”

The report does not clarify where the intelligence community got that number, and the Office of the Director of National Intelligence did not respond to a request for comment asking to clarify.

But last year, the Carnegie Endowment for International Peace, a Washington, D.C. think-tank, released a report on the global spyware industry that included the same number of countries as well as the same dates as the new intelligence community report. The Carnegie report, written by Steven Feldstein and Brian Kot, referenced data that the two collected, which they said came from sources such as digital rights groups and security researchers that have studied the spyware industry like Citizen Lab, the Electronic Frontier Foundation and Privacy International, as well as news reports.

It’s important to note that the Carnegie dataset, as the authors explained last year, includes what we refer to as government or commercial spyware, meaning tools to remotely hack and surveil targets remotely, such as those that NSO and Intellexa make. But it also includes digital forensic software used to extract data from phones and computers that are physically in the possession of the authorities. Two of the most well-known makers of this type of tools are Cellebrite and Grayshift, both of which are widely used in the United States as well as in other countries.

The U.S. says ransomware is an ongoing risk to U.S. public services and critical infrastructure because cybercriminals associated with ransomware are “improving their attacks, extorting funds, disrupting critical services, and exposing sensitive data.”

Ransomware has become a global problem, with hacking gangs extorting companies in some cases millions of dollars in ransom payments to get their stolen files back. Some cybersecurity experts have called on governments to outright ban ransom payments as necessary to stop hackers profiteering from cybercrime.

But the U.S. has shunned that view and takes a different approach, opting to systematically disrupt, dismantle and sanction some of the worst offenders, who are based in Russia and outside of the reach of U.S. justice.

“Absent cooperative law enforcement from Russia or other countries that provide cyber criminals a safe haven or permissive environment, mitigation efforts will remain limited,” the threat assessment reads. In other words, until Russia — and a few other hostile states — give up their criminals, expect ransomware to continue to be the modern-day snow day.

The use of generative AI in digital influence operations isn’t new, but the wide availability of AI tools is lowering the bar for malicious actors engaging in online influence operations, like election interference and generating deepfakes.

The rise of detailed and convincing deepfake imagery and video is playing its role in information warfare by deliberately sowing confusion and discord, citing Russia’s use of deepfake imagery against Ukraine on the battlefield.

“Russia’s influence actors have adapted their efforts to better hide their hand, and may use new technologies, such as generative AI, to improve their capabilities and reach into Western audiences,” warned the report.

This was something echoed by NSA cybersecurity director Rob Joyce earlier in January about how foreign hackers are using chatbot tools to generate more convincing phishing emails, but that AI is also useful for digital defense.

The report also noted that China is increasingly experimenting with generative AI, noting that TikTok accounts run by a Chinese military propaganda arm “reportedly targeted candidates from both political parties during the U.S. midterm election cycle in 2022.”

U.S. spy agencies have caught on to a popular practice: Why get a warrant for data when they can just buy it online? Given how much data we share from our phone apps (which many don’t give a second thought), U.S. spy agencies are simply buying up vast troves of Americans’ commercially available location data and internet traffic from the data brokers.

How is that legal? After a brief exchange with the head of the Defense Intelligence Agency — one of the agencies confirmed to have bought access to a database containing Americans’ location data — Sen. Ron Wyden noted that the practice was allowed because there is no constitutional or statutory limit on buying commercially available data.

In other words, U.S. spy agencies can keep buying data on Americans that is readily available for purchase until Congress puts a stop to the practice — even if the root of the problem is that data brokers shouldn’t have our data to begin with.

Read more on TechCrunch:

A government watchdog hacked a US federal agency to stress-test its cloud securityUS sanctions founder of spyware maker Intellexa for targeting AmericansNSA says it’s tracking Ivanti cyberattacks as hackers hit US defense sectorShould we ban ransom payments?

