The hardware industry is under pressure these days: slower spending cycles from consumers and businesses, market saturation — not to mention innovation largely coming in the form of software at the moment — are all contributing to an overall decline in sales. Now, a startup has raised some funding to expand its alternative to hardware sales: hardware-as-a-service.

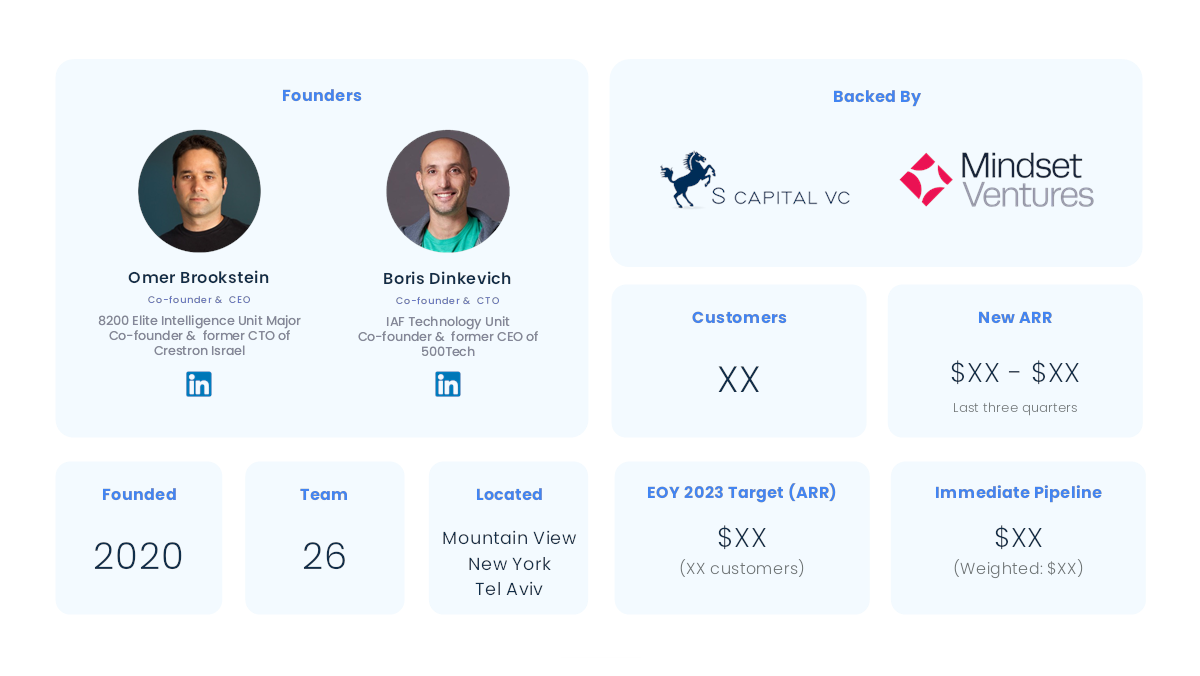

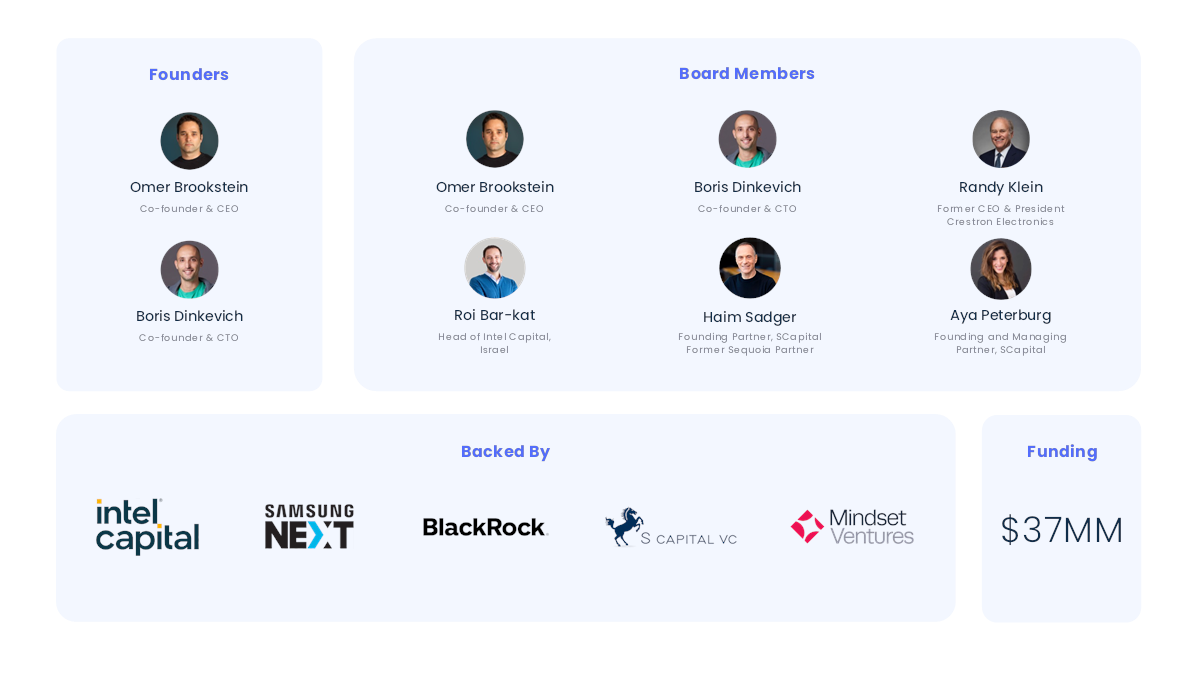

Xyte (pronounced “Excite”), an Israeli startup that lets hardware OEMs and their channel partners build subscription services for devices, has raised $30 million in funding.

The money is coming in two tranches. There is a $20 million Series A led by Intel Capital with Samsung Next, S Capital and Mindset Ventures participating, which will be used to expand the company’s business in the U.S. (where it opened an office in Silicon Valley a few months ago).

And there is a $10 million debt line from BlackRock that it plans to use to help customers make the transition to subscription models. “OEMs have cash flow challenges, moving from one-time to recurring revenues, they still have bills of materials and other expenses,” said Xyte’s CEO Omer Brookstein.

He said the company is not disclosing its valuation with this round except to note that it is “reasonable” in light of the current state of the market and the fact that startups are no longer being overvalued as they might have been in previous years. Since launching in 2019, Xyte has raised $37 million to date, including that $10 million debt tranche.