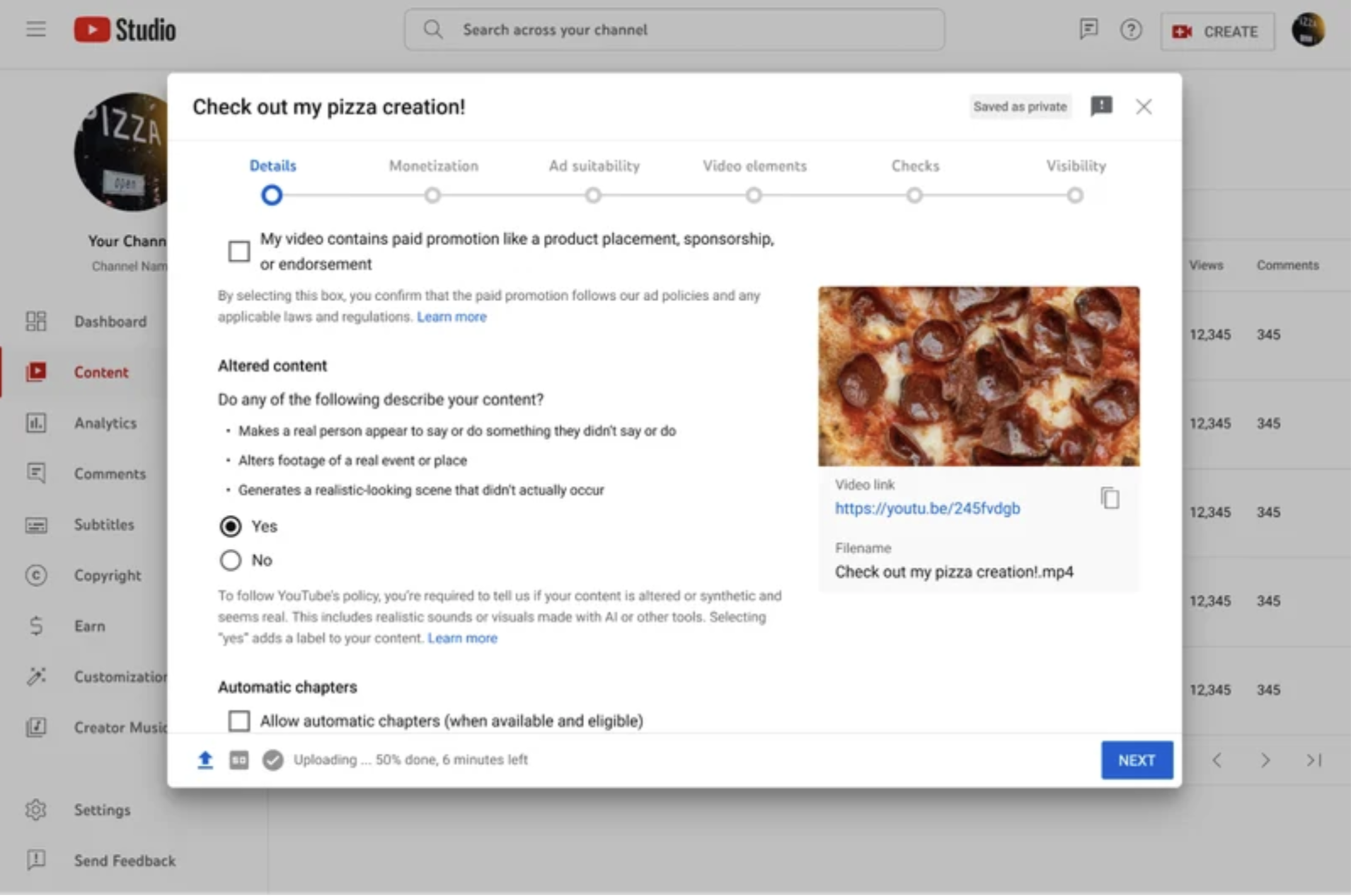

YouTube is now requiring creators to disclose to viewers when realistic content was made with AI, the company announced on Monday. The platform is introducing a new tool in Creator Studio that will require creators to disclose when content that viewers could mistake for a real person, place or event was created with altered or synthetic media, including generative AI.

The new disclosures are meant to prevent users from being duped into believing that a synthetically created video is real, as new generative AI tools are making it harder to differentiate between what’s real and what’s fake. The launch comes as experts have warned that AI and deepfakes will pose a notable risk during the upcoming U.S. presidential election.

Today’s announcement comes as YouTube announced back in November that it was going to roll out the update as part of a larger introduction of new AI policies.

YouTube says the new policy doesn’t require creators to disclose content that is clearly unrealistic or animated, such as someone riding a unicorn through a fantastical world. It also isn’t requiring creators to disclose content that used generative AI for production assistance, like generating scripts or automatic captions.

Instead, YouTube is targeting videos that use the likeness of a realistic person. For instance, creators will have to disclose when they have digitally altered content to “replace the face of one individual with another’s or synthetically generating a person’s voice to narrate a video,” YouTube says.

They will also have to disclose content that alters the footage of real events or places, such as making it seem as though a real building caught on fire. Creators will also have to disclose when they have generated realistic scenes of fictional major events, like a tornado moving toward a real town.

YouTube says that most videos will have a label appear in the expanded description, but for videos that touch on more sensitive topics like health or news, the company will display a more prominent label on the video itself.

Viewers will start to see the labels across all YouTube formats in the coming weeks, starting with the YouTube mobile app, and soon on desktop and TV.

YouTube plans to consider enforcement measures for creators who consistently choose not to use the labels. The company says that it will add labels in some cases when a creator hasn’t added one themselves, especially if the content has the potential to confuse or mislead people.

YouTube adapts its policies for the coming surge of AI videos

Keeping up with an industry as fast-moving as AI is a tall order. So until an AI can do it for you, here’s a handy roundup of recent stories in the world of machine learning, along with notable research and experiments we didn’t cover on their own.

This week, Meta released the latest in its Llama series of generative AI models: Llama 3 8B and Llama 3 70B. Capable of analyzing and writing text, the models are “open sourced,” Meta said — intended to be a “foundational piece” of systems that developers design with their unique goals in mind.

“We believe these are the best open source models of their class, period,” Meta wrote in a blog post. “We are embracing the open source ethos of releasing early and often.”

There’s only one problem: The Llama 3 models aren’t really open source, at least not in the strictest definition.

Open source implies that developers can use the models how they choose, unfettered. But in the case of Llama 3 — as with Llama 2 — Meta has imposed certain licensing restrictions. For example, Llama models can’t be used to train other models. And app developers with over 700 million monthly users must request a special license from Meta.

Debates over the definition of open source aren’t new. But as companies in the AI space play fast and loose with the term, it’s injecting fuel into long-running philosophical arguments.

Last August, a study co-authored by researchers at Carnegie Mellon, the AI Now Institute and the Signal Foundation found that many AI models branded as “open source” come with big catches — not just Llama. The data required to train the models is kept secret. The compute power needed to run them is beyond the reach of many developers. And the labor to fine-tune them is prohibitively expensive.

So if these models aren’t truly open source, what are they, exactly? That’s a good question; defining open source with respect to AI isn’t an easy task.

One pertinent unresolved question is whether copyright, the foundational IP mechanism open source licensing is based on, can be applied to the various components and pieces of an AI project, in particular a model’s inner scaffolding (e.g., embeddings). Then there’s the need to overcome the mismatch between the perception of open source and how AI actually functions: Open source was devised in part to ensure that developers could study and modify code without restrictions. With AI, though, which ingredients you need to do the studying and modifying is open to interpretation.

Wading through all the uncertainty, the Carnegie Mellon study does make clear the harm inherent in tech giants like Meta co-opting the phrase “open source.”

Often, “open source” AI projects like Llama end up kicking off news cycles — free marketing — and providing technical and strategic benefits to the projects’ maintainers. The open source community rarely sees these same benefits, and when they do, they’re marginal compared to the maintainers’.

Instead of democratizing AI, “open source” AI projects — especially those from Big Tech companies — tend to entrench and expand centralized power, say the study’s co-authors. That’s good to keep in mind the next time a major “open source” model release comes around.