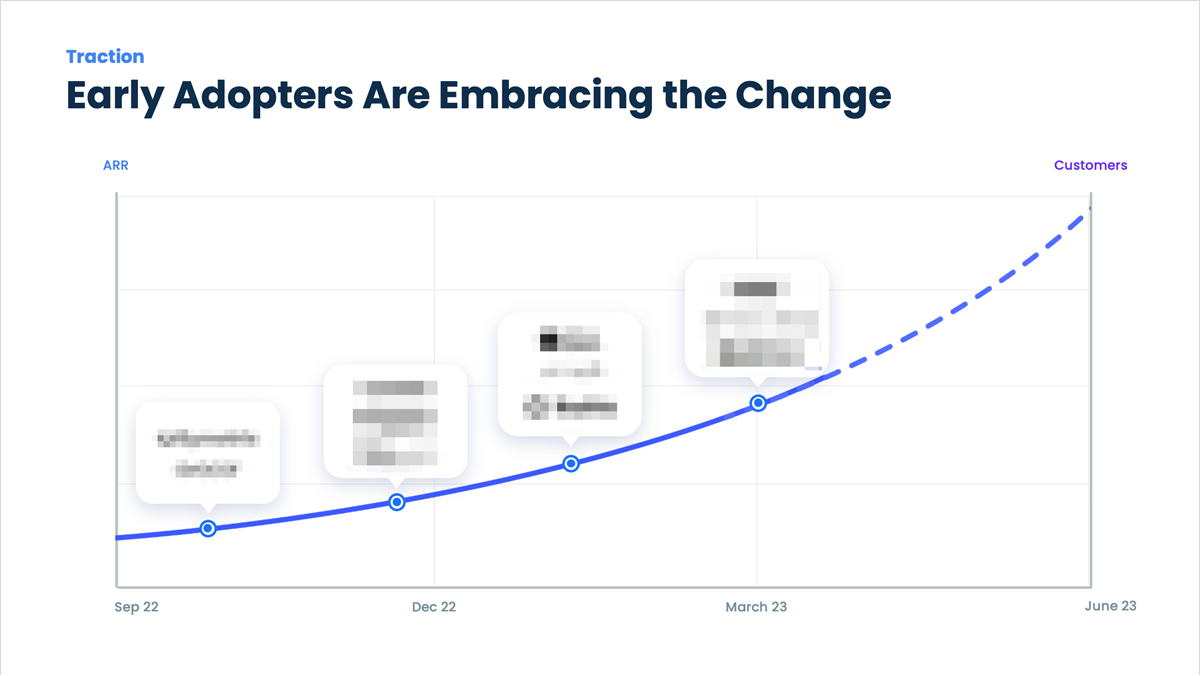

Some other data points from Brookstein: customers number in the “thousands” with tens of thousands of devices managed on the Xyte platform. ARR is currently $1 million and it’s on track to triple that this year, and the next. Customers include Intel, Schneider Electric and Rebar, and there are some recognizable names among those currently talking to the company. In other words, it’s still early days for Xyte, but there are some signals of good growth ahead.

“Hardware as a service” might not sound as familiar as SaaS but in some regards it’s a model that has been in place for a while.

Mobile operators for years offered hardware as a service when they sold, for a monthly payment, phones on contracts that bundled temporary ownership of a handset with a mobile voice, text and data service contract, and — after the rise of smartphones — potentially other premium services like music subscriptions bundled in too.

Further back than that, you could argue that basic hardware leasing plans were also an early incarnation of “HaaS” — albeit those typically came as bare device deals, with software still to be purchased outright by the customers on top of that.

But Xyte believes there is a new gap in the market that spells opportunity. Before starting Xyte with co-founder Boris Dinkevich (who is the CTO), Brookstein worked at a device maker called Crestron, building high-end AV systems that proved to be very expensive to shift when it came to sales. It was there that he first started to think about how a service model might be applied to devices like these, he said.

Those ideas were given more velocity by other changing tides in the market. The growth of cloud services has been the big juggernaut in IT over the last several years. Gartner’s most recent report on IT spend, for example, said growth would come in cloud services, with areas like software and services growing nearly 14% and 9% respectively, while hardware sales would continue to decline by nearly 9% this year.

And when you consider developments in areas like AI, software has taken the spotlight away from hardware when it’s come to innovations.

That’s something catching on with hardware makers themselves, who have started to shift into building considerably more services around their devices. While trailblazing, trend-setting leaders like Apple have yet to move to hardware-as-a-service itself for the iPhone or anything else, for years there have been rumors of its interest in that area. Innovations like eSIM, which let you swap carriers more easily; easy trade-ins of old devices for new; and of course introducing very expensive new devices like headsets, all could be helping to lay the groundwork for Apple to longer term consider HaaS in the future.