Here are some other AI stories of note from the past few days:

Meta updates its chatbot: Coinciding with the Llama 3 debut, Meta upgraded its AI chatbot across Facebook, Messenger, Instagram and WhatsApp — Meta AI — with a Llama 3-powered back end. It also launched new features, including faster image generation and access to web search results.AI-generated porn: Ivan writes about how the Oversight Board, Meta’s semi-independent policy council, is turning its attention to how the company’s social platforms are handling explicit, AI-generated images.Snap watermarks: Social media service Snap plans to add watermarks to AI-generated images on its platform. A translucent version of the Snap logo with a sparkle emoji, the new watermark will be added to any AI-generated image exported from the app or saved to the camera roll.The new Atlas: Hyundai-owned robotics company Boston Dynamics has unveiled its next-generation humanoid Atlas robot, which, in contrast to its hydraulics-powered predecessor, is all electric — and much friendlier in appearance.Humanoids on humanoids: Not to be outdone by Boston Dynamics, the founder of Mobileye, Amnon Shashua, has launched a new startup, MenteeBot, focused on building bipedal robotics systems. A demo video shows MenteeBot’s prototype walking over to a table and picking up fruit.Reddit, translated: In an interview with Amanda, Reddit CPO Pali Bhat revealed that an AI-powered language translation feature to bring the social network to a more global audience is in the works, along with an assistive moderation tool trained on Reddit moderators’ past decisions and actions.AI-generated LinkedIn content: LinkedIn has quietly started testing a new way to boost its revenues: a LinkedIn Premium Company Page subscription, which — for fees that appear to be as steep as $99/month — include AI to write content and a suite of tools to grow follower counts.A Bellwether: Google parent Alphabet’s moonshot factory, X, this week unveiled Project Bellwether, its latest bid to apply tech to some of the world’s biggest problems. Here, that means using AI tools to identify natural disasters like wildfires and flooding as quickly as possible.Protecting kids with AI: Ofcom, the regulator charged with enforcing the U.K.’s Online Safety Act, plans to launch an exploration into how AI and other automated tools can be used to proactively detect and remove illegal content online, specifically to shield children from harmful content.OpenAI lands in Japan: OpenAI is expanding to Japan, with the opening of a new Tokyo office and plans for a GPT-4 model optimized specifically for the Japanese language.

Can a chatbot change your mind? Swiss researchers found that not only can they change your mind, but if they are pre-armed with some personal information about you, they can also actually be more persuasive in a debate than a human with that same info.

“This is Cambridge Analytica on steroids,” said project lead Robert West from EPFL. The researchers suspect the model — GPT-4 in this case — drew from its vast stores of arguments and facts online to present a more compelling and confident case. But the outcome kind of speaks for itself. Don’t underestimate the power of LLMs in matters of persuasion, West warned: “In the context of the upcoming US elections, people are concerned because that’s where this kind of technology is always first battle tested. One thing we know for sure is that people will be using the power of large language models to try to swing the election.”

Why are these models so good at language anyway? That’s one area that has a long history of research, going back to ELIZA. If you’re curious about one of the people who’s been there for a lot of it (and performed no small amount of it himself), check out this profile on Stanford’s Christopher Manning. He was just awarded the John von Neumann Medal. Congrats!

In a provocatively titled interview, another long-term AI researcher (who has graced the TechCrunch stage as well), Stuart Russell, and postdoc scholar Michael Cohen speculate on “How to keep AI from killing us all.” Probably a good thing to figure out sooner rather than later! It’s not a superficial discussion, though — these are smart people talking about how we can actually understand the motivations (if that’s the right word) of AI models and how regulations ought to be built around them.

Stuart Russell on how to make AI ‘human-compatible’

The interview is actually regarding a paper in Science published earlier this month, in which they propose that advanced AIs capable of acting strategically to achieve their goals (what they call “long-term planning agents”) may be impossible to test. Essentially, if a model learns to “understand” the testing it must pass in order to succeed, it may very well learn ways to creatively negate or circumvent that testing. We’ve seen it at a small scale, so why not a large one?