There is also the argument, Brookstein noted, that building subscriptions is not a core competency of an OEM, which is one reason why the company believes it has a shot at working with a large range of third parties in building out such services as a complement to more traditional sales.

He likens what Xyte is doing to Stripe and Shopify, which provide the tools to enable transactions or online selling to companies that might not be experts in these areas, but still need to incorporate these processes into their businesses.

“Shopify realised, very early days, that if I’m an SMB a mom-and-pop shop and I want to do some e-commerce, I don’t have the skill set to connect…whatever. I just want a store,” he said. “I think in many ways, it’s very similar to what we do.” Another comparable is Paddle, which offers a platform for subscriptions as a service to app and software makers.

Taken together, the idea that Xyte has put together is a platform that lets companies not just build out equipment subscriptions, but bundling that equipment with other services that a customer might want to use. That in turn can be applied to anything from a connected truck through to a laptop. Usage can be charged either on length of ownership, or by usage. (Pricing also comes by way of monthly subscriptions to Xyte’s customers.) The original business, the OEM or a channel partner, can in turn use the platform to manage and track devices, and provide that too as a service to its customers as well.

Initially, Xyte has focused on the B2B market, betting on the fact that enterprises and smaller businesses not only already do a lot of equipment leasing and have to manage chain of supply and device management around that already.

“What I’m seeing in the market is more and more businesses are looking for a way to upgrade experiences and deliver new services, but they don’t necessarily want to spend a bunch of money on hardware, they want to pay X amount of dollars and have it work,” Brian McCarson, VP and General Manager of the NUC Group at Intel, said of the rationale of why some companies are moving to using a service model for equipment.

But Brookstein said that it’s started to discover that its customers are also interesting in building out HaaS that they want to offer to consumers, too — one example being Schneider electric selling its Wizer connected home heating products on Xyte-powered subscriptions — coming full circle from the days of mobile handset subsidies.