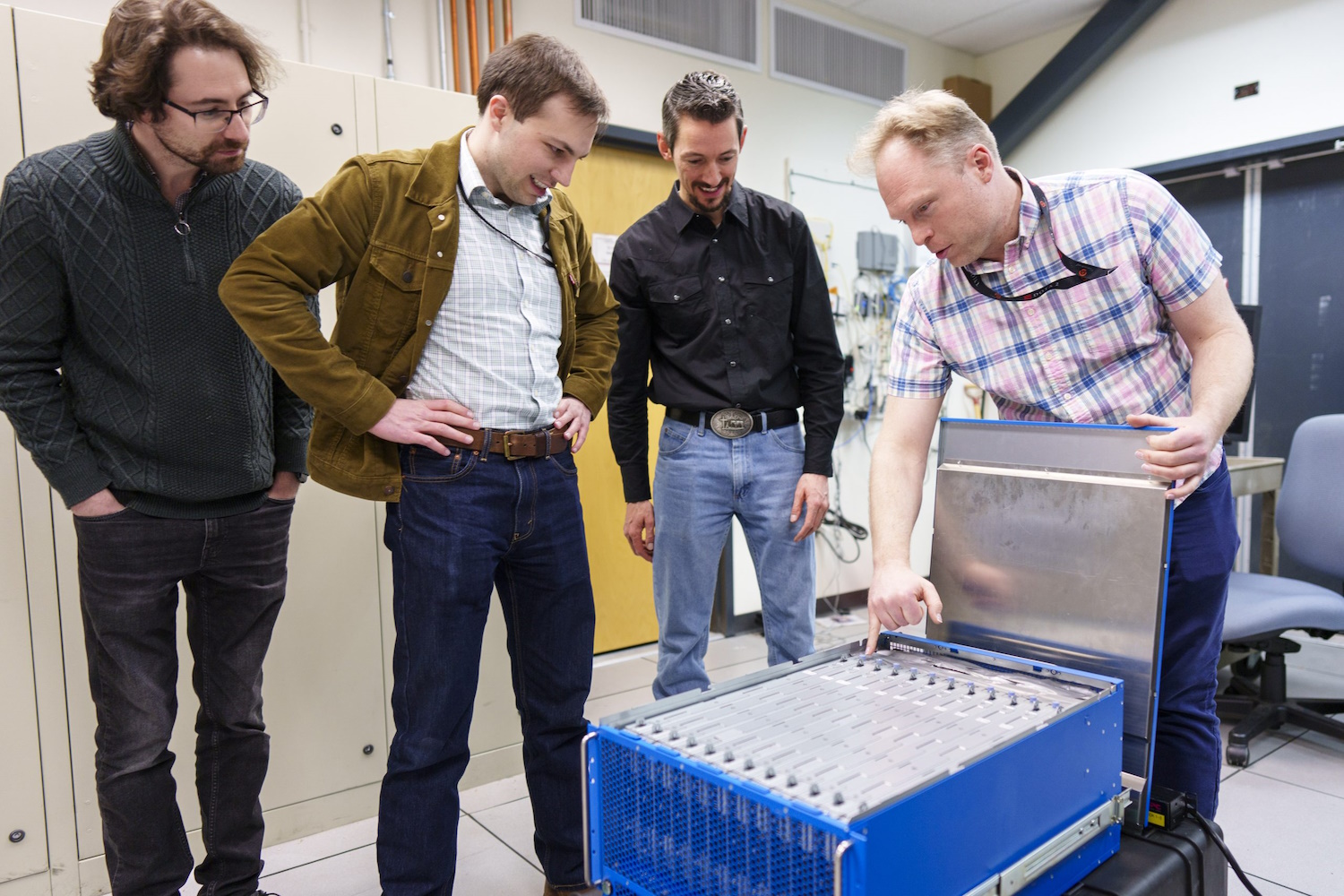

Russell proposes restricting the hardware needed to make such agents … but of course, Los Alamos National Laboratory (LANL) and Sandia National Labs just got their deliveries. LANL just had the ribbon-cutting ceremony for Venado, a new supercomputer intended for AI research, composed of 2,560 Grace Hopper Nvidia chips.

And Sandia just received “an extraordinary brain-based computing system called Hala Point,” with 1.15 billion artificial neurons, built by Intel and believed to be the largest such system in the world. Neuromorphic computing, as it’s called, isn’t intended to replace systems like Venado, but is meant to pursue new methods of computation that are more brain-like than the rather statistics-focused approach we see in modern models.

“With this billion-neuron system, we will have an opportunity to innovate at scale both new AI algorithms that may be more efficient and smarter than existing algorithms, and new brain-like approaches to existing computer algorithms such as optimization and modeling,” said Sandia researcher Brad Aimone. Sounds dandy … just dandy